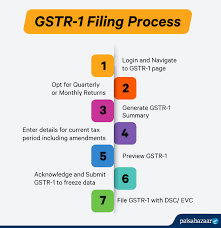

In this, we add our output supply which is sold to a registered person and it is an output supply. Whichever business 1.5 More than ten million transactions take place, in which they file monthly returns. And of any business Transactions of less than 1.5 crores can file it both in Quarterly and Monthly. When we open our GSTR-1 portal,

The first thing we do is show the option of business, in which we have to show the transaction of all our sales, that is also to show the transaction of sales with the registered person. Are fallacy. When we click this, we have to enter the GST number first. And then the Amount and Invoice Date. Then we have to enter the taxable amount in the same column as we have sold it according to the tax, in which it automatically finds the tax whether it is intrastate or integrated.

Under Filling GSTR-1 {(5A, 5B – B2C (Large)} Invoices?

Inside this, if we sale business 2 consumer and registered persons, we have to enter all the details in it, there is no need for an invoice and we add all our consumer transactions inside it. But there is one more thing in it. This is the fact that we sell more than 2.5 lakhs in Intrastate. Then we have to take the invoice number.

Under GSTR-1 Credit / Debit Notes (Registered)?

In this, we are sold through whatever registered person. His debit and credit notes are proof. Within this, we have to select our number and date by ourselves. In this, we have to enter the original invoice number and original invoice date of the person whose notes are made. If it is not original then your debit and credit notes cannot be made.

And in the option, we also have to select this type.

Under GSTR-1 Credit / Debit Notes (Unregistered)?

These tables are a part of GST-1. In which we see all our exports. Meaning that we export our goods to another state. So we fill it in this table. In this, the registered person can claim the refund of his exports and his supply tax is only in the interstate. In this, we will enter shipping no, enter date and whatever taxable amount will be entered.