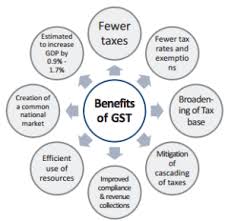

There are 8 benefits of GST

0% tax on the essential commodity:- Within this, we have to pay 0% tax, which means that whatever our regular products are like (Fresh Vegetables, Books, Honey, News Paper, and Wheat Toothpaste, Soap),

there are a lot of groceries. We have to pay 0% tax paid, we can also call it exit which is tax-free service.

Earlier, we also had to pay Value Added Tax. But with the arrival of GST, the tax has been removed from all these tools. These are tax-free items.

cascading tax :- Earlier, we were taxed again after paying a Goods Tax. To which we call Cascading Tax.

In this, even after paying tax, we were taxed. GST was brought in to remove this tax.

In which we will not have to pay much tax anymore. And with this, the price of the product will also be reduced.

Make in India

It also supports Make in India of our country, because if we get any goods from outside to our country,

then we have to pay customs duty as well as IGST so that it can be imported from outside Goods will be priced higher. And it will be more probable in our country

because its price is high because fewer people will buy it and there will not be much effect on our country. Earlier,

when we used to import any goods from outside, only custom duty had to be paid, so that in our country we had an effect on our goods.

Due to GST, now we import goods from outside, its price increases.

Fully computrize

In this, no paperwork will be accepted, so that there will be no problem. Because of paperwork,

there were a lot of problems that could not be known, so with the coming of GST, all these processes have been fully computerized.

Which will not have any kind of corruption. And whatever work will be done, A network will be created within the GST in which all the businesses will be registered and they will get a GSTIN number.

Due to this, if any business does not submit its tax, then it will be known that it can be filed or action can be taken.

Maxium 10000 in cash

In this, we can give a cash in business up to BS10000 only. More than that, we have to use net banking. Which will reduce corruption. And if someone pays more money than this, then his address will be known easily.

Credit bank on inter state transaction

The benefit of this is that when we used to supply any goods from one state to another state, we had to give us 2% SST at that time. (Central Sales Tax) which used to go from 50 to 60 crores. And his entire world comes to common people.

Which was the problem in it, not the supplier, but the common people. But after the arrival of GST, now we will have to pay CGST which will be refunded to the entire business.

Profit of State for five year

The advantage of this is that if there is a loss of tax in any state, then the entire profit of this will have to be paid to the Indian government by 5 years.

Anti pofiteering provision

This has the advantage that earlier in any business I used to be tax increment or decree, the entire profit was given to the owner of the company. But after the arrival of GST, the entire profit of whatever profit will be received by the common people, we call it anti profiteering provision.