Hello Friends,

In my today’s blog, I will let you know about section 194J of the Income Tax Act.

What is it?

Section 194J of the Income Tax Act, 1961, mandates the Tax Deduction at Source (TDS) on payments made for professional or technical services rendered by resident individuals or Hindu Undivided Families (HUFs). TDS acts as an advanced tax collection mechanism, ensuring timely government revenue collection and reducing tax evasion.

Who is Liable to Pay?

- Deductor: Any person (other than an individual or HUF) making payments for professional or technical services in India is liable to deduct TDS at source. This includes companies, firms, partnerships, associations, trusts, local authorities, government bodies, etc.

- Payee: The recipient of the payment for professional or technical services (a resident individual or HUF) is liable to pay income tax on the entire amount received, including the deducted TDS.

Who is Responsible for Deduction?

The deductor is solely responsible for withholding TDS at the prescribed rate, depositing it with the government treasury by the specified due date, and filing TDS returns electronically. Failing to comply with these obligations attracts penalties and interest.

What Services Are Covered?

Section 194J applies to a broad range of professional and technical services, including:

- Legal services (advocates, solicitors, chartered accountants, etc.)

- Engineering services (architects, civil engineers, software engineers, etc.)

- Medical services (doctors, dentists, consultants, etc.)

- Management consultancy

- Technical consultancy

- Auditing services

- Financial services (investment advisors, tax consultants, etc.)

- Royalties for use of intellectual property (films, music, literary works, etc.)

- Payments to directors for specific services (excluding regular salary)

Threshold Limit and Applicability

- TDS deduction under Section 194J is mandatory if the aggregate payment for professional or technical services to a resident payee exceeds ₹30,000 during a financial year.

- This threshold applies separately to each payee and each type of service, meaning even separate payments below ₹30,000 can collectively trigger TDS if they cross the limit from the same payee for the same service.

TDS Rates and Exemptions

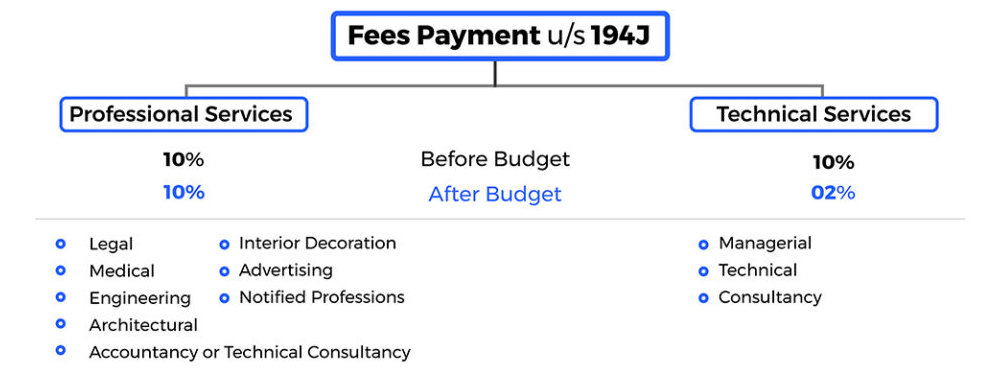

- Standard Rate: 10% of the gross payment is deducted unless specific exemptions or lower rates apply.

- Lower Rate (2%): Applies to:

- Technical services (not professional services): Includes engineering, architectural, drafting, designing, data processing, consultancy, or supervision related to these activities.

- Royalties in the nature of consideration for cinematographic films: Payments to artists, musicians, or authors for rights to use their work in films.

- Exemptions: Certain categories are exempt from TDS under Section 194J, such as payments made to:

- Government departments

- Local authorities

- Public sector undertakings

- Universities and educational institutions

- Hospitals and charitable institutions

- Payments for legal services rendered by a lawyer to his/her client in any court or tribunal established by law

- Payments for professional services received by an individual or HUF whose gross receipt from profession or business in the preceding financial year did not exceed ₹1 crore (companies) or ₹50 lakh (individuals/HUFs)

Penalties and Interest for Non-Compliance

- Failure to deduct or deposit TDS: A penalty of 100% of the tax deducted but not deposited, subject to a minimum of ₹10,000.

- Late filing of TDS returns: Late filing fee of ₹10,000.

- Interest on delayed payment: Simple interest at 1.5% per month on the tax amount from the due date to the date of payment.

Advantages and Disadvantages

Advantages:

- Revenue collection: Ensures timely government revenue collection and reduces tax evasion.

- Advance tax payment: Payees prepay tax through TDS, reducing their final tax liability.

- Transparency: Creates a record of transactions, enhancing transparency and accountability.

Disadvantages:

- Compliance burden: Increases administrative burden for deductors, especially small businesses.

- Cash flow impact: Deducted TDS reduces immediate cash flow for payees.

- Potential errors: Incorrect deductions or deposits can lead to penalties and financial losses.

What It Tells Us

Section 194J plays a crucial role in the Indian tax system. By effectively implementing TDS on professional and technical services, the government ensures timely revenue collection while encouraging compliance and transparency. However, it’

Thanks,