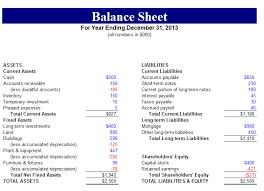

What is company balance Sheets? In The Balance Sheets, all the assets and all the liabilities of any company are fully accounted for. This shows us how much loan we have taken. How many debaters do we have? How many are Creditors? How many shareholders are holding our shares? What […]

Continue readingCategory: GST – Tax – TDS – MCA

Amazon GST Issues – You are shipping certain item(s) to a state for which you have not entered GSTIN in your business account

Amazon GST Issues You are shipping certain item(s) to a state for which you have not entered GSTIN in your business account. Please note that for such item(s) you will not get GST Invoice. Your business account admin(s) can go to Manage Your GST page and add GSTIN. Solution Form […]

Continue readingStarting in GSTR-3B

When we open (3B), a report opens in front of us, in which we file all the details of that, only then we can file our returns, in which we are asked about our turnover, which we can tick by the entire column. After that, our Return Dashboard opens. *First […]

Continue readingAmended Invoices in GSTR 1

9A – Amended B2B Invoices If we have made any mistake in this (B2B ), then we can change it by going to 9(A) business to business return file. In this, we Can change the cut-off to less than 2.5 lakh. 6A – Exports Invoices These tables are part of […]

Continue readingWhat is 4A, 4B, 4C, 6B, 6C – B2B Invoices, Under GSTR-1 All Details?

In this, we add our output supply which is sold to a registered person and it is an output supply. Whichever business 1.5 More than ten million transactions take place, in which they file monthly returns. And of any business Transactions of less than 1.5 crores can file it both […]

Continue readingWhat is an input tax credit?

The input tax credit is the first input which means that when we bring any raw material in our business, then it is called our input of business. The input of three types of any business is 1 Raw Material 2 Service 3 Capital Goods, these are what we call […]

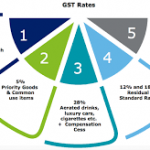

Continue readingWhat are GST rate slabs?

GST means goods and services tax .there are 7 types of tax slab rate 0 % 0.25% 3% 5% 12% 18% 28% In India there are 7 tax slabs, so how will this tax slab rate be charged, how much will be charged, and which will not be taxed on […]

Continue readingHow would you differentiate between CGST, SGST, and IGST?

Meanning SGST:- State goods and service tax When we sell goods in our own state, it is called SGSTCGST:- In this, when we supply the goods at one place like we are in Delhi, we are selling the goods inside it, then whatever tax will be there will be tax […]

Continue readingWhat are CGST, SGST, and IGST?

The full name of GST is Goods and Service Tax, in this, GST has been dived into 3 parts. CGST-Central Goods & Service Tax SGST-State Goods & Service Tax IGST-Integrated Goods & Service Tax First of all, we know about SGST – the full form of SGST is State Goods […]

Continue readingWhat are the benefits of GST?

There are 8 benefits of GST 0% tax on the essential commodity:- Within this, we have to pay 0% tax, which means that whatever our regular products are like (Fresh Vegetables, Books, Honey, News Paper, and Wheat Toothpaste, Soap),there are a lot of groceries. We have to pay 0% tax […]

Continue readingRate of tax under the composition scheme?

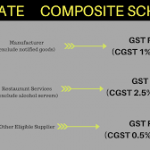

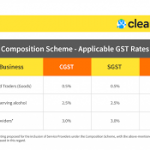

These are the most points of composition scheme because any company accepts this scheme. Because the rates of tax in this are levied at a special rate pay tax. Whatever rates are inside it are special rates. The rate of tax at the favorable rate is the percentage of turnover, […]

Continue readingWho is eligible for the composition scheme?

The first question that comes in this is that the eligibility for the composition scheme is individual, the first of which we have to check 2 points to check its Scheme. Which is the most important. Whoever can become a competition dealer has to follow certain rules and regulations only […]

Continue readingWhat is GST Composition Scheme?

The purpose of this GST scheme in IndiaThose small companies used to get a lot of problems in running their company.His most important problem was that to run his business, he had to take a lot of complexes, due to which he used to come to problems in running his […]

Continue readingwhat is GST (goods and service tax)

GST is a kind of indirect tax, its full form is Goods and Service Tax.This bill was passed in India on July 1, 2017, so that any goods or services will be taxed only.Because before this all were taxed separately and more.Whose amount was too much. And now due to […]

Continue readingCONCEPT OF GST

In this way, we can expand this in our Language. Before coming to GST India, we used to have total 14 types of tax due to which different tax was paid on each place. Every state used to keep its own tax rate that if any sale or purchase of […]

Continue readingGENESIS OF GST IN INDIA

THE genesis of ideas in India was the Gelcoat task force in 2004 who recommended the fully integrated GST idea in India on a national basis. Central budget (2007-2008):-those inseminates and the government and its central budget are wise just due to being implemented. In India with the effort from […]

Continue readingFEATURES OF INDIRECT TAXES

If we take India in the taxes one of the important sources of revenue and only in the world wide indirect tax is the major source of tax revenue and it continues to grow because many countries are actually shifting to the consumption tax regime, (a)In India more than 50 […]

Continue readingINTRODUCTION TO GST IN INDIA

(A)GST IN INDIA AN INTRODUCTION *background of taxes:-if you take any country it is actually the responsibility of the government to fulfill the increasing devolvement needs of its people and how the government can fulfill them by getting all public expenditure.If you take in India:-India is still a developing economy […]

Continue readingSTATEMENT OF CASH FLOWS & OTHER COMMON REPORTS

The net cash increase for the period is XXXX amount indicated in item number five it is a total of three activities operating activities investing activities and the financial activities cash at the end of the period this is going to be the total of cash of the beginning of […]

Continue readingSTATEMENT OF CASH FLOWS & OTHER COMMON REPORTS- 2

Statement of cash flow The statement of cash flows shows the flow of cash within the business, including where it came from and how it was spent during a specific time period. Cash flows is categorized into 3 types of activities 1 operating activities:- shown how much cash was generate […]

Continue reading