Hi guy’s

This is Ravi Varma, in this article I will tell you about how to create a new TDS correction challan for the payment of interest & late filing fees

Let’s start,

Why do we need to generate a TDS challan for the rectification of outstanding demands?

If we make the monthly payment of TDS late by mistake or we are late in filing the return of TDS, then we need to submit a new TDS challan to pay all the taxes amounts.

Follow these steps to generate a new TDS correction challan.

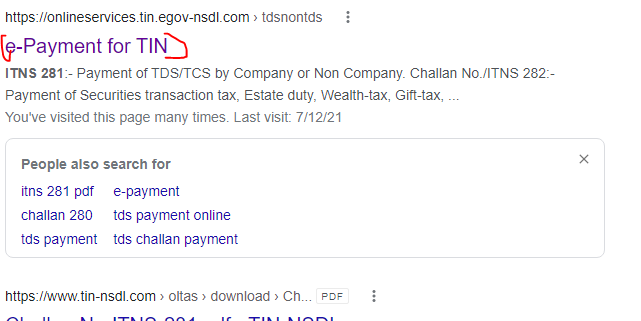

- Go to the e-payment of TIN web page.

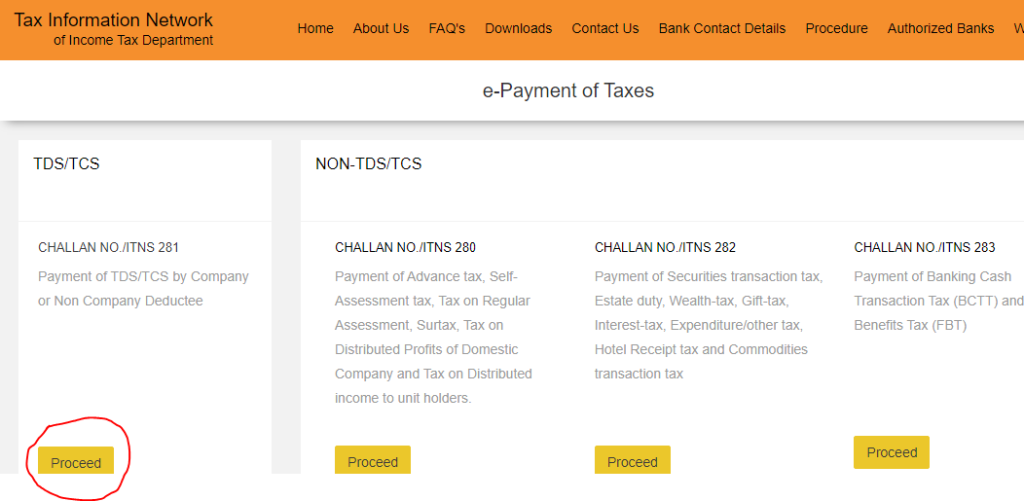

2. Go to ITNS 281 Challan and at the bottom, you see a Proceed button, click on it.

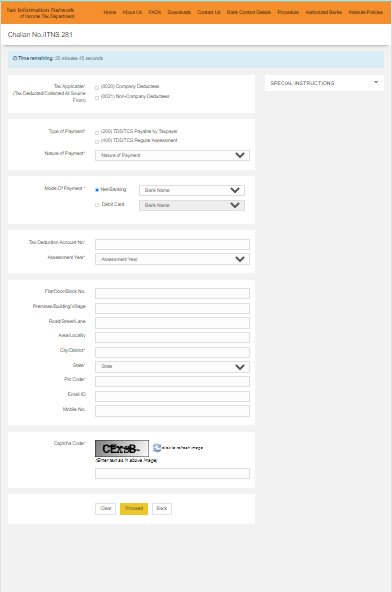

3. After clicking on Proceed button you see a new interface of ITNS 281 challan.

4. Now we have to fill all the columns one by one.

- Tax applicable (Tax Deducted/Collected At Source From)

- (0020) Company Deductees – If we deduct TDS on behalf of the company deductee then we have to choose the company deducted option.

- (0021) Non-Company Deductees – If we deduct TDS on behalf of the non-company deductee then we have to choose the non-company deducted option.

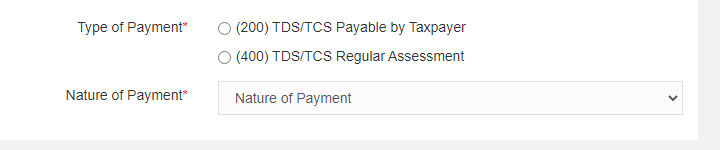

Step 5:- Select Type of Payment.

- (200) TDS/TCS Payable by Taxpayer:- Select this option if you are depositing TDS for the first time

- (400) TDS/TCS Regular Assessment:- And if you want to make any kind of correction in your TDS report then select this option.

- *****Note point If we have received any notice from the government of interest or late fee then we have to select option 400.

Step 6:- Nature of Payment

Select the nature of the payment.

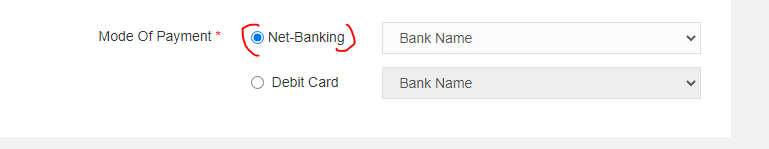

Step 7:- Mode Of Payment

- Net-Banking:- Select it if you want to make online payment through net banking

- Debit Card:- And if you want to make payment through offline mode then you choose it.

step 8:- Tax Deduction Account Number

Enter your company TAN number.

step 09:- Assessment Year

Choose your assessment year i.e. financial year is 2021-2022 then the assessment year will be 2022-2023.

Step 10:- Address

It is mandatory to enter your complete address along with state, district, and pin code.

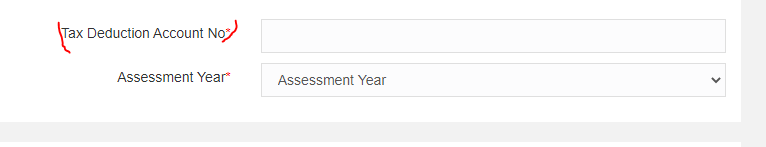

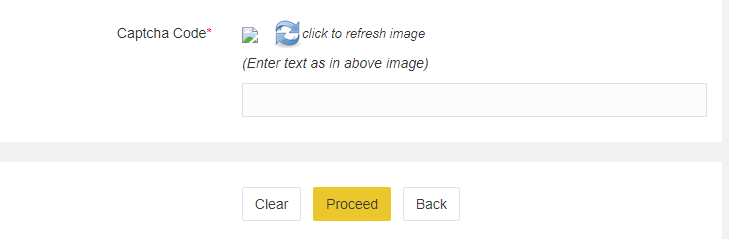

Step 11:- Captcha Code

You can process this form only after entering the captcha code

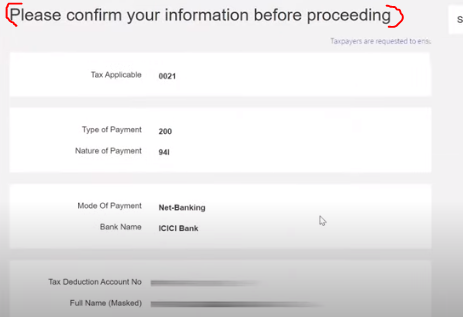

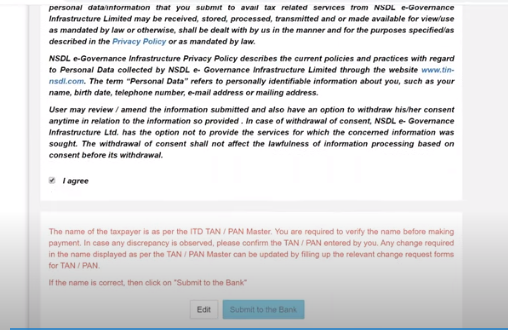

Step 12:- Now you will get an option to confirm whatever you have filled while filling this form.

- Do scroll down and click I agree & submit to the bank.

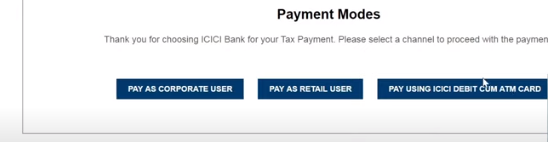

Step 13:- Now you have to choose your bank, the way you want to make the payment to the government.

Step 14:-Enter your user ID or password and proceed.

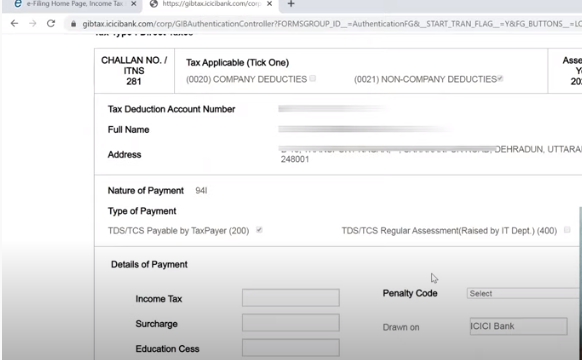

Step 15:- Now your bank’s gateway will open in front of you, in which you will have to enter the amount of tax, if there is any interest and penalty, then you will also have to enter it and after that, you will click on continue.

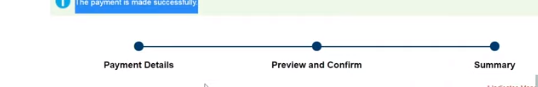

Last Step:- After this verification click on submit option and you will automatically move to the payment summary option And above you will get the message that your payment is made successful.

Note point**** TDS monthly payment always has to be made before 7th of the next month and if want to pay in offline mode then always before 6th of the next month