We are aware that companies deduct TDS/TCS, and if we exceed the exemption limit in any criteria, TDS/TCS will be applicable to us. Why? Because the Indian government has announced that if a person surpasses the exemption limit of earnings, they are liable to pay tax on that amount. Consequently, the Indian tax department has established tax criteria based on income.

Ever wondered where all the information on your Income Tax Return (ITR) comes from? Enter the Annual Information Statement (AIS), your one-stop shop for understanding your financial activities and taxes for a specific year. Think of it as a detailed report card for your finances!

What is the AIS?

Imagine Form 26AS, a common document used for tax filing, on steroids. That’s essentially what the AIS is. It provides a broader picture of your financial situation by

compiling information from various sources, including.

- Tax Deducted at Source (TDS)/Tax Collected at Source (TCS): This section shows the tax deducted from your salary, interest income, and other sources by entities like your employer or bank.

- Statement of Financial Transactions (SFT): This section dives deeper, showcasing your high-value financial transactions, such as.

a. Buying or selling stocks, bonds, etc.

b. Investing in mutual funds.

c. Earning interest from various sources (like bank deposits).

d. Receiving dividend income from investments.

e. Making large cash deposits or withdrawals.

Benefits of Using the AIS.

The Annual Information Statement (AIS) helps with taxes by making things easier, finding mistakes, showing all your money, and making it easier to talk to tax people. It’s like having a helpful guide to understand your taxes better.

Here are the benefits of using the Annual Information Statement (AIS) explained in simpler terms.

a. Easy Tax Filing: AIS helps you file your taxes faster because it already fills in some of the information you need. That means less time spent collecting and entering data.

b. Getting Things Right: Using AIS makes it more likely that your tax return is accurate and complete. This keeps you on the right side of the tax rules and reduces the chances of making mistakes.

c. Finding Mistakes: Checking your AIS helps you catch any mistakes or missing details in your finances. Fixing these errors before you file your taxes can prevent problems later on.

d. Seeing Everything: AIS gives you a big-picture view of all your money movements and income sources for the year. This helps you make better decisions about your money.

e. Talking to Tax People: If the tax office ever asks questions about your taxes, having AIS makes it easier to show them what’s what. You can use it to explain where your money came from and why.

f. Keeping Things Clear: AIS makes it clear what money you earned and where it came from. This helps build trust between you and the tax people because they can see everything laid out clearly.

Using AIS makes doing your taxes simpler, helps you avoid mistakes, and makes sure you’re following the rules properly.

How to Check the AIS Statement?

The Annual Information Statement (AIS) is a comprehensive document provided by the Income Tax Department that summarizes your financial information for a specific year. It can help understand your income sources, taxes deducted, and overall financial activity.

Here’s a step-by-step guide on how to check your AIS statement.

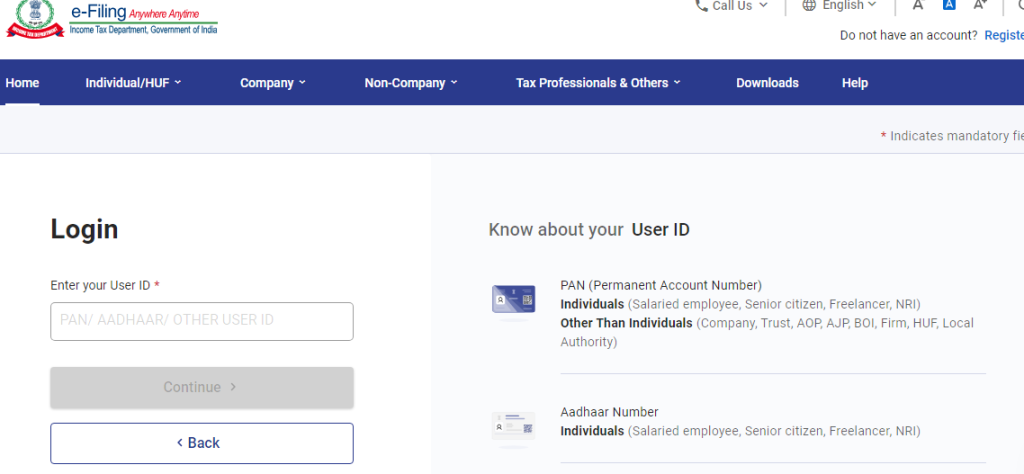

Step 1: Visit the Income Tax Department e-filing portal.

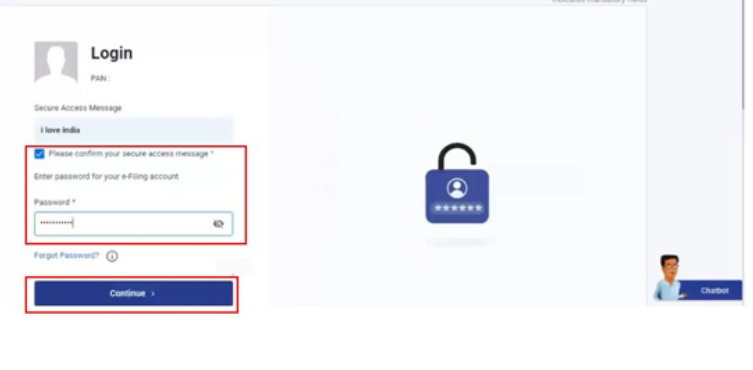

Step 2: Log in using your credentials.

On the e-filing portal homepage, click on the “Login” button located in the top right corner. Enter your PAN (Permanent Account Number), password, and captcha code. Then, click on “Login” to proceed.

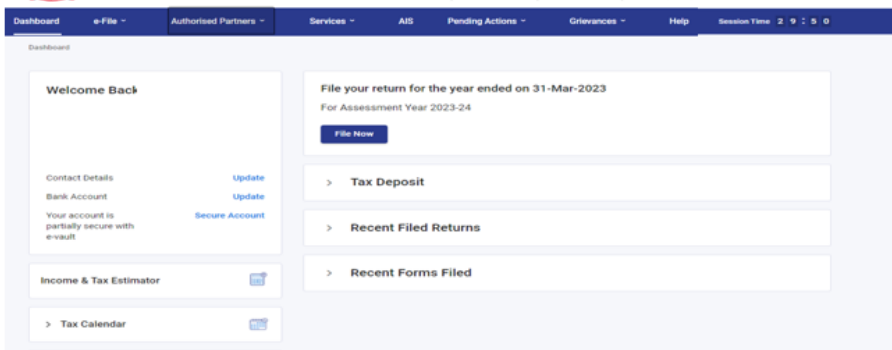

Step 3: After the login your e-file portal will be displayed!

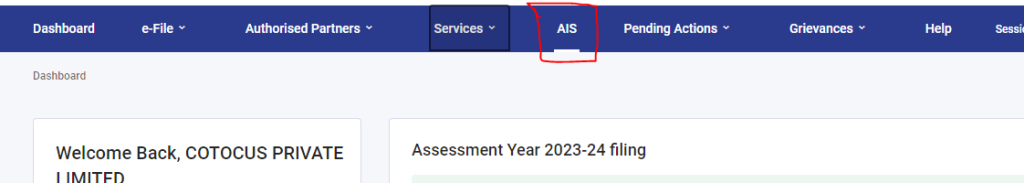

Step 4: Navigate to the “Annual Information Statement (AIS)” section by clicking on it.

Once you’re logged in, you’ll be directed to your dashboard. Look for the “Annual Information Statement (AIS)” tab located on the left-hand side of the screen. Click on “Annual Information Statement (AIS)”.

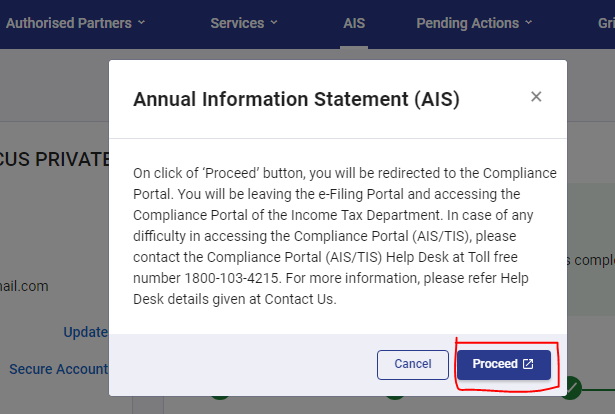

Step 5: In this page you would have to click on the proceed button.

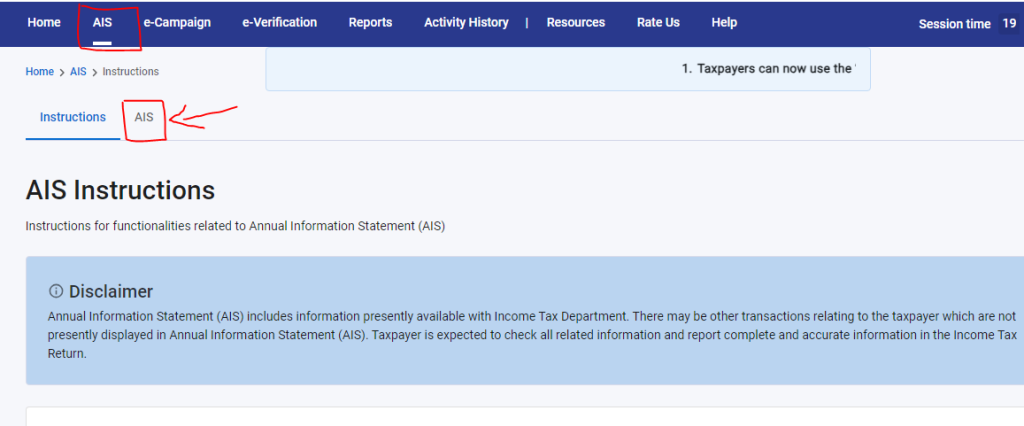

Step 6: After that, please click on the AIS Tab.

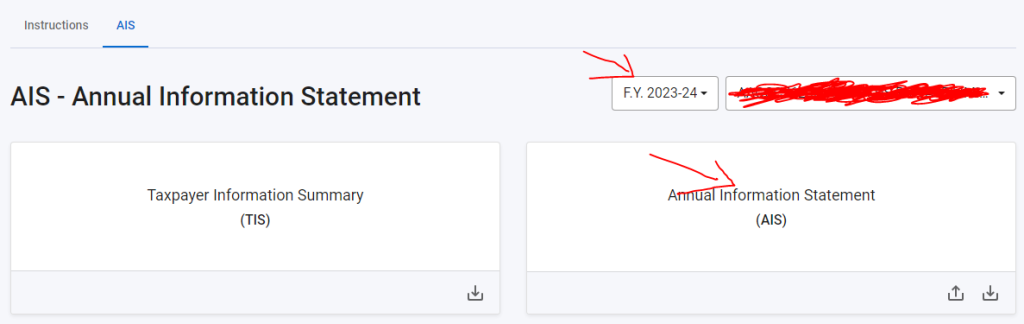

Step 7. After that, please select the financial year and click on the “ANNUAL INFORMATION STATEMENT Button”.

Step 8. After clicking on it your AIS report will appear on your dashboard in the part B section.

Additional Notes:

- You may need to enter a password to open the downloaded AIS PDF. The password is typically your PAN in lowercase followed by your date of birth (DDMMYYYY) for individuals or the date of incorporation/formation for non-individuals.

- If you encounter any difficulties accessing your AIS statement, you can contact the Income Tax Department Helpdesk for assistance.

By following these steps, you can easily check your AIS and gain valuable insights into your financial activity for the chosen year. Remember, the AIS is a helpful tool for tax filing and managing your finances effectively.

Thanks!