Hey all,

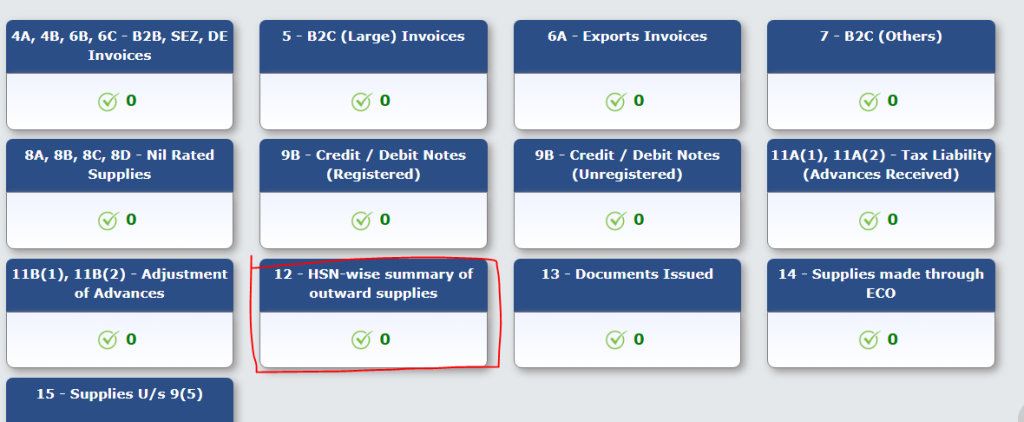

This is Ravi, and today, I will let you know the new changes in column number 12 in the GST Portal.

What is Table Number 12 in the GST?

In Table number 12, businesses report the HSN-wise (Harmonized System Nomenclature) summary of the outward supplies. This entails providing details of invoices issued during the reporting period.

Changes in the table no. 12?

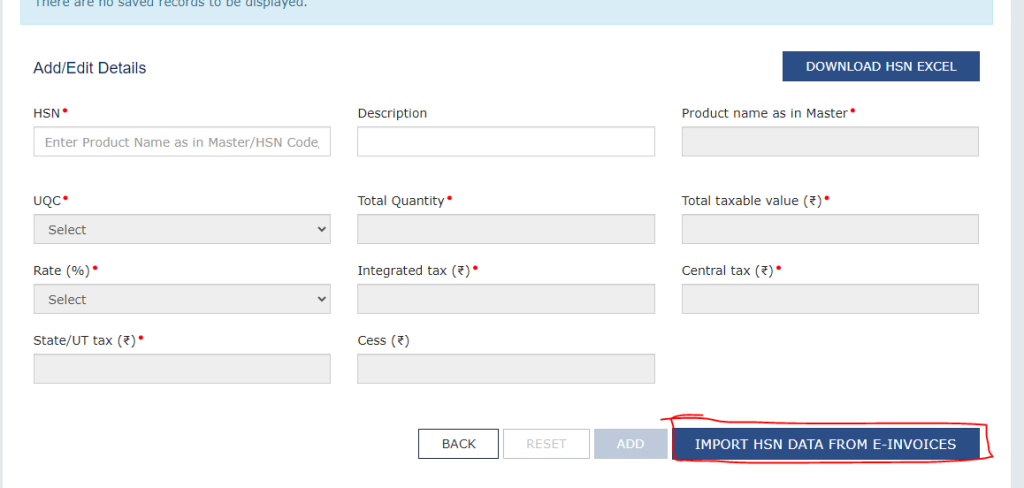

In Table No. 12 of the GST Portal, we have to enter the HSN-wise details based on our records. Previously, we manually entered all the details of our invoices in Table No. 12. However, after the implementation of new changes in Table No. 12 of GST, we now simply need to click on the “Import HSN wise summary from e-invoice” button. Upon clicking this button, our HSN details will automatically import from the e-invoice portal and populate Table No. 12 of the GST return form.

Note Point***

- Don’t enter the HSN-wise details manually, if you enter your HSN-wise data manually first, and then you click on the import HSN-wise data after that your all the data will be removed from table no12 of the GST. Once imported, verify that the records match your data. If all records align, proceed to save the data. However, if any discrepancies arise where the HSN data does not match your records, make necessary manual adjustments.

Thanks,