This is Good News for all the Small Businesses and Professionals to Increase the Turnover Limits for Presumptive Taxation Scheme (AY 2024-25).

The Indian government, in the Budget 2023, introduced some good changes for small businesses and professionals opting for the presumptive taxation scheme under sections 44AD & 44ADA. In this blog summarizes these revisions applicable to the Assessment Year (AY) 2024-25.

What is the Presumptive Taxation Scheme?

The presumptive taxation scheme is a simplified method of calculating taxable income for eligible businesses and professions. Instead of maintaining detailed accounts, bookkeeping, and journal reports, taxpayers declare a pre-determined percentage of their gross receipts as income that’s it. This simplifies tax filing and reduces the compliance burdens for all small businesses and professions.

Turnover Limits Increased.

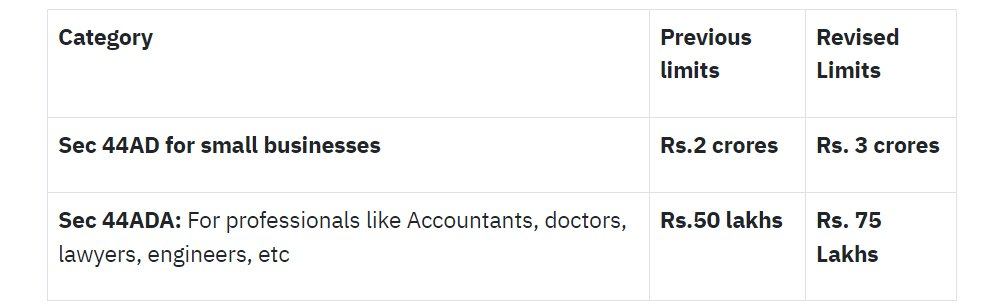

The key change for AY 2024-25 is the increased turnover limits for availing the presumptive taxation scheme.

According to section 44AD (For Businesses) – The previous limit of Rs. 2 crore has been raised to Rs. 3 crore. This is a significant increase that benefits a wider range of small businesses.

Important Note: This revised limit of Rs. 3 crore under Section 44AD comes with a condition. To be eligible, businesses must ensure that at least 95% of their total receipts are received through digital modes (including bank transfers, credit/debit cards, etc.). This incentivizes businesses to adopt digital payment methods.

According to section 44ADA (For Professionals) – The limit for professionals has also been raised from Rs. 50 lakh to Rs. 75 lakh. This offers tax relief to a larger pool of professionals like doctors, lawyers, architects, and consultants.

Similar to Section 44AD, a condition applies to Section 44ADA. Professionals can avail of the increased limit of Rs. 75 lakh only if their cash receipts do not exceed 5% of their gross receipts in the previous year. This nudges professionals towards adopting more digital transactions.

Section 44AE (For Micro Businesses) – There has been no revision to the limit under Section 44AE for AY 2024-25. It remains at Rs. 1 crore.

Benefits of the Revised Limits

Here is a small example about 44AE – The tax calculation is (Profile Limit = Minimum 7500 rs / per vehicle / Per Month)

These increased turnover limits offer several advantages

Reduced Compliance Burden – Small businesses and professionals can benefit from a simplified & easy tax filing process.

Increased Scope – More businesses and professionals can now opt for the presumptive scheme.

Boost for Digital Transactions – The conditions attached to the revised limits encourage the adoption of digital payment methods.

Who Should Consider the Presumptive Scheme?

If you are a small business owner or a professional with a turnover or gross receipts within the revised limits, and you maintain minimal business accounts, then the presumptive taxation scheme can be a suitable option for you. It can help you save time and resources on tax filing.

FAQs: –

Q What are the current turnover limits for the presumptive taxation scheme under Sections 44AD, 44ADA, and 44AE for AY 2024-25?

Ans – Section 44AD (Businesses): Rs. 3 crore (with at least 95% digital receipts)

Section 44ADA (Professionals): Rs. 75 lakh (with cash receipts not exceeding 5% of gross receipts)

Section 44AE (Micro Businesses): Rs. 1 crore (no change)

Q Do I have to maintain detailed accounts if I opt for the presumptive scheme?

Ans – No, you are not required to maintain detailed accounts under the presumptive scheme.

Q Can I claim any deductions for expenses under the presumptive scheme?

Ans – No, you cannot claim deductions for expenses since your income is pre-determined as a percentage of your gross receipts.

Q Is the presumptive scheme mandatory for eligible businesses and professionals?

Ans – No, the presumptive scheme is optional. You can choose to file taxes under the regular method if it proves more tax-efficient in your case.

Q Should I consult a tax advisor before opting for the presumptive scheme?

Ans – Yes, consulting a tax advisor is recommended to determine if the presumptive scheme is the most suitable option for your specific tax situation.

Thanks,