Hi Guy’s

This is Ravi Kumar, and today I will let you know about the applicability of linking PAN with Aadhar

Let’s get started,

According to the Indian government, the government has already clarified that please link your Aadhar with your Pan after the due date we would collect a part of the late fee for the late processing to link with your Aadhar.

People are not understanding this notice which is declared by the government and now, the late fee collecting has started by the government. (late fee is Rs. 1000)

Who is required to link PAN with Aadhaar?

In this case, who is a resident of India, an individual is a resident of India, a person below the age of 80 years is a resident of India, and who does not belong to these states Jammu Kashmir, Assam, and Meghalaya.

Who is required to link PAN with Aadhaar?

In this case, who is a Non-resident of India, an individual is a Non-resident of India, a person above the age of 80 years, and who belongs to these states Jammu Kashmir, Assam, and Meghalaya.

How to check PAN and Aadhaar linking status

If you want to check your link status then please follow these steps.

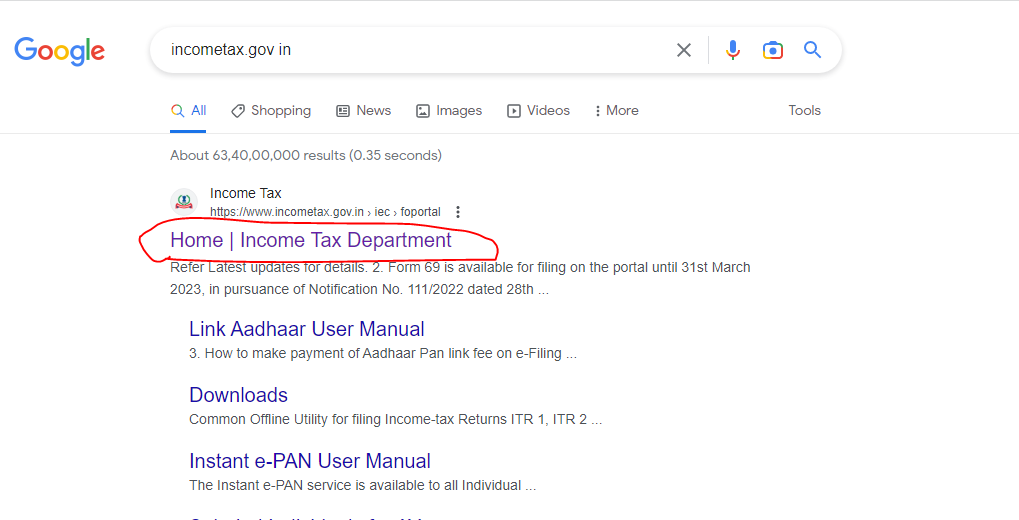

- Go to the income tax portal and click on the 1st option.

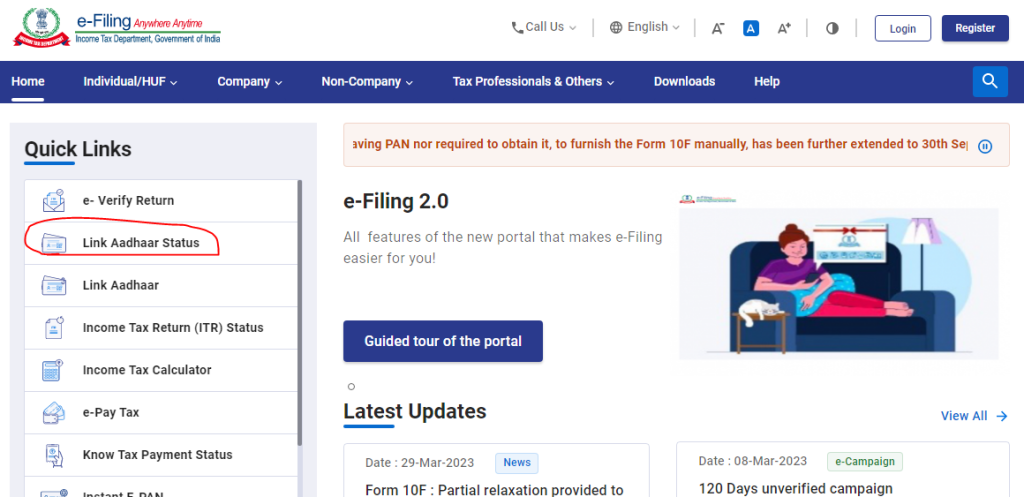

- After that, Please click on the link Aadhar status this option is visible on your left-hand side.

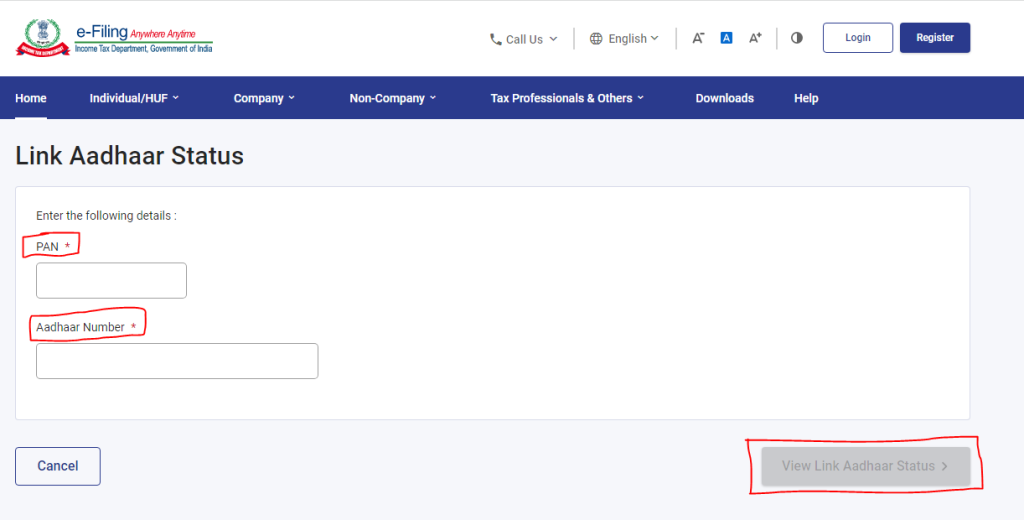

- After that you have to enter the number of your PAN and Aadhar after that please click on the View Link Aadhar Status option.

If your PAN is linked with your Aadhar then you will receive a pop-up that is your Aadhar is already linked with the given PAN number.

How to link my Aadhar with my PAN?

If your Aadhar is not linked with your PAN then you would have to pay 1000 as a late fee charge to the government and after 4 to 5 days please raise a request for the linking of your PAN with Aadhar.

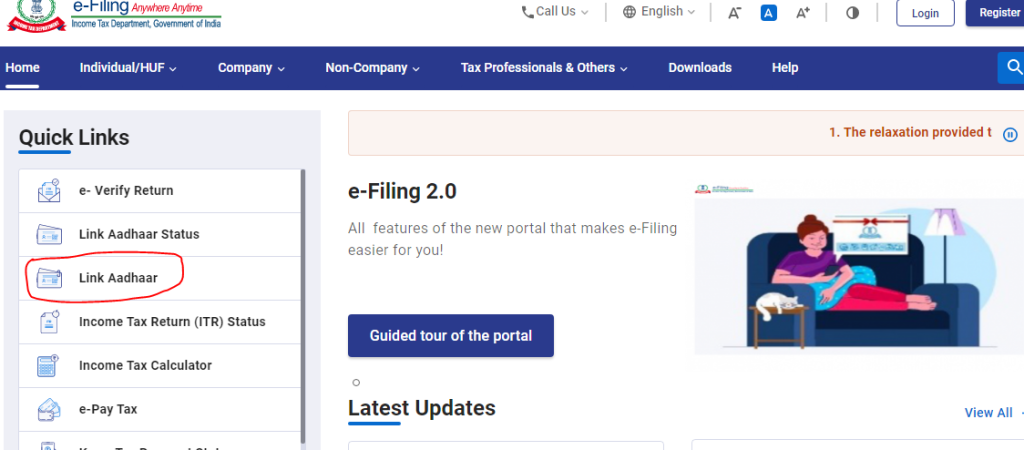

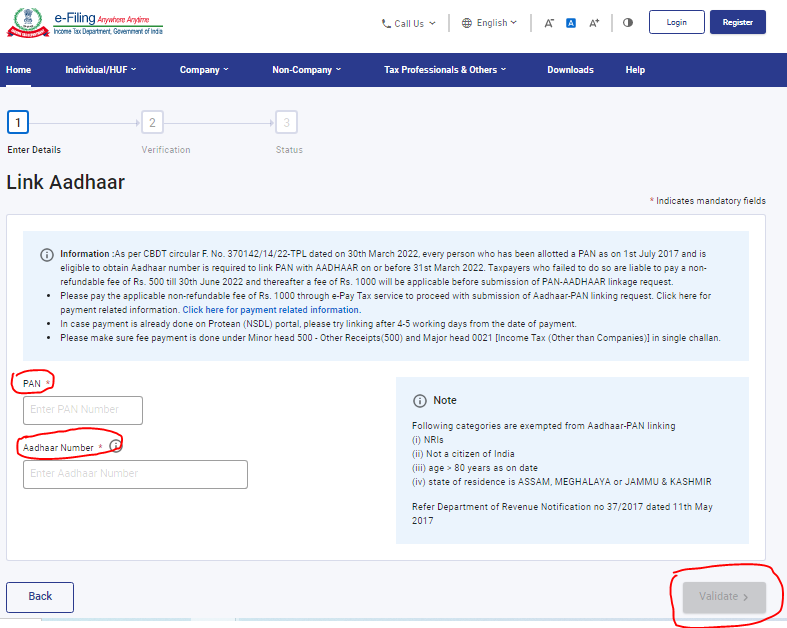

- Click on the Link Aadhar option.

- After that, you will have to enter your Aadhar and PAN number in the given column and then click on the validate button.

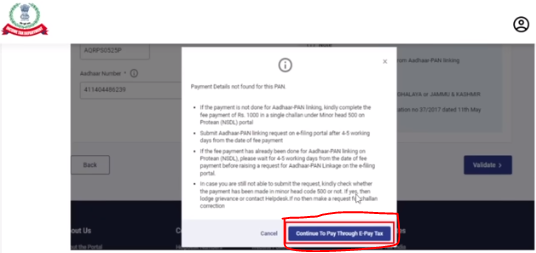

- After that, a new popup is showing on your dashboard, then click on the continue to pay through e-pay tax button.

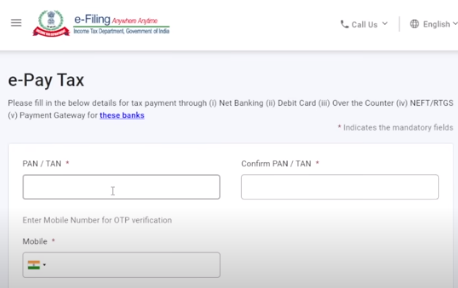

- After that, Please enter your PAN number, and your Aadhar number, and also enter your mobile number this mobile number must be linked with your PAN after that you will get a message for the next process.

- Now in this option, you will enter the OTP which is received in your registered mobile number then your dashboard is showing like this. so you have to click on the continue button.

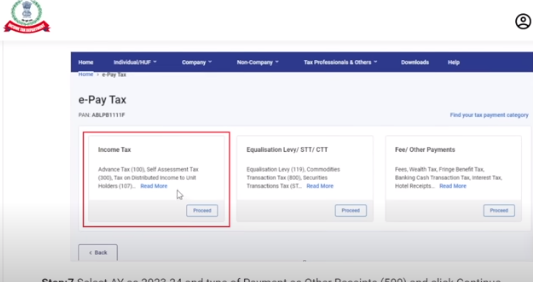

- And then select this option.

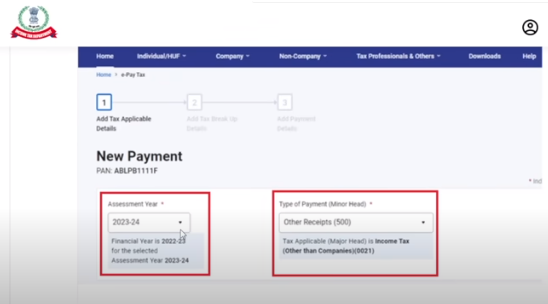

- After that, please enter the Assessment year and choose the minor head for the challan payment.

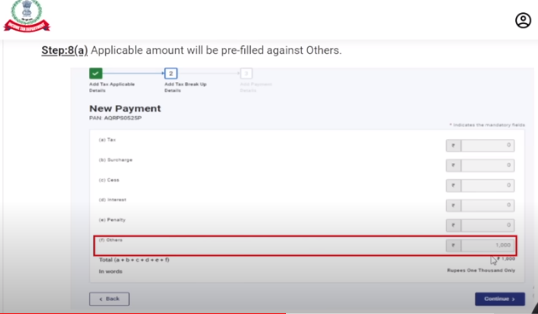

- After clicking on the proceed button on the next page you can see the payment option one more thing the payment amount is already fielded by the government in the given column. then click on the continue button.

- And the last step is please select your bank for the payment of late fees and after the payment, your liability is over to you. And you will get your linked Aadhar in the next 4 to 5 days.

Thanks,