Hi guy’s

This is Ravi Varma, in this article I will tell you about the Traces site.

Let’s start,

What are the documents required to take registration on TRACES?

- Most important You have availed TAN number of your Firm.

- You have to your latest TDS Return statements.

- You should have the token number of Form 26Q

- You should have full details of your challan because you have to give your challan details on TRACES portal.

Follow these steps to register on TRACES

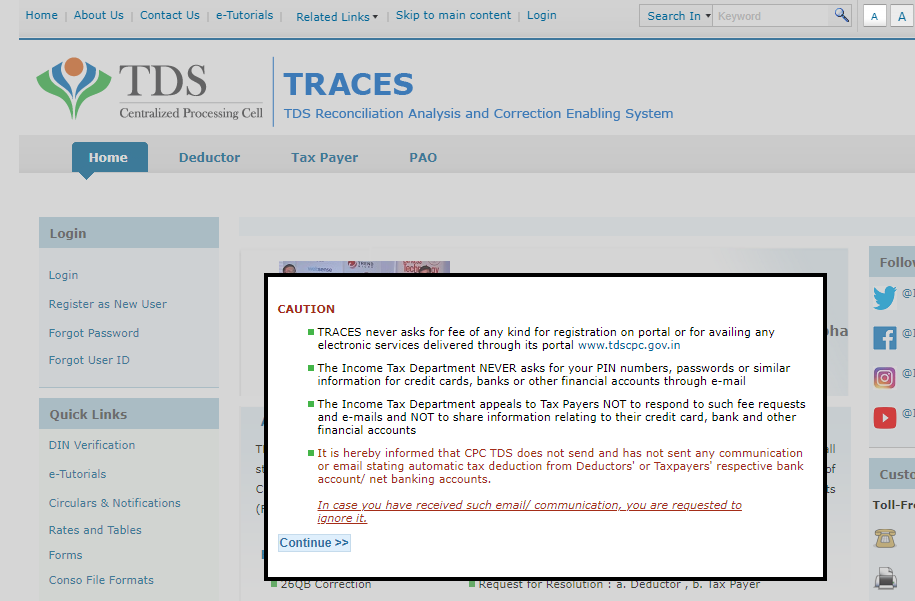

- Go to the the TRACES portal site and click to continue button (tdscpc.gov.in)

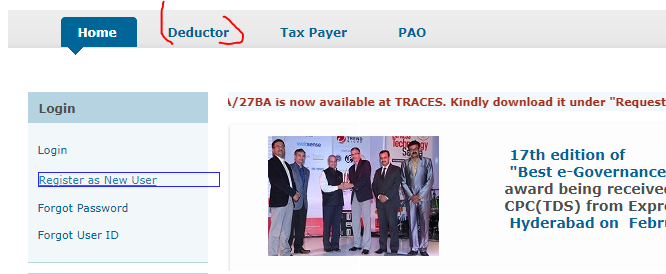

- click to the register as new user icon.

- Sellect Your firm type.

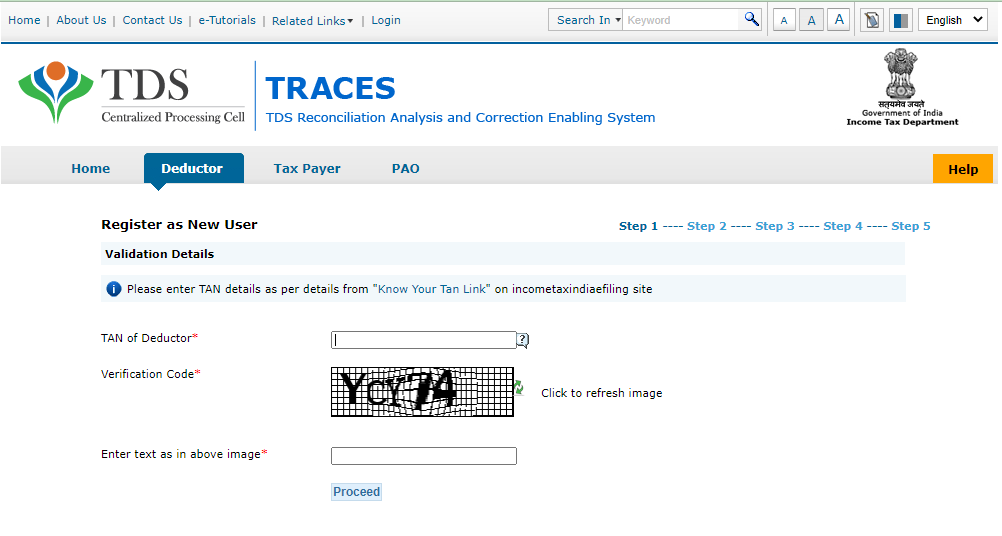

- After selecting the type of your firm, you have to give the valid tan number of your firm and enter the captcha code.

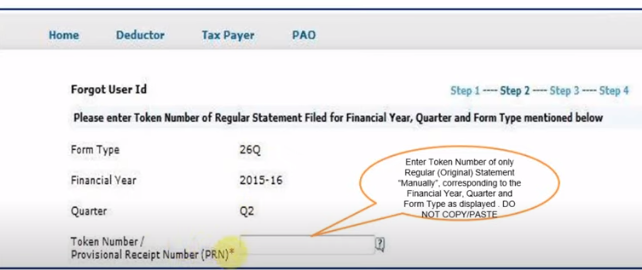

- After doing this step the next step is to enter your first TDS return token number.

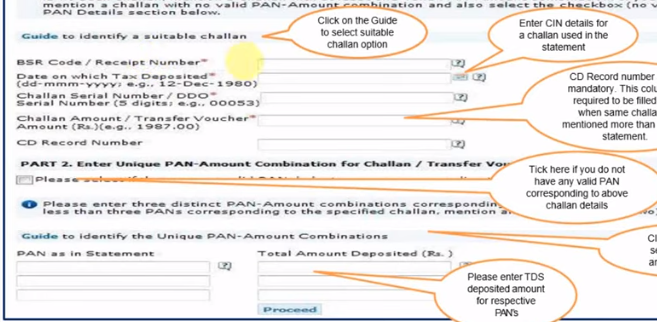

- After this, you will have to give all the basic details of any of your Challan.

A. your BSR code

B. Date of tax deposited.

C. Challan serial number.

D. Total challan voucher amount.

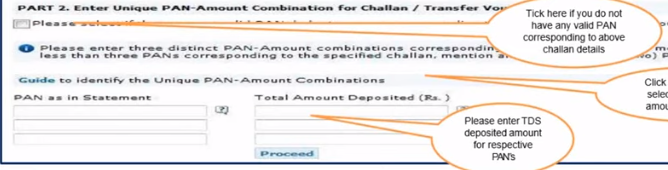

- In this option, you have to give details of the PAN number of your submitted challan and then click on proceed option.

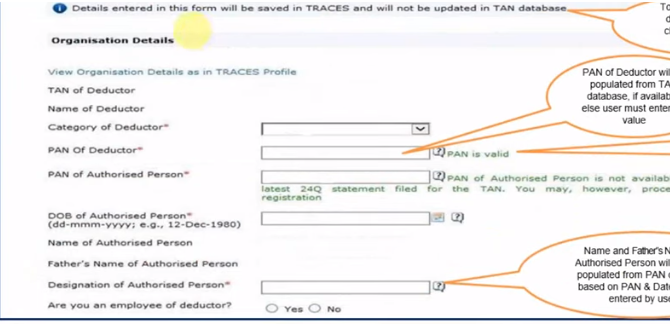

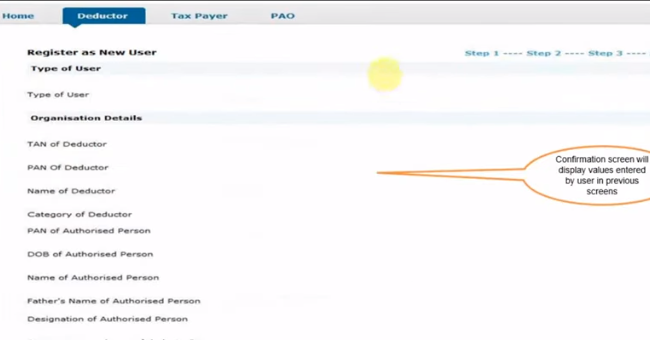

After this, you have to enter the details of your firm.

a. Deductor TAN number

b. Name of deductor(Firm name)

c. What is the category of deductor?

d. PAN number of the firm who is deducting TDS

e. Whoever is the authorized person to deduct TDS, his PAN number will have to be given.

f. The details of the date of birth of the authorized person have to be given.

g. The designation of the authorized person has to be mentioned in which position the person is holding in the company.

h. If the authorized person is an employee then the employee option has to be selected

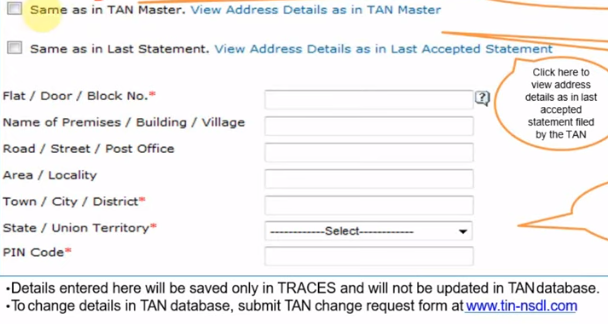

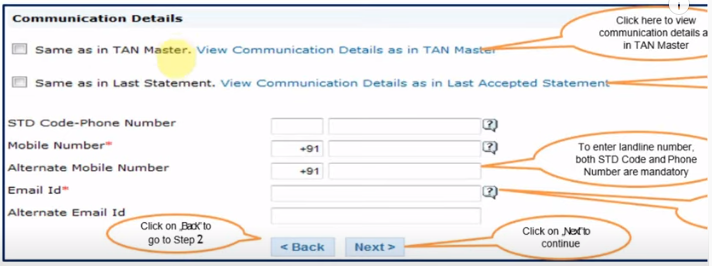

- After this you have to give the details of the address of your firm, you can give this details in two ways.

- Same as in TAN number:- This means that whatever address is mentioned in your TAN number, they can give it to us.

- Same as in last statement:- This means that whatever address is mentioned in your previous TDS return, you can give it to us.

- Communication Details :- In this, it takes information about the communication details of your firm, if there is some problem or error, then a message will be sent to you in the form of traces.

- In this also you can give communication details in two ways

- Same as in TAN number:- This means that they can give whatever communication details are mentioned in your TAN number.

- Same as in last statement:- This means that you can give whatever communication details have been mentioned in your previous TDS return.

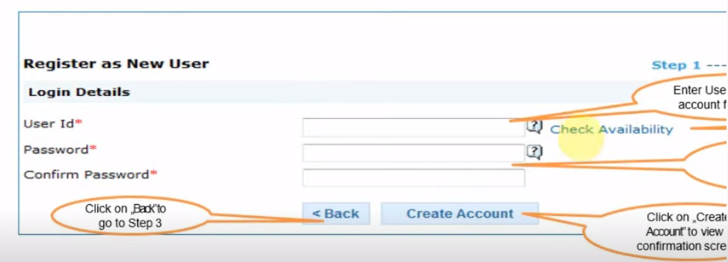

- Register as new user.

The last step to register on the TRACES portal is to create a login ID and password.

You have to enter your unique login ID and password in it and then click on create an account.

- After this you will get the confirmation details showing all the details of your firm, if all the details are correct then click on the confirmation option and if anything is wrong then you can go to the edit option and you can correct it.

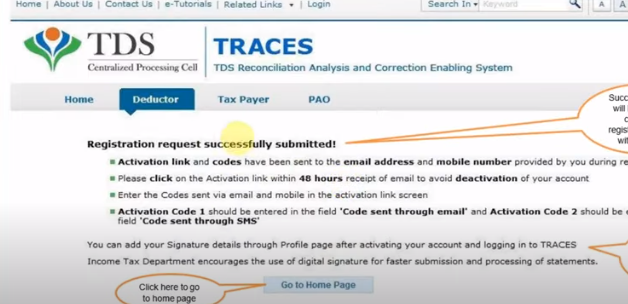

- If we click on confirm option then we will get the message of registration on traces.

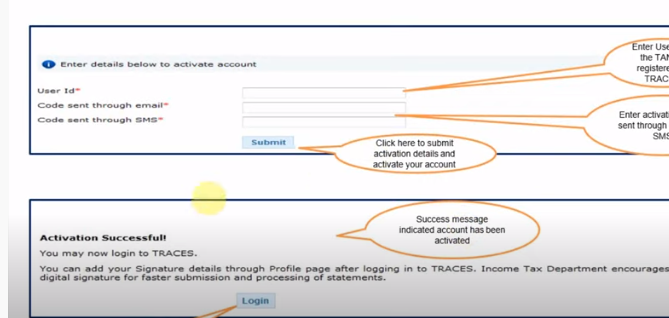

- After this, a link will be sent to your email from Trace, on clicking of which you will get an activation code, with the help of which you can register yourself on the Trace site.

- enter your user Id & verification code which is received in your email and then click on the submit option.

Finally, you have successfully registered on the traces site.

Thank’s