Hi guy’s

This is Ravi Varma, in this article I will tell you about the new TAN registration on the new income tax portal.

Let’s start,

I will tell you how you can register your TAN number on the new income tax portal in a very easy way.

Please follow these steps for new TAN registration on the new income tax portal.

STEP – 1

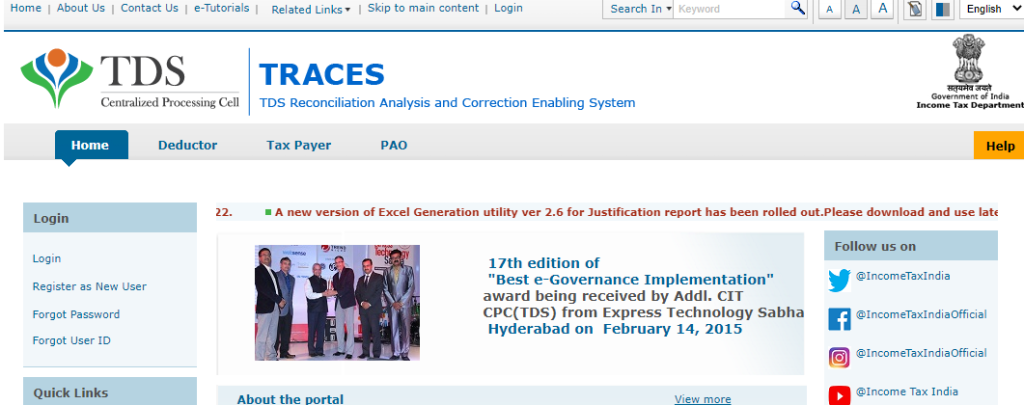

Go to the traces site portal (https://contents.tdscpc.gov.in)

STEP – 2

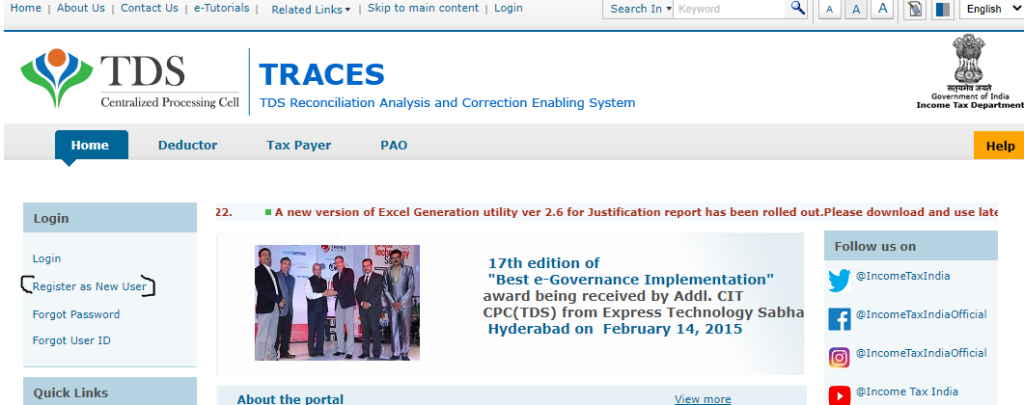

Click on Register as a new user.

STEP – 3

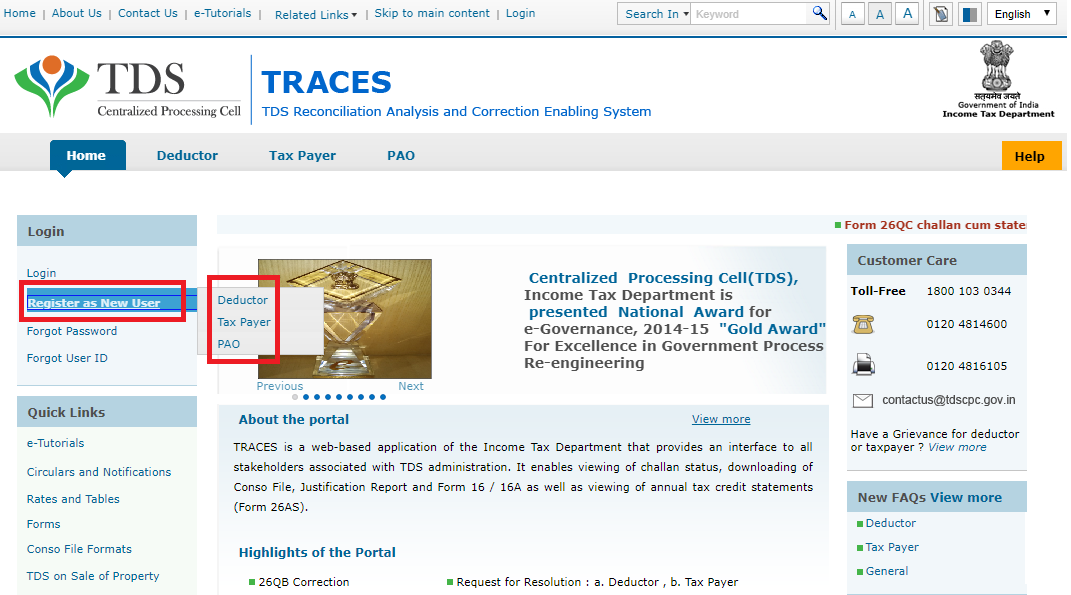

Select Deductor.

STEP – 4

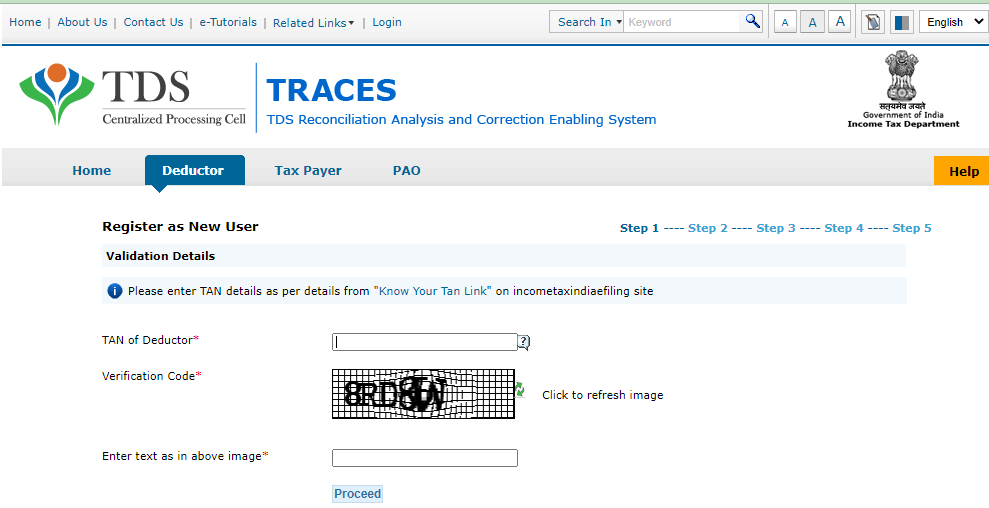

After selecting the deductor option you will see a new detail which is asked to fill in your TAN details.

Enter your company TAN number and verification code and then click on proceed button.

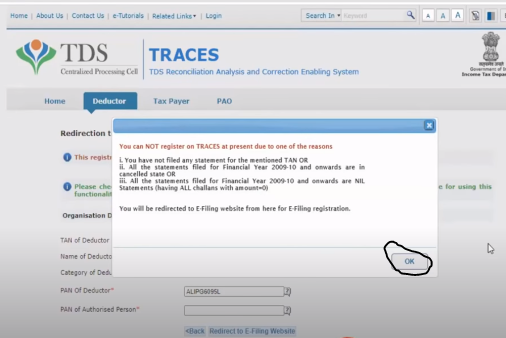

STEP – 5

As soon as you click on the Proceed button, you will see some popups in which you will be given some notices as to why you cannot register on TRACES, Then you simply click to ok button.

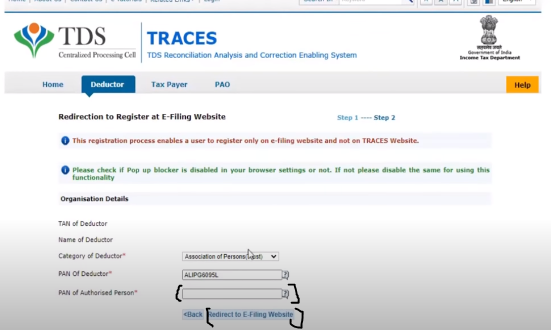

STEP – 6

As soon as you click on the OK button, you need to enter the PAN number of the person authorized to deduct TDS and select the nature of your business as it auto-populates wrong, and click to redirect to the E-filling website option.

**** The TAN number and deductor name will appear in the auto-populated.

STEP – 7

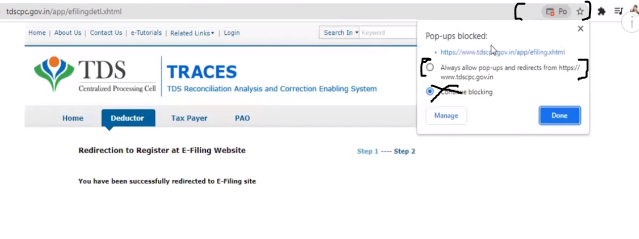

IMPORTANT POINT

As soon as you click on Proceed e-Filling website, you will see a blocking popup beside your URL which you have to give permission and click the done button.

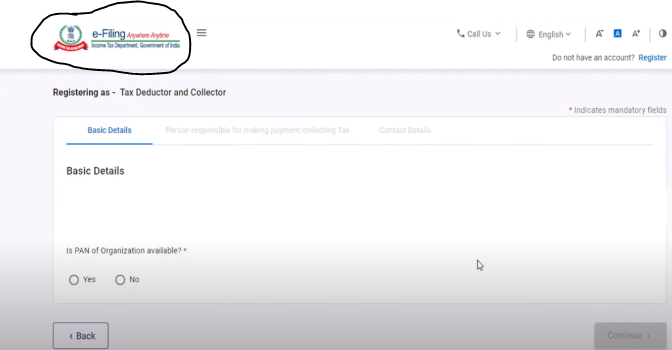

STEP – 8

after doing this step you have directly entered the TDS E-filling website.

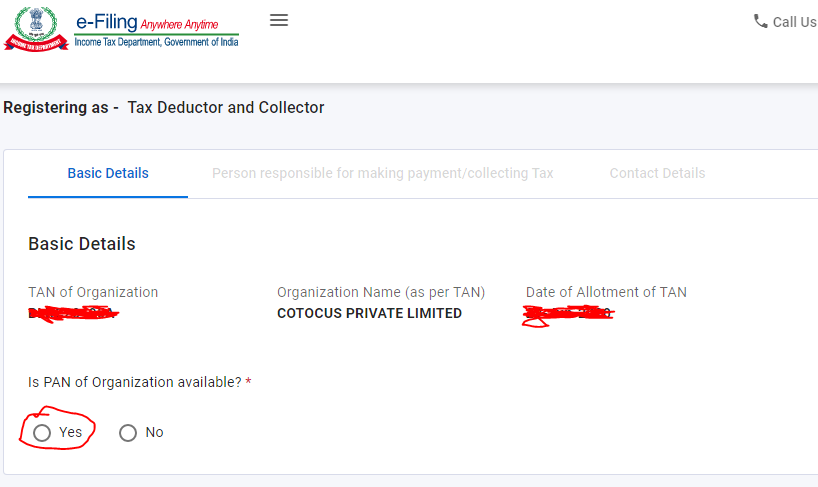

STEP – 9

Here you will be asked whether your firm also has a PAN number, then by clicking Yes, you will have to enter your firm’s PAN number.

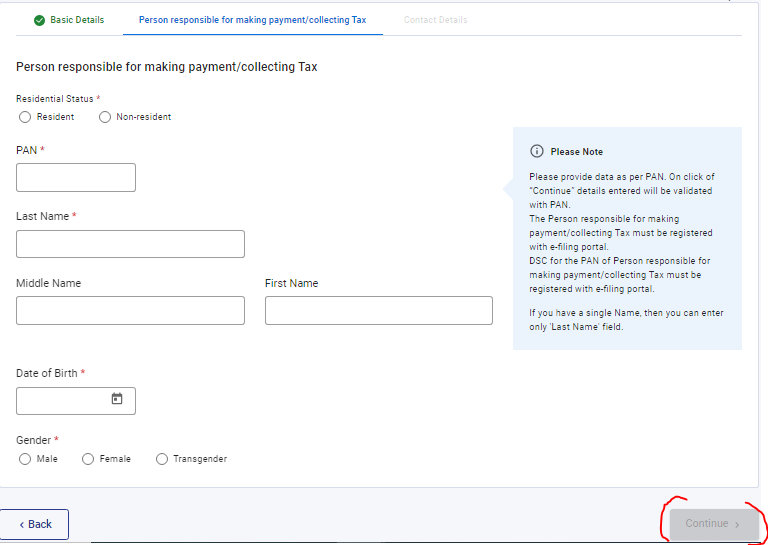

STEP – 10

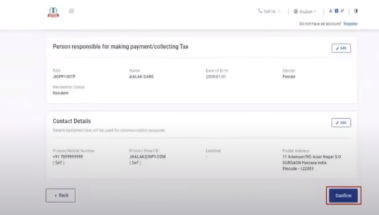

After filling it, you will have to fill in the details of the responsible person, inside which you will have to enter his PAN number as well as the date of birth, after that, you have to do the next process by clicking on the continue option.

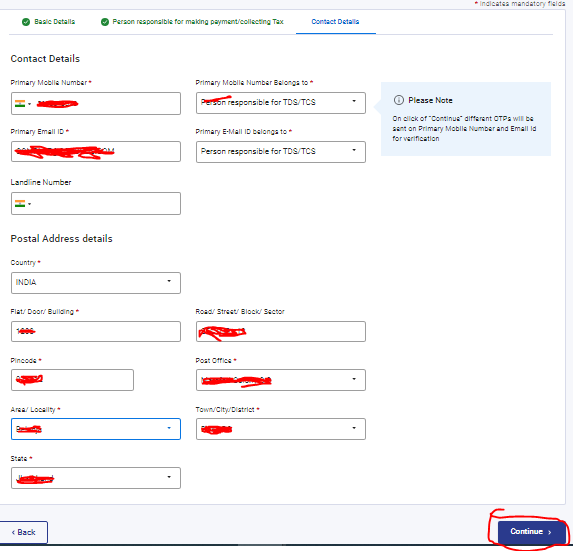

STEP – 11

In this step, you have to tell about the contact details of the responsible person, in which all his details have to be filled.

- CONTACT NUMBER – When you have to do any company work on the TDS portal, then your OTP comes on this number.

- EMAIL ADDRESS – When you have to do any company work on the TDS portal, then your OTP comes on this Email Address.

- ETC.

After filling all these columns click on the continue button.

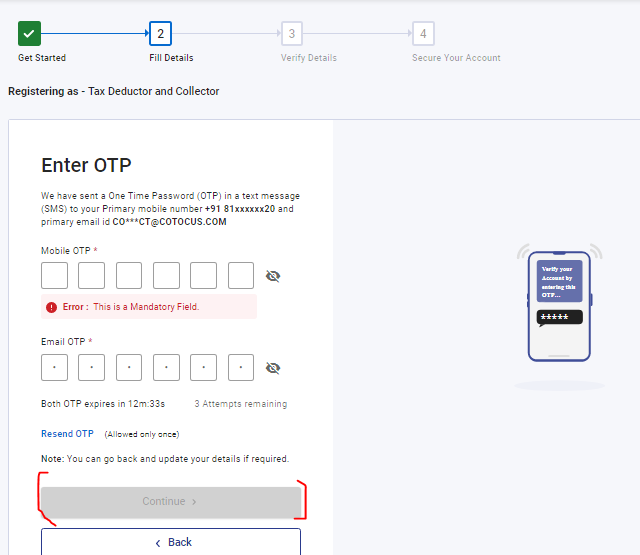

STEP – 12

In this option, you have to enter the OTP and this OTP will be received on your phone number and email address which you just entered.

Then click on the Continue Option.

STEP – 13

As soon as you enter your OTP, after that, you will see all your details which you just entered, then you have to click on the confirm option

STEP – 14

After this process, you will get the option to generate your password, in this, you will have to generate the password, only then you will be able to open your income tax portal.

Then click on the register button.

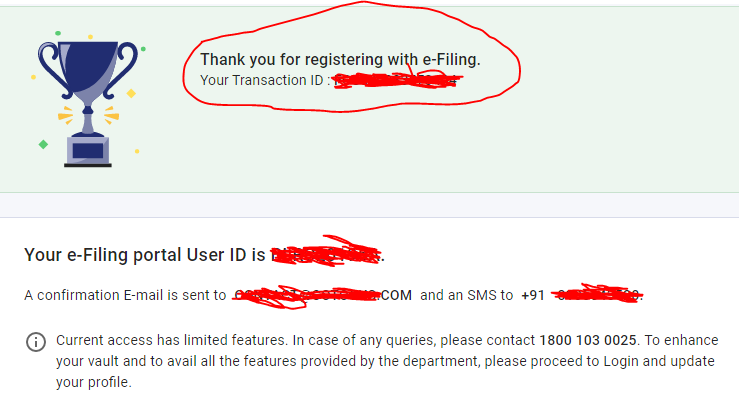

STEP – 15

As soon as you click on register, you will receive the message of your registration successfully.

STEP – 16

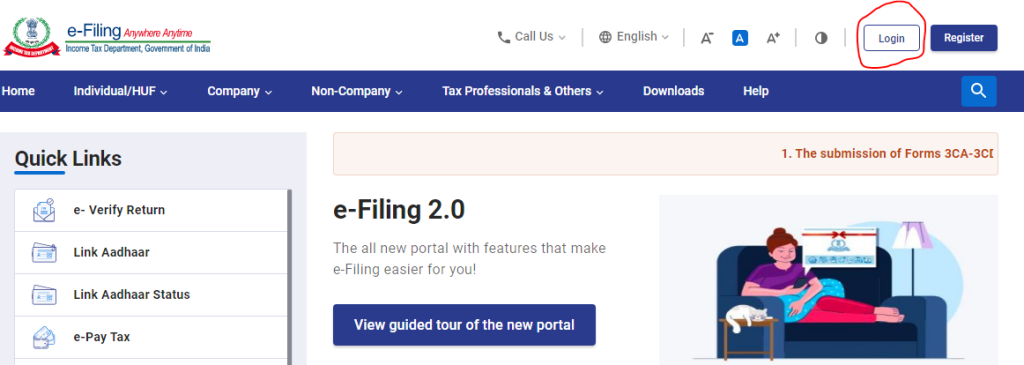

FINAL PROCESS ACTIVATION TAN NUMBER

To complete this process, you have to go to the Income Tax portal and click on Log in.

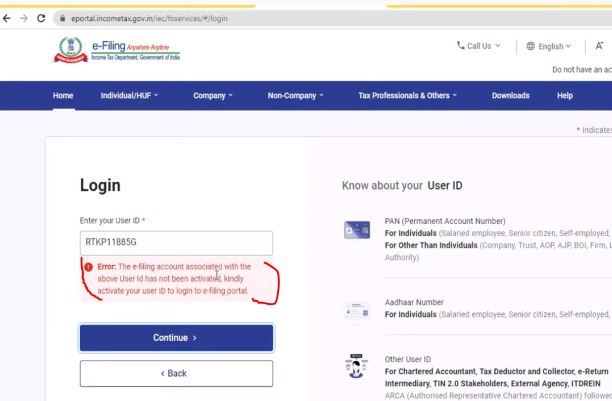

STEP – 17

Enter your login I’d i.e your TAN number and click on the continue button after clicking this you will get a popup.

A message will come in this that please activate your TAN number first.

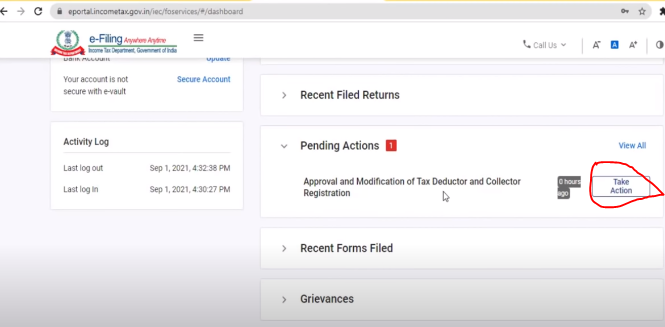

STEP – 18

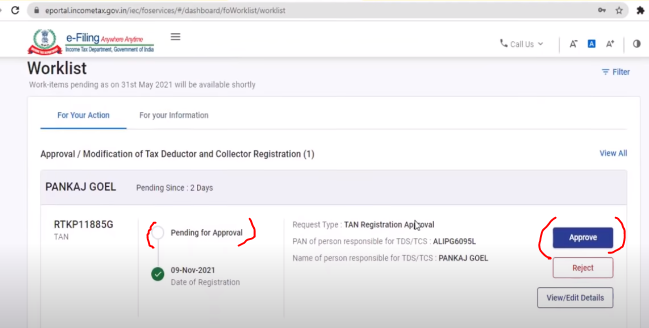

To activate your TAN number, you will first have to enter the PAN number of your authorized person, after that you have to click on the worklist in the pending option, you will get the option of approval and modification, by clicking on which your TAN will be activated.

STEP – 19

After this you will have to approve a process, then your TAN number will be activated.

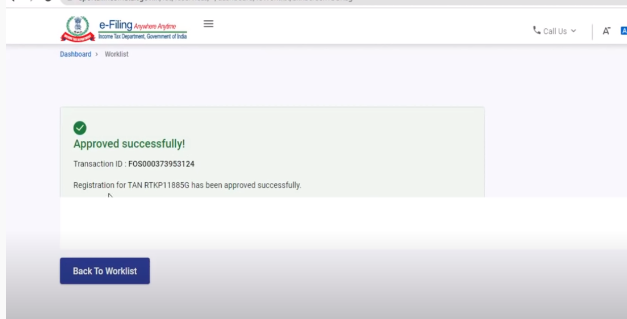

STEP – 20

As soon as you approve, you will receive your activation message, then you will be able to log in to your income tax portal with your TAN number.

Thanks,