Hey all,

Today, I would let you know about the OLTAS challan correction process.

what is the OLTAS challan request form?

Request for OLTAS challan correction refers to the formal process of rectifying errors or discrepancies in an Online Tax Accounting System (OLTAS) challan. OLTAS is a system introduced by the Reserve Bank of India (RBI) to facilitate the online payment of various direct taxes. When taxpayers make tax payments using OLTAS, they receive a challan as proof of payment.

At times, mistakes may occur in the details provided in the OLTAS challan, such as incorrect taxpayer information, inaccurate tax type, assessment year, major head code, minor head code, or the total amount paid. To ensure accurate tax records, taxpayers or deductors can request corrections for the OLTAS challan.

The process involves submitting a formal request to the relevant authorities, providing the correct information, and supporting documents (if necessary) to substantiate the need for the correction.

Timely initiation of the correction process is crucial to avoid potential complications or penalties arising from inaccurate tax records. Upon approval of the request for OLTAS challan correction by the tax authorities, a corrected challan is issued, reflecting the accurate tax payment details.

The approval of the Assessing Officer is not required for correcting certain fields in the OLTAS challan. These fields are as follows:

- Financial Year: You can correct the Financial Year up to the Financial Year relating to the Date of Deposit of the Challan. For example, if the challan is of F.Y. 2008-09, and the Date of Deposit is 20-06-2016, the Financial Year cannot be greater than 2016-17.

- Minor Head Code (200 and 400): You can correct the Minor Head 200 for TDS/TCS payable by the taxpayer and Minor Head 400 for TDS/TCS payable under the regular assessment.

- Major Head Code (0020 and 0021): You can correct Major Head 0020 if the Deductee is a Company and Major Head 0021 if the Deductee is an entity other than a Company.

- Section Code: You can correct any Section Code 94C, 94D, 94H, 94I, or 94J, except for Section Code 195.

In these specific fields, you do not need approval from the Assessing Officer to request corrections for an OLTAS challan. However, it is essential to follow the correct procedure and provide accurate information while making corrections to ensure compliance with tax regulations and maintain accurate tax records.

Why do we need to use the OLTAS challan correction request form?

The OLTAS (Online Tax Accounting System) challan correction request form is essential for rectifying errors or discrepancies in previously submitted OLTAS challans. There are several reasons why this form is crucial:

- Error Correction: The form allows taxpayers to correct mistakes made during the initial tax payment process. This includes rectifying inaccurate details such as taxpayer information, tax type, assessment year, major head code, minor head code, and the total amount paid.

- Accuracy of Tax Records: By using the correction request form, taxpayers ensure their tax records are accurate and up-to-date. Accurate records are vital for maintaining proper accounting, complying with tax regulations, and avoiding potential legal issues.

- Avoiding Penalties: Incorrect information on the OLTAS challan could lead to penalties or interest payments due to underreporting or misreporting of taxes. Utilizing the correction request form helps avoid such penalties and ensures compliance with tax regulations.

- Official Documentation: The correction request form serves as official documentation of the corrections sought. It provides a record of identified errors and the subsequent actions taken to rectify them.

- Transparency and Accountability: The correction request process enhances transparency and accountability in tax payments. It allows tax authorities to verify and authenticate the corrections before updating the taxpayer’s records.

- Compliance with Tax Regulations: Correcting the OLTAS challan ensures that the taxpayer’s records adhere to the requirements stipulated in tax laws and regulations.

- Updated Financial Records: Accurate tax payment records are crucial for maintaining precise financial records. Using the correction request form helps keep financial records up-to-date and consistent.

It’s important to note that the process for OLTAS challan correction may vary depending on the tax department’s guidelines and procedures. Taxpayers should follow the correct process and provide necessary supporting documents (if required) while submitting the correction request to avoid delays and ensure accurate updates to their tax records.

Steps for OLTAS Challan Correction on TRACES

- Log in to TRACES – Log in to TRACES – Enter your User Id, Password, TAN or PAN, and captcha

- Navigate to the request for OLTAS correction – Go to Statements / Payments > Request for OLTAS Correction

- Review the checklist – Review the checklist and click on ‘Proceed’

- Proceed to the CIN details – You can only correct Financial Year, Minor Head Code (200 and 400), Major Head Code (20/21), and Section Code. Click on ‘Proceed’

- Enter the CIN details – Enter the Challan (CIN) Details – BSR Code, Date of Deposit, Challan Serial Number, and Challan Amount. Click on ‘Go’

- Proceed to edit the challan details – If the details of the challan are valid, the user can proceed to edit the challan details. Select the new values of Financial Year, Major Code, Minor Code and Section Code. Click on ‘Submit’

- Verify the details – The updated values will appear in the summary table. Verify the details and click on ‘Confirm’

- Authorized person – Details of the Authorised Person will appear on the screen. Verify the details and click on submit.

- Success message – Upon successful submission of the OLTAS Challan Correction, a confirmation message will be displayed on the screen. The message will include a unique Request Number as proof of the correction request. Additionally, you will receive an email notification acknowledging the submission of the OLTAS Challan Correction. This email will serve as a record of the correction request for your reference.

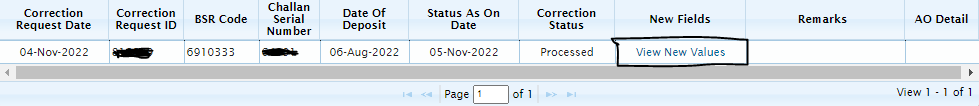

Steps to Track OLTAS Challan Correction Request on TRACES

- Log in to TRACES – Enter User Id, Password, TAN or PAN and, captcha

- The process to go – Go to Statements / Payments > Track OLTAS Challan Correction Request

- Search the request – using Request Number, Date, or View All

- Correction – The status of the correction request will appear on the screen. Click on ‘View New Values‘ to view the updated values. The new values will appear on the screen

Thanks,