Hi everyone,

In my today’s blog session, I will let you know how to pay the professional Tax through the NIC portal.

Introduction of NIC Portal

The NIC Portal is a website created by the Government of India to make it easy for people to get information and use online services. It’s like a one-stop shop for various government things, such as important documents and services you can apply for. The goal is to make it simple for everyone to access government info and services from different areas. The website is made to be easy to use, so you can quickly find what you need. The NIC Portal also keeps your information safe while you use it. Overall, it’s part of the government’s plan to make things more digital and user-friendly for everyone in India.

Who needs to pay the Professional Tax through the NIC portal?

Professional Tax is a kind of tax that some Indian states collect from people who earn money through their jobs, businesses, or professions. It’s important for both employees and people who work for themselves. The rules for who needs to pay this tax and how to do it can be different in each state. To find out if you need to pay Professional Tax through the NIC portal, check the rules of your state government. They will have information on their website or the NIC portal about how to register and pay this tax if it applies to you.

Here are the steps of how to pay professional Tax through the NIC portal.

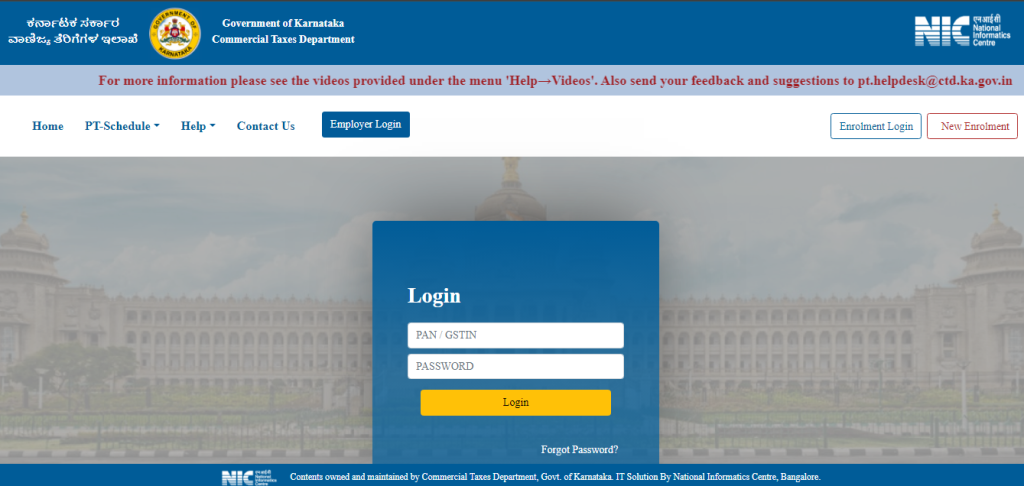

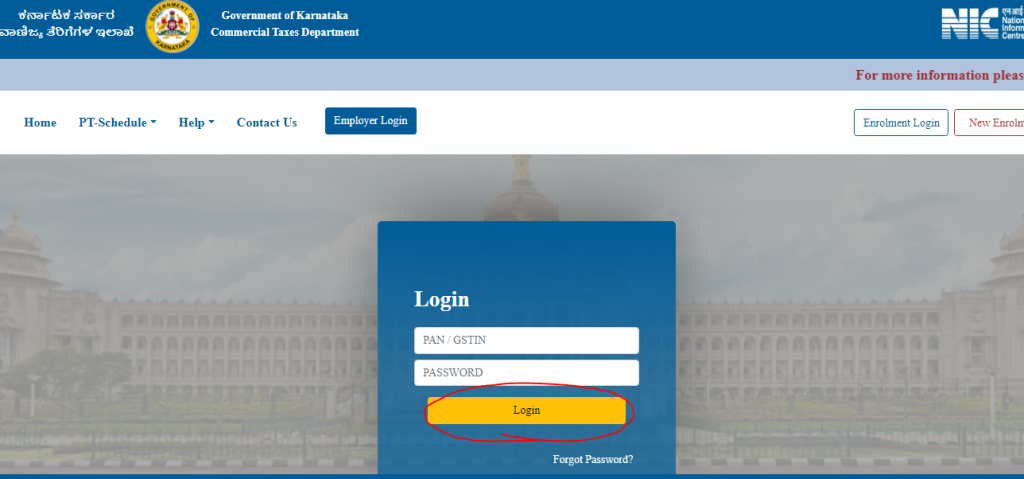

a. Login to the NIC portal with your ID (PAN / GSTIN) & Password.

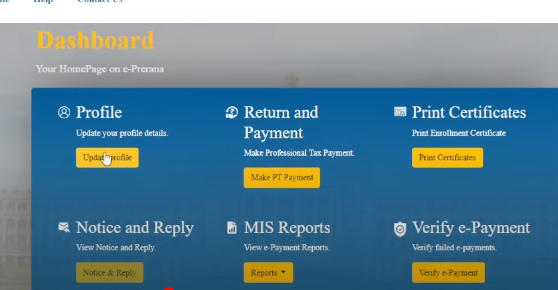

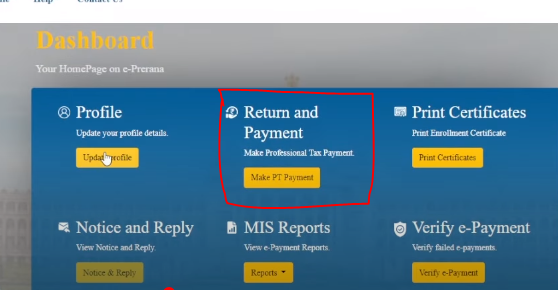

b. After that, you are redirected to the NIC portal Dashboard.

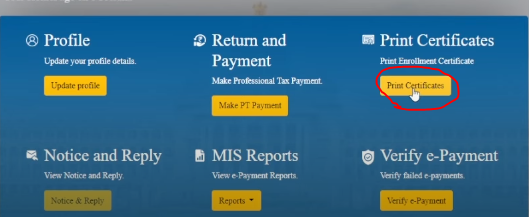

c. After entering the Dashboard please click on the Return and Payment Button.

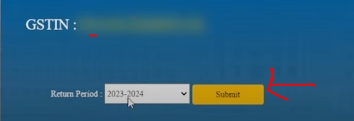

d. After that, please select the return period and click on the submit button.

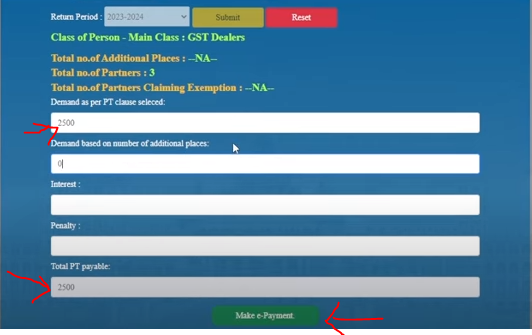

e. After selecting the period you would enter the tax details and you just click on the make e-payment button.

f. If you missed paying the tax then you would be entered the interest and penalty in the given column.

g. You need to enter the place details if you have 01 business place then enter 01 in the column of the number of additional places and if you have 02 business places then enter 02.

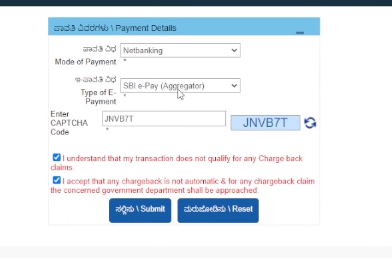

h. After clicking on the make e-payment button you are redirected to the e-payment gateway portal for making the payment.

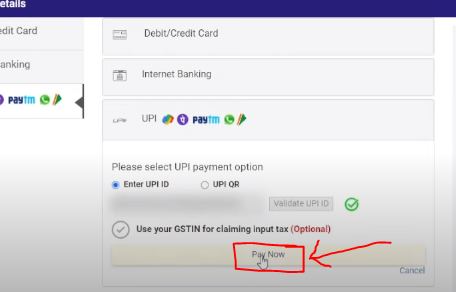

I. After clicking on the submit button, please select the payment mode in this tab and click on the pay now button after selecting the payment mode.

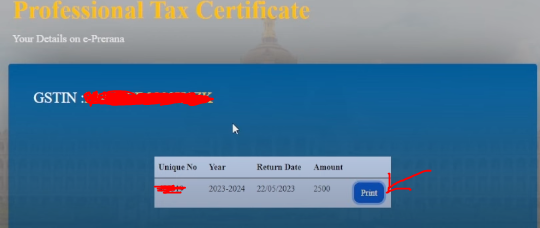

j. After making the payment please go to the print certificate tab and click on it.

k. And finally click on the print but so after that, your payment certificate will print.

Thanks,