Hi everyone,

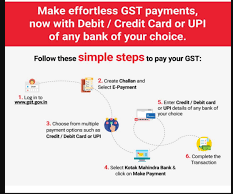

In my today’s blog, I will let you know how to pay the GST amount through the UPI.

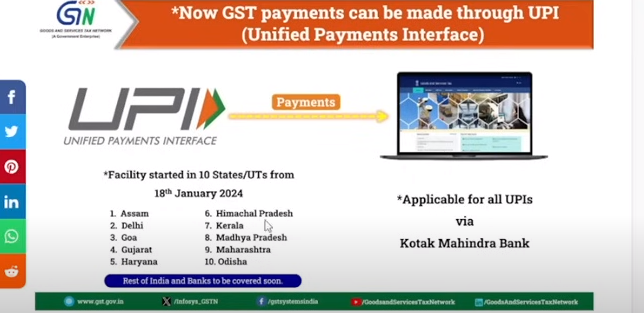

The UPI Payment for GST is a new way for businesses to pay their Goods and Services Tax (GST) using their UPI-linked bank account. It’s like an electronic method introduced in January 2024 to make paying GST easier.

Here are the main points

Why? To pay GST online.

How? It uses the UPI system to quickly transfer money.

Benefits? It’s convenient, fast, and makes financial transactions clearer.

Who can use it? You need to be a GST taxpayer with a UPI-linked bank account.

How does it work? You create a challan on the GST portal, select UPI payment, use your UPI PIN, and get a confirmation.

In simple words, think of UPI as a safe and easy way to transfer money between bank accounts using your phone. Now, businesses can use it to pay their GST directly, making the process smoother and more user-friendly than before.

Why has the government introduced this option for GST payment?

The Indian government introduced UPI payments for GST in January 2024 for several important reasons –

1. Promoting Digital Payments:

- Boosting Cashless Transactions: UPI aligns with the government’s aim for a cashless economy, reducing issues with physical cash like counterfeiting and black money.

- Increasing Tax Compliance: Easy and fast UPI payments can encourage businesses to pay GST promptly, improving tax compliance and government revenue.

2. Enhancing Convenience and Transparency:

- Simplified Payment Process: UPI removes the need for manual challan filling or visiting banks, making GST payments quicker and more convenient.

- Real-time Transaction Tracking: UPI transactions provide immediate confirmation and transaction history, improving transparency and reducing errors or delays.

3. Lower Transaction Costs:

- Reduced Fees: UPI transactions generally have lower fees compared to other online methods like credit cards, reducing the financial burden on businesses.

- Direct Transfer to Government Account: UPI payments skip intermediary banks, leading to faster fund transfer and potentially lower administrative costs for the government.

4. Wider Accessibility:

- Leveraging Existing Infrastructure: UPI uses the established mobile banking infrastructure, making it accessible to a large number of businesses, even in rural areas with limited access to traditional banking.

- Inclusiveness: By integrating with various UPI apps, the government ensures inclusivity, considering the diverse preferences and comfort levels of businesses regarding mobile payment platforms.

Introducing UPI payments for GST is a significant move to simplify tax payments, encourage digital transactions, and enhance financial transparency for businesses and the government.

Here I am giving you steps for how to make the payments through the UPI for the GST payment.

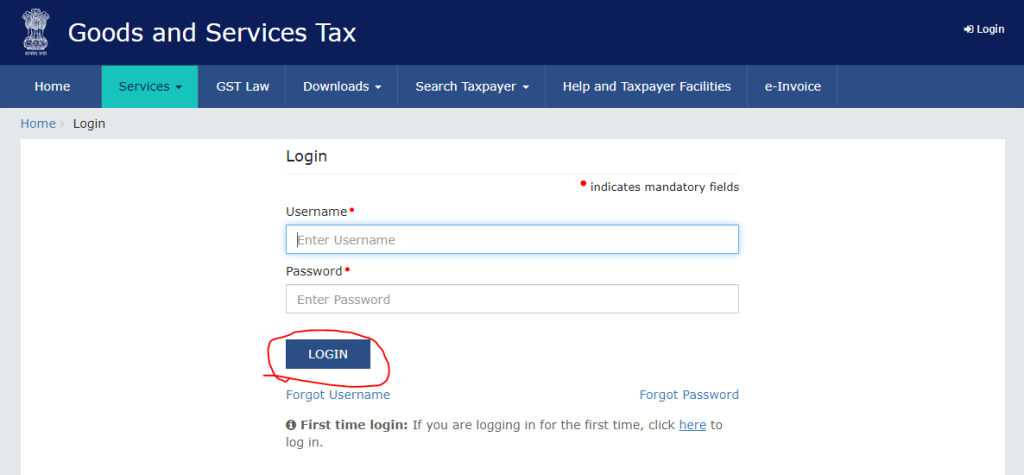

a. Login to the GST portal with your credentials.

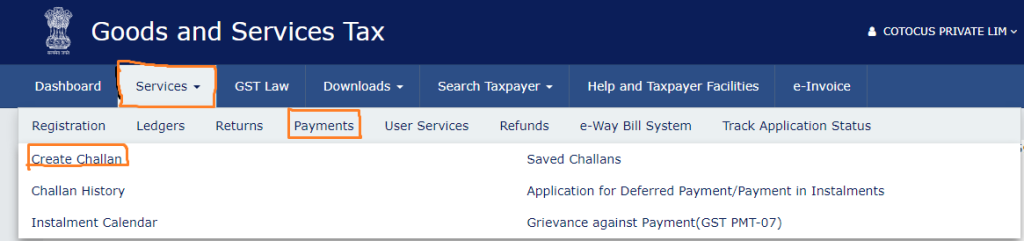

b. Go to Services > Payments > Create Challan Or you can directly pay it through the GSTR-3B payment process.

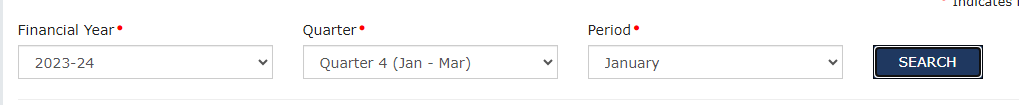

c. After that, Please select the Tax Period and Type of Payment.

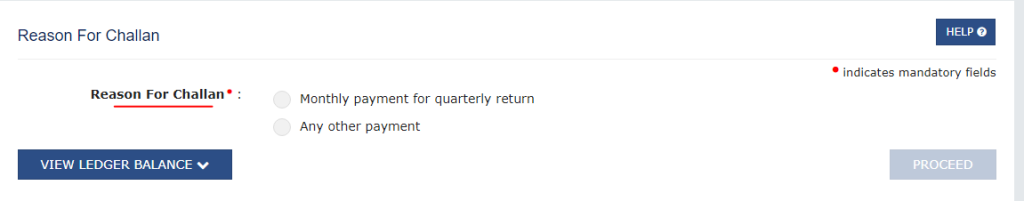

d. Please select the reasons of challan and click on the proceed button.

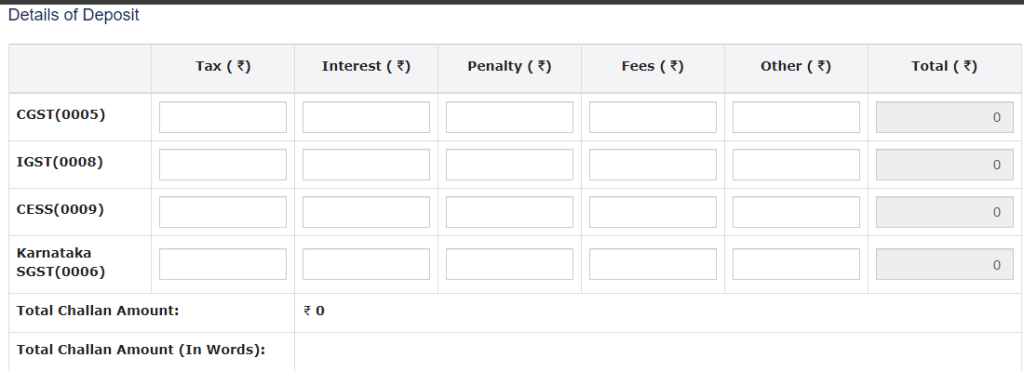

e. After that, Enter the GST Liability amount under the relevant heads.

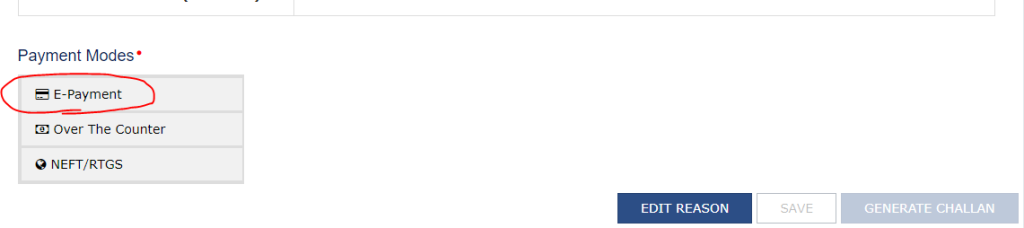

f. Please select the payment mode and click on the Generate Challan button after entering the liabilities.

g. After clicking on the generate challan button please select the E-payment mode button.

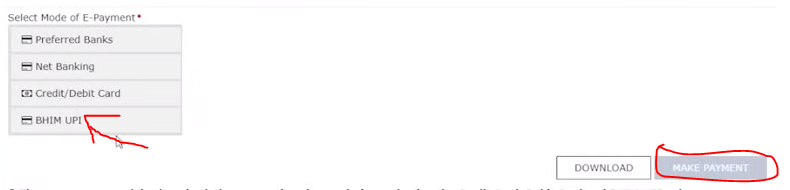

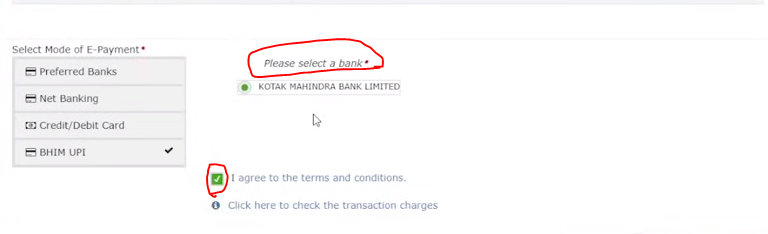

h. After clicking on the UPI button please select your bank and tick the I agree button.

I. After completing this steps you can able to make your GST payment through the UPI services.

J. This UPI payment option is given only for 10 states.

- Assam

- Delhi

- Goa

- Gujrat

- Haryana

- Himachal Pradesh

- Kerala

- Madhya Pradesh

- Maharastra

- Odisha

Thanks,