- COMPLIANCE:- Compliance means that in order to do any work properly, we have to follow all the rules and laws made by them so as not to bear any loss beyond.

- While starting any business in India, all the rules made by the Indian Government should be followed. Everything a government needs when starting a company. All that information should be conveyed to them in a correct and desirable manner so that after that I will not face any kind of loss beyond you, nor give any kind of penalty. Because any person can start a company but they do not know that after starting the company they have to follow the rules made by the Indian government or else they have to bear a lot of losses.

- WHAT IS ROC (Registrars of company):- These are to fulfill all the Compliance of the company. In which the Compliance of Limited Liabilities Partnership Company and Private Limited Company comes so that no company makes any kind of mistake. So that he does not have any kind of loss. ROC has been appointed under section 609 of the Companies Act.

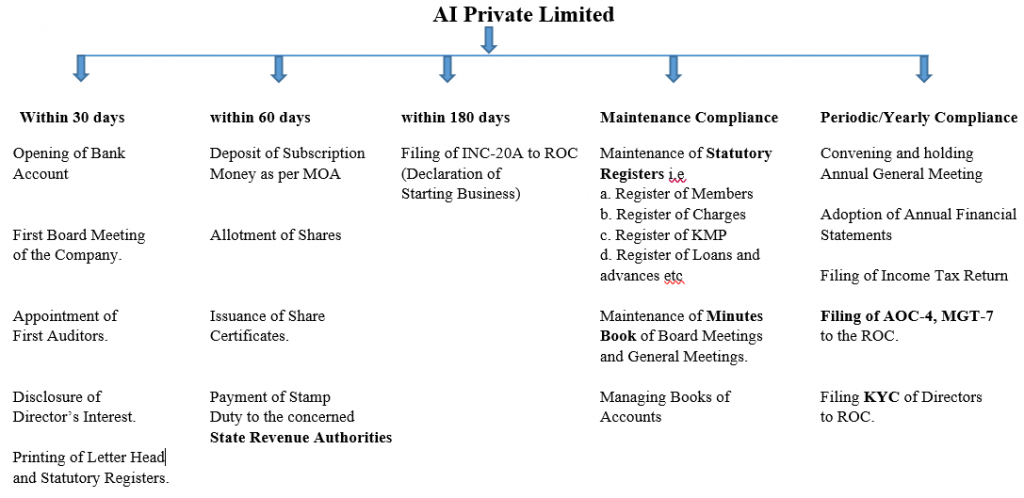

WHAT ARE THE MANDATORY COMPLIANCE FILLING FOR A PRIVATE LIMITED COMPANY (ROC)

(1) Appointment of Auditor(ADT-1):- When we start a company, we have to file the appointment of the auditors form within 15 days of the first annual general meeting of our company.

(2) Filing balance Sheet(AOC-4):- In any private limited company, when the balance sheets of that company are made, according to the auditor of the company, then we have to file that balance sheet before the 30 days of the Annual General Meeting, awarding it to the Companies Act.

(3) Filing Of Annual Return(MGT-7):- Any company has to file this form within 60 days of the end of their annual general meeting and within this, we have to give all the information of the company.

- CIN Number (Corporate Identity Number):- When a new company is registered. So he is given a number according to the Government Act, which is a 21 alphanumerical number. Whom we called CIN number.

- Registered office address:- When starting any company, we have to give the registered address of the place where we have registered.

- All our shareholders and debenture holders in the company, who have held the shares of the company, have details of how much turnover the company has.

- How much loan any company has taken for the company

- All the meetings have been held by the director and the auditor, how many person meetings have I attended, their attendance was how many minutes the meeting was, what is the decision taken

- By what ratio are directors remunerated in the company

(4) First Board Meeting:- We have to have a first board meeting within 30 days of the formation of any new company.

(5) Subsequent Board Meeting:- There should be 4 board meetings in any holding company and there should be a gap of 120 days in 2 board mating according to the rule of the company act.

(6) First Annual General meeting :- The first annual general meeting of any company is necessary to be inside the 9 month of the end of the financial year. Date can also be extended in this, but for that permission has to be taken from the government.

(7) Appointment of First Auditor:- First auditor should be selected within 30 days of the start of the first board meeting of any company.

(8) Appointment of Subsequent Auditor:- Subsequent auditors are appointed for 5 years in any company for Annual General Meeting and are appointed within 15 days of Annual General Meeting.

(9) Statutory Audit of Account:- For any company to maintain all its transactions, it means the turnover in the financial year of the company. A charter account is required to keep their accounts. Because the right to audit is given to a charter account.

(10) Filing of Income Tax Return for a company:- All companies are required to file income tax returns. Otherwise, he gets a penalty, according to 100 Rupees every month. And its last date is 30 September.

(11) Directors KYC:- It is necessary to get directors KYC done every year. Whose last date is 30 September. If you do not do this, then the directors are charged 5000. According to the company act.

(12) Form MSME-1:- If any company has taken a loan from MSME, then has taken the goods or service, then we have to file all the details in this form. We file this form twice a year. On October 30 and last 30 April, and if we did not pay it within 45 days, then we also have to write the reason why we did not pay why it was late.

(13) Form DPT-3:- If any type of loan has been taken over a company that is outstanding. Or any kind of loan, the amount of that loan is filed in this form. And its last date is till 30th June. And if any company does not file it then it can be fined from 25000 to 300000.

So we have to follow all these competitions of the Registrar of Companies so that we do not face any kind of risk and keep running the company.