Hello everyone!

Welcome to my blog! Here, I’ll guide you on how to make the payment of short tax payment in GSTR-9C Stay tuned for step-by-step instructions and helpful tips!

Every taxpayer is facing this issue of short payment because we all are human and it is our major thing that we will make mistakes. after seeing all the things we can also make the mistake of filling the GST requirement that’s why I am giving you a helpful guide and because of this, you can rectify your mistake when you file your GSTR-9C.

Many people are making short payments of taxes and due to this reason we are getting the notice for the short payment of taxes but there are 02 ways to pay the taxes first we can make the payment through the DRC-03 form and we would enter the short payment information in our GSTR-1 table (According to the GST rules we can do this work on the same FY) and second we can make the payment when we will file our GSTR-9C.

If you do not pay your short payment of the tax then it is always showing in your GST dashboard so what do you have to do? you just enter that amount when you are filling your GSTR-9C in the columns of B2B and B2C and also show the tax amount in the respective column of GST.

After completing this process you can easily make your mistake for the short payment in the GSTR-9C filling process.

But there is no option for making the payment for the tax in the GSTR-9C, so what do you have to do? we will take help from the DRC-03 table for making the payment of short taxes.

Here are the steps for the DRC-03 payment.

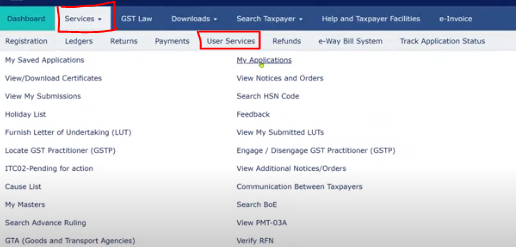

- After logging into the GST portal, please click on the services tab under the services tab please go to the user services portal.

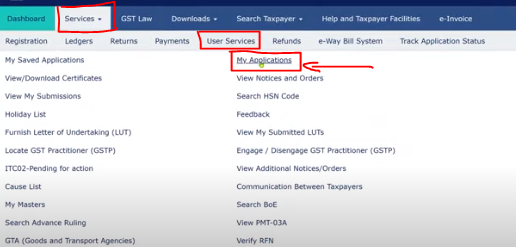

2. After clicking on the user services tab please select the My Application button.

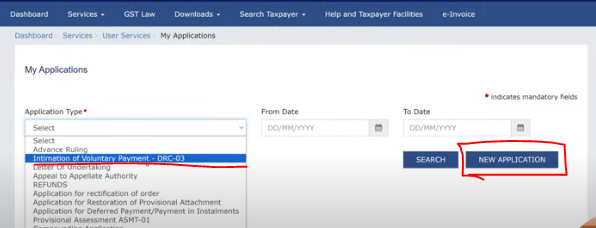

3. After clicking on the My Application button you have to select the DRC-03 option and click on the new application button.

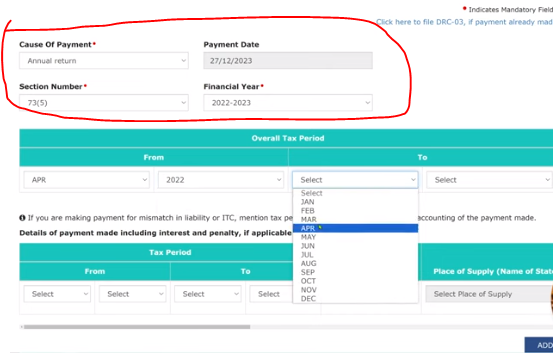

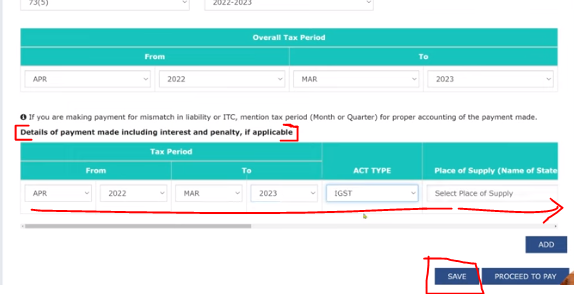

4. After that, you will be moving to the DRC-03 dashboard, and in this dashboard, you have to select the “cause of the payment”, section no, and financial year. Fill the details into the respective columns.

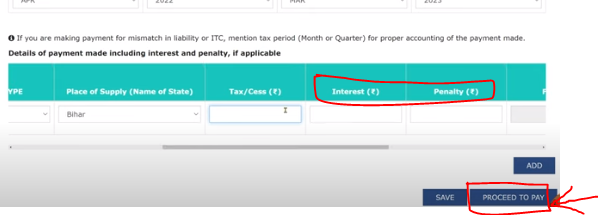

5. This is the important part to inform you that, please calculate your interest concerning the late filing and enter the interest amount into the given column if you have not filled your GSTR-3B then you would enter the penalty amount into the respective column.

6. After entering the details please click on the proceed to pay button.

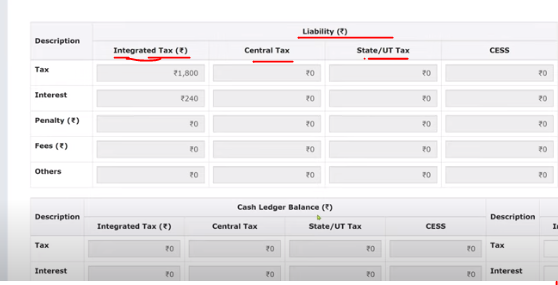

7. After clicking on the proceed button, please verify the tax details.

Note point***

Please see this message for availing the ITC while making the payment of taxes.