Hello Guy’s

This is Ravi Kumar, and today I will let you know about the payment of TDS/TCS in a new way.

Let’s Begin,

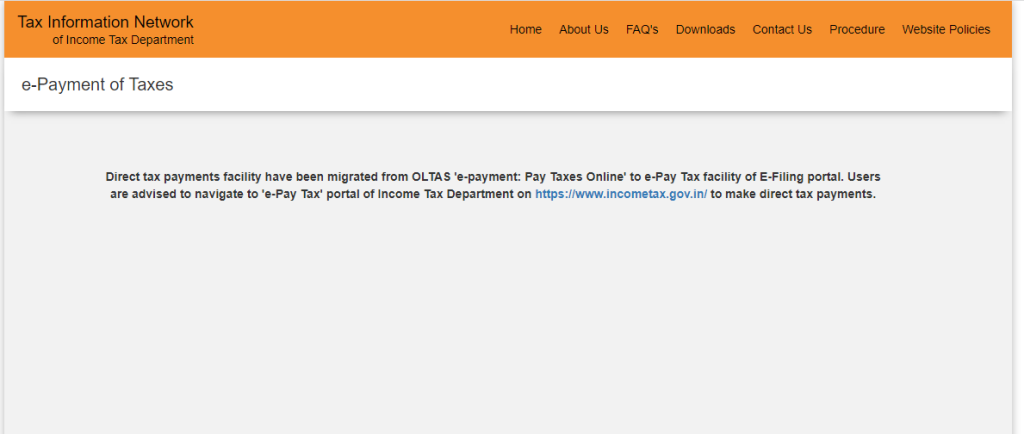

If you are thinking to pay the TDS/TCS from the NSDL portal then you can’t do the TDS/TCS payment from the NSDL portal.

How to pay TDS?

Now the Government has changed the platform for the TDS/TCS payment and you can’t pay your TDS/TCS amount from the NSDL portal because in this portal you can see a message that is for the TDS/TCS payment.

The Government has introduced a new way for the payment of TDS/TCS.

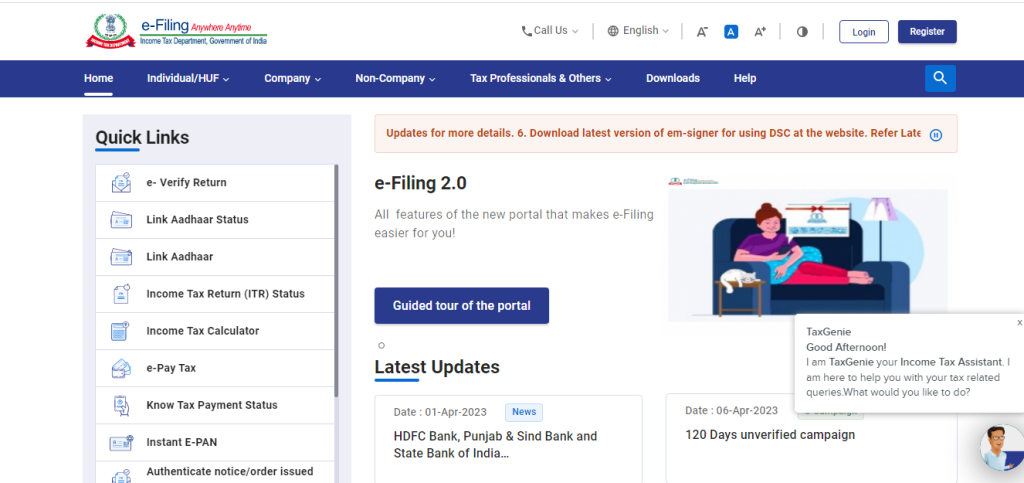

- Go to the income tax portal

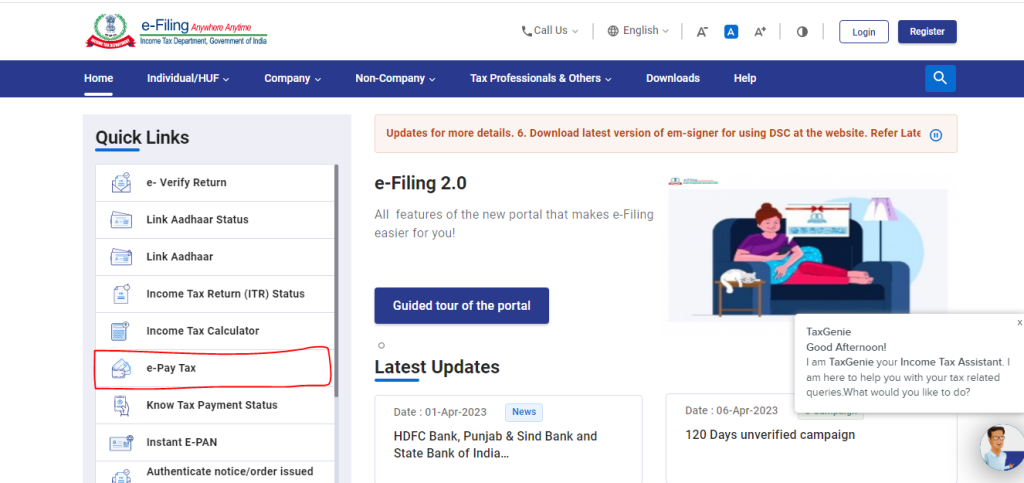

- Click on the e-Pay Tax option.

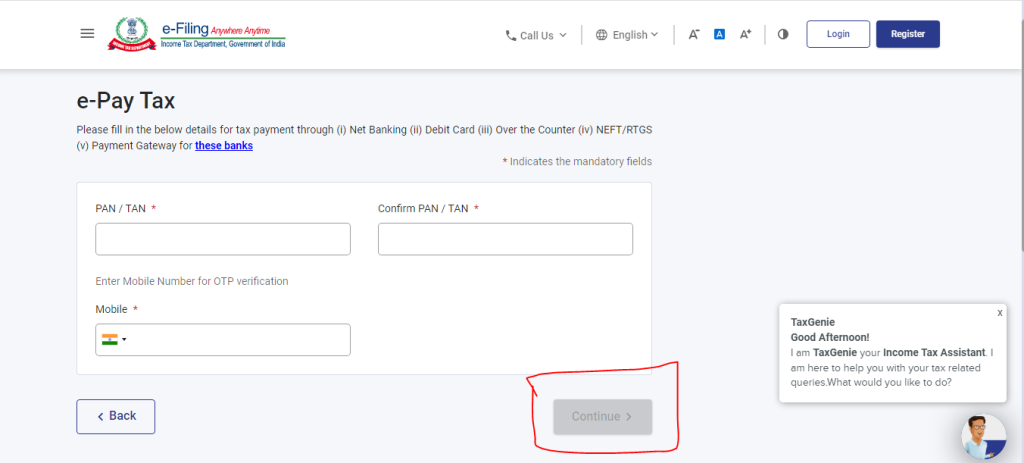

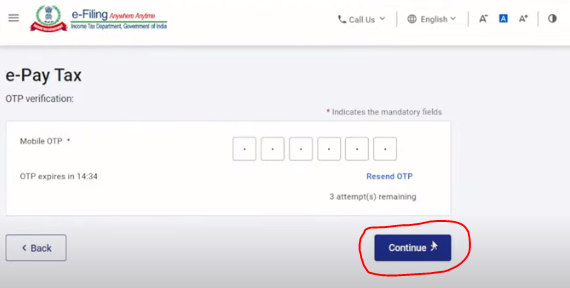

- After that, you have to enter your TAN number and your registered mobile number because you will receive an OTP for doing the next process.

- After clicking on the Continue button please enter the OPT this OTP is received in your registered mobile number.

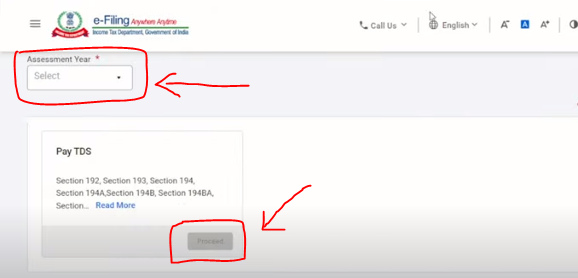

- In this option, you have to select the assessment year for your payment and after selecting the assessment year the pay TDS section will be automatically enabled and visible to you for the proceeding then click on the proceed button.

- Note*** The challan number is automatically selected by the portal for the payment of TDS/TCS so you don’t have to select any challan number just click on the proceed button.

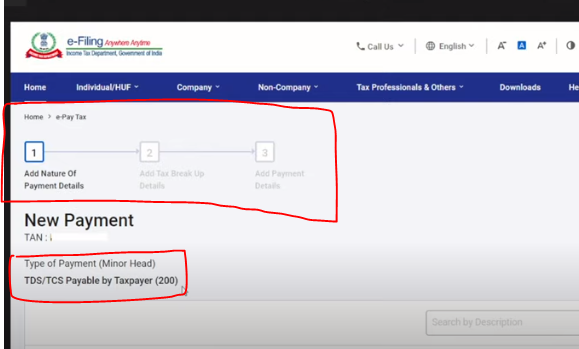

- In the next step, you can see the three options for the payment of your tax and also the minor head for the payment of this challan is auto-selected by the portal.

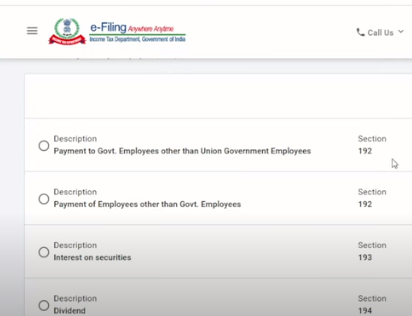

- In the next option, you have to select the section of your TDS payment.

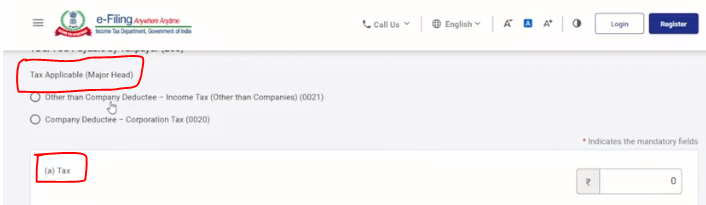

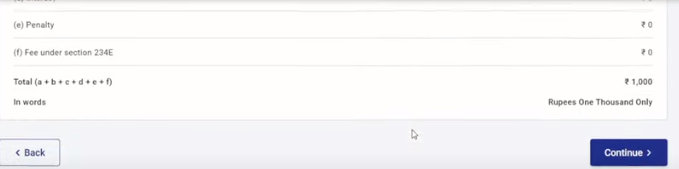

- After that, select the major head and enter the tax amount in the given column by the government and then, click on the continue button.

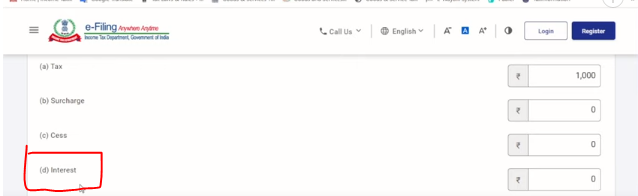

- And if you have any interest payment liability then enter the interest amount in the Interest column.

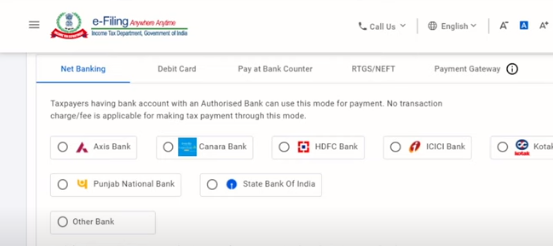

- After completing all these steps now in the next step you have to select the bank payment option and pay your interest by selecting the bank

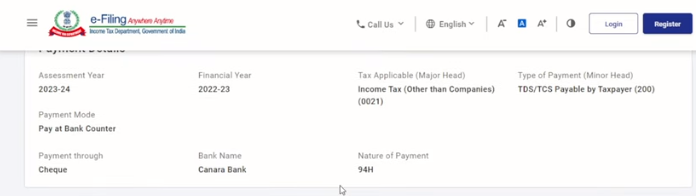

- After the payment, you can see your payment details and then please click on the continue button.

- After clicking on the continue button you can see the details of your challan and also you can the CRN number of your payment.

Thanks,

[…] https://www.stocksmantra.in/new-option-to-pay-tds-tcs-2023-how-to-pay-tds-tcs-in-a-new-way-2023/ […]