Hi guy’s

This is Ravi Varma, in this article I will tell you about how to pay interest & late filing fees

Let’s start,

When we make monthly payments of TDS late due to any reason, then interest starts charging on us. (If we do not deposit the TDS AMT then 1.5% p.m will be fined up to)

If we delay in filing TDS return then we start charging a late filing fee and this amount cannot exceed the TDS amount but if we do not file TDS return then we are fined up to 1 lakh Will go (If we do not fill the TDS return then 200 per day will be fined up to)

*****If we have to do any kind of correction of TDS or we have to pay any kind of penalty then we can do all this work on the TRACES portal.

STEP TO STEP FILING TDS INTEREST & LATE FILING FEES

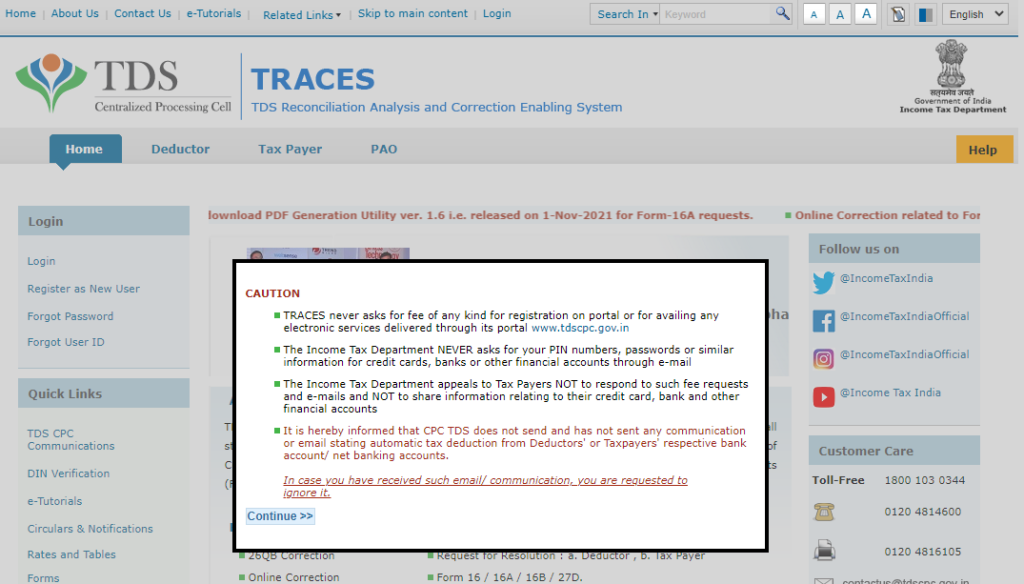

Please log in to your traces portal with your credentials.

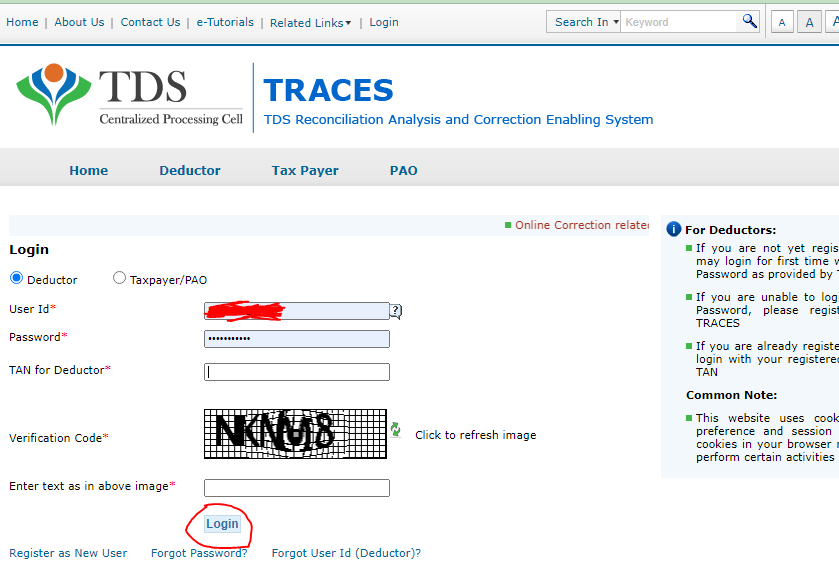

2. Enter your Login ID, Password along with your company’s TAN number, and also enter the verification code after doing this please click on the login button.

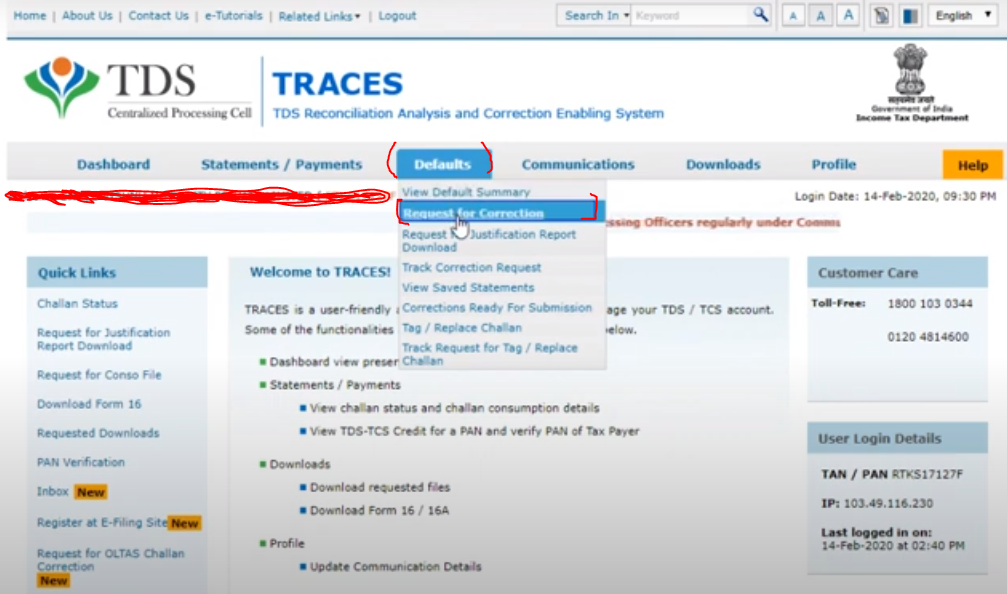

3. Go to the default section and under this, you will see the request for correction option then click on it.

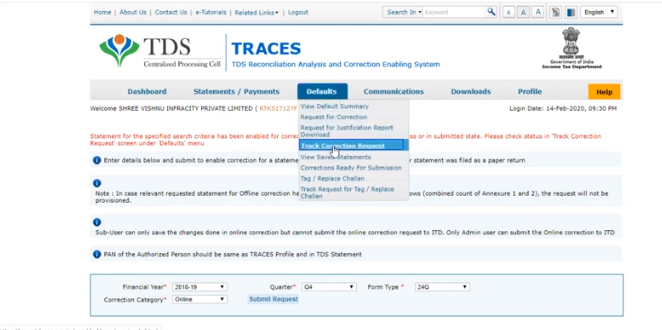

4. In this, you will ask for some details of the year for which year you want to make corrections.

A. Financial year – First we have to select the financial year.

B. Quarter – 2nd we have to select the quarter.

C. Form type – 3rd we have to select the form type.

D. Correction Category – And last we have to select the correction category (offline/online)

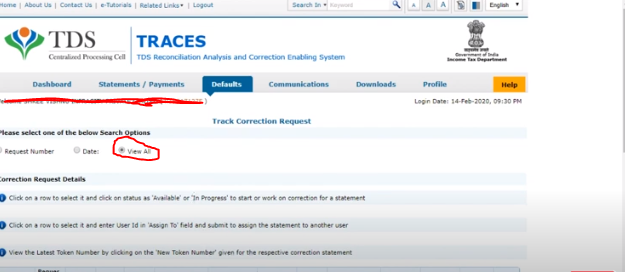

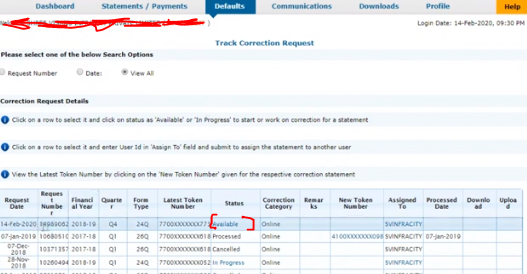

5. Next go to the track correction report option.

6. Under this you have to click on the view all option.

7. As soon as you click on View All option then you will get all your statuses to show as many statuses you have submitted for correction and as soon as this status will be available then you have to click on it

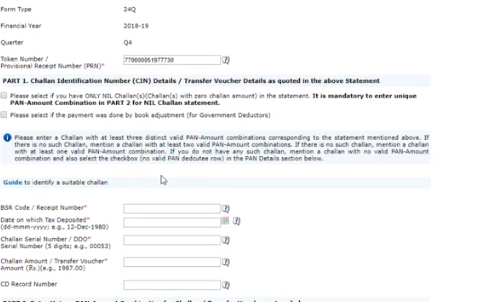

8. When you click on the available statement, you will now be asked for some details to make the correction of that statement, which you will have to fill.

- Token number – You will get this token number on your income tax portal

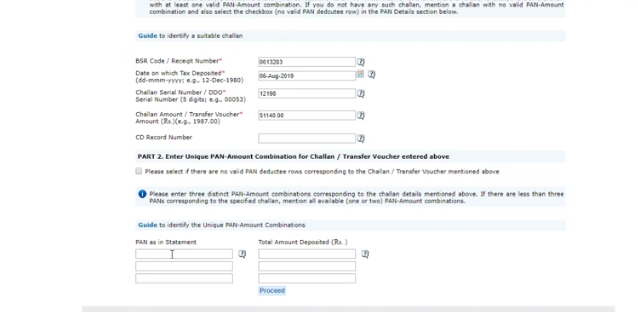

- BSR code – When you submit your TDS challan to the bank, at that time the bank also gives the BSR code of your bank in your statement.

- Date of tax deposit – On whichever date you have paid TDS, you have to write that date here. (DD/MM/YY)

- Challan Amount – You have to write the total value of the TDS amount you have paid in that challan here. {(And while writing the amount, in the last you have to give a point and write double zero (2000.00)}

9. In the next option, you have to enter the details of the deductee having at least 3 PAN numbers.

And you will also have to enter the Amount of TDS deducted according to that PAN.

And click on the proceed button.

***If there will not be any details with 3 deductees then you will have less than 3 deductees then you can complete this step from its details also.

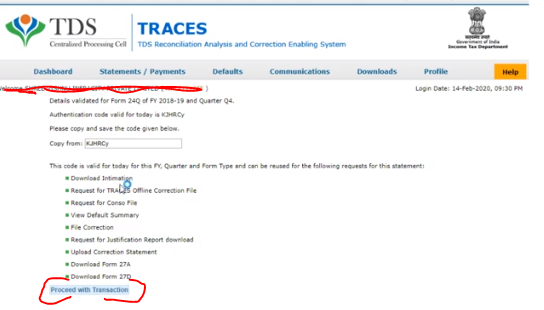

10. As soon as you click on Proceed button you will get a code after that, when you have any problem related to it in the future, you can solve it with this code, now you have to click on proceed with transaction button.

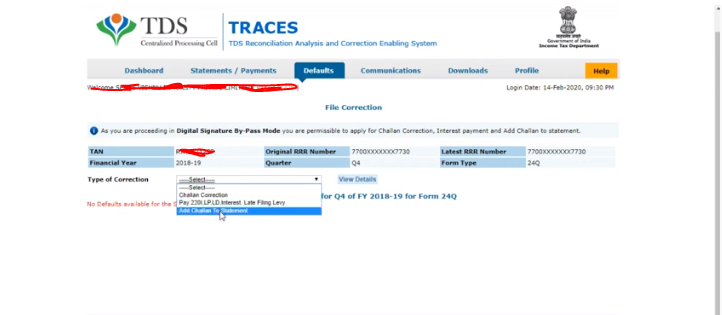

11. In the next step, you have to add the challan, then for this, you have to select the option of add challan and click on the view detail option.

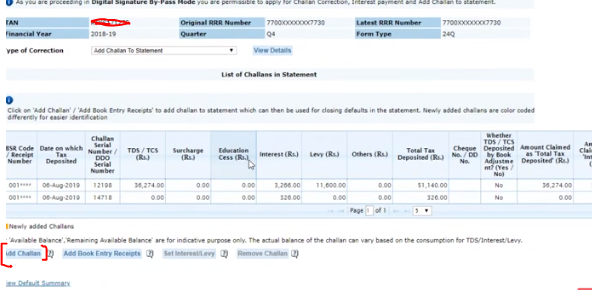

*****You have to create a new challan for all the interest or late fees you have to pay and enter all the penalty amount in that challan and submit it with the help of the ITNS-281 form.

12. Now you have to select the challan which you have submitted by clicking on the option of Add Challan given below.

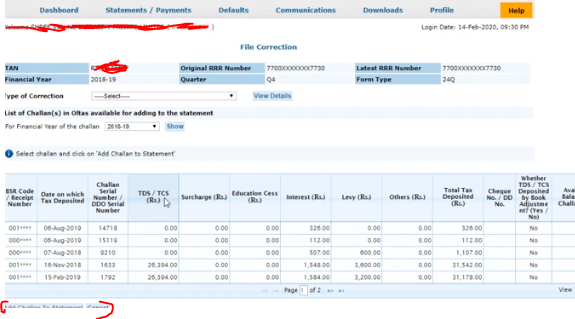

13. In this option, you will select the challan and click on add challan statement.

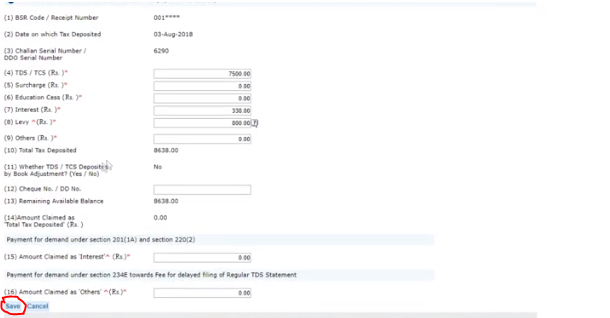

14. After this, we will set off whatever tax we had deposited, in this column, we will enter interest and late fees amount in the given column and click on the save button given below.

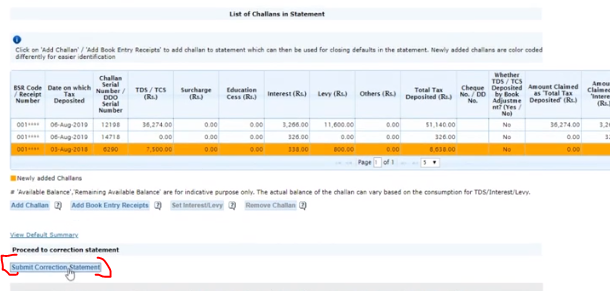

15. The color of the challan from which you have selected and paid the interest will change and after that, you have to click on the submit correction statement given below.

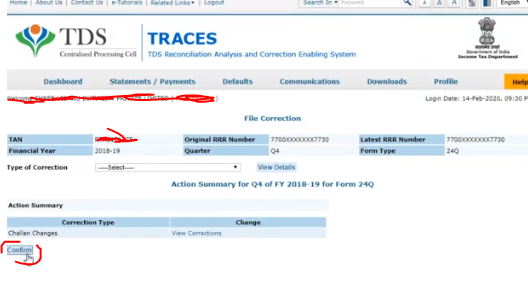

16. After this we will again get a confirmation option, then we have to click on confirm.

17. Now we will have a popup to submit the correction we have done, then we have to click on that pop-up.

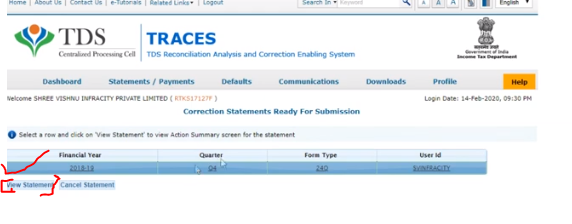

18. After that, you have to select the correction statement and click on the view statement.

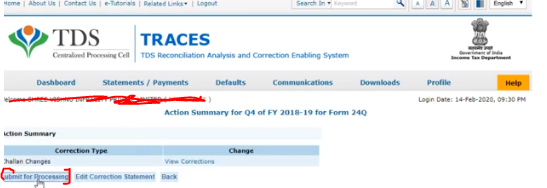

19. Now you will finally complete the last step and click on submit for processing button, as soon as you click on this option your statement will be submitted successfully and you will get the final message that your correction has been saved.

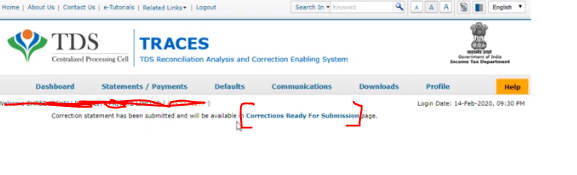

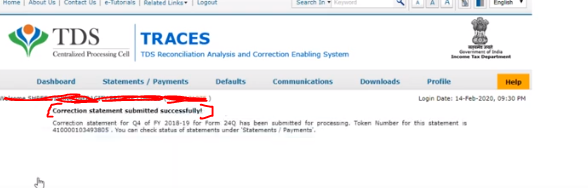

20. You got a final message that your statement is submitted successfully.

If you do not know how to file ITNS 281 challan in step by step method then you can click on the link to learn how we can prepare challan for correction or interest & late fees. https://www.stocksmantra.in/how-to-generate-a-new-tds-challan-for-payment-of-interest-and-late-filing-fees/