Hi Guys,

This is Ravi Kumar, and Today I will let you know about the bank validation feature on the GST portal.

Let’s begin,

First of all, When we have been getting the GST registration then this time, it is a must to add the Bank account in the GST portal after that, the GST government would give you the refunds.

So, now the GST department has announced that please validate your Bank Account which is already has been added by you to the GST portal, and if you are not added the Bank account then please add your account and validate it. Because some of the bank validation is expired due to some reason like Aadhar linking, wrong PAN number, inactive PAN number and etc.

It is a must to validate your bank account details in the GST Portal after that you can get refunds from the GST Department.

How to check the Bank Account validation status?

Here are the steps to know about your account status on the GST portal

- Open your browser and put gst.gov.in

- After that, please click on the login button and enter your ID and Password.

- After login into the GST portal Please click on the view profile button.

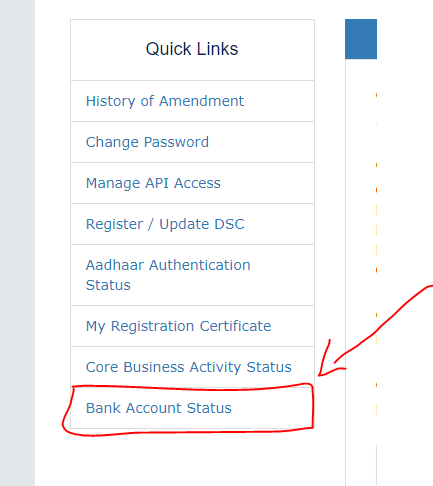

- After clicking on it, Please turn down your scroll so you can see the bank account status option on your left-hand side.

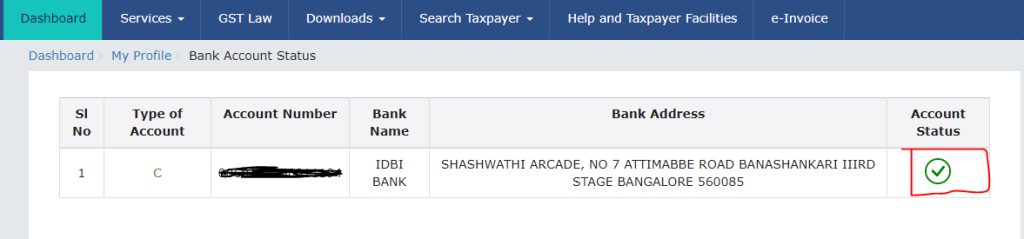

- After clicking on the bank account status you can see your account status in the next tab.

Note Point****

There are some errors in the validation of bank details. let me show you.

- If you would see this type of error it means your bank validation will take a few more days for the validation.

- Here are the errors symbols for the bank validation.

- Success – It means your account is successfully registered in the GST portal and verified by the department.

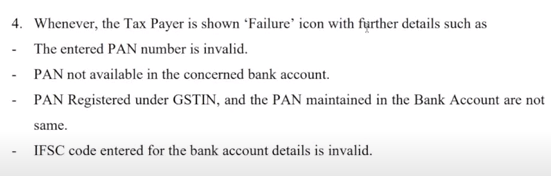

- Failure – That means you have not uploaded the correct PAN details into the GST portal

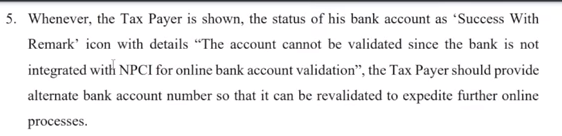

- Success with remark – That means, you have not given the correct details to the Bank for an account opening.

- Pending for validation – If you are facing this issue then please wait till the validation.

- Special Notes – If you are having some errors for the account validation then please delete your account details from the GST portal and enter the correct details of the bank and then validate your account. I am sure after finishing these steps your account will be validated by the NPCI or GST department.

Thanks,