Hi guy’s

This is Ravi Varma, in this article I will tell you how to change and update your profile in the traces portal

Let’s start,

If you want to change your address or email address on your TRACES portal, then follow these steps

- Go to the TRACES site

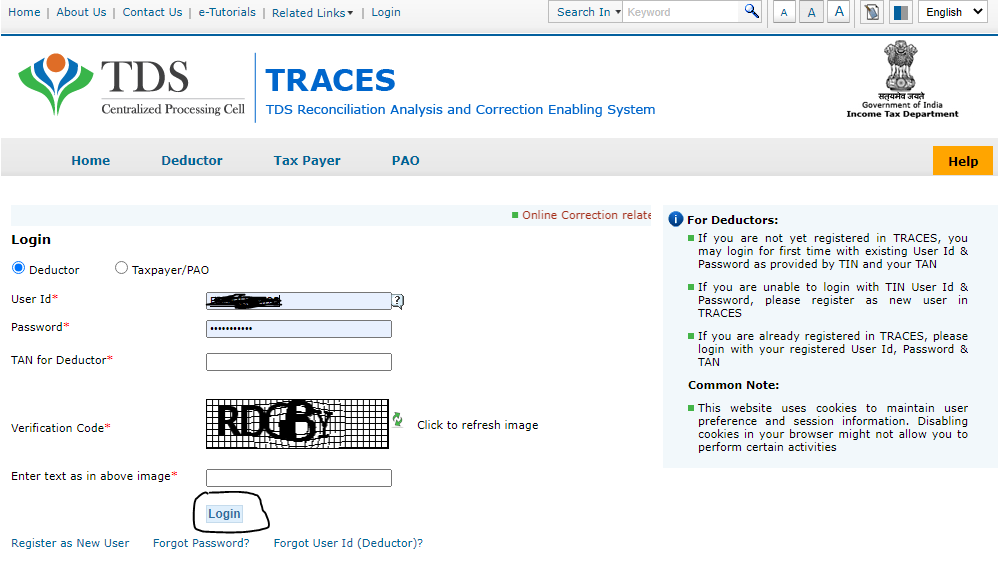

- Please click on the login button and enter your log-in id and password to enter the traces portal.

- Enter your login id and password and also enter your company TAN number because it is very important for the log-in traces portal.

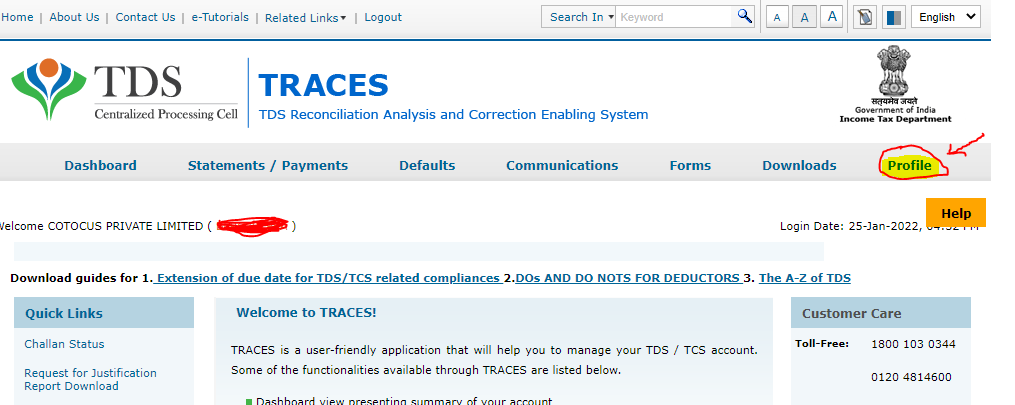

- As soon as you enter the trace portal look on the right side here you will see the profile button then you click on it.

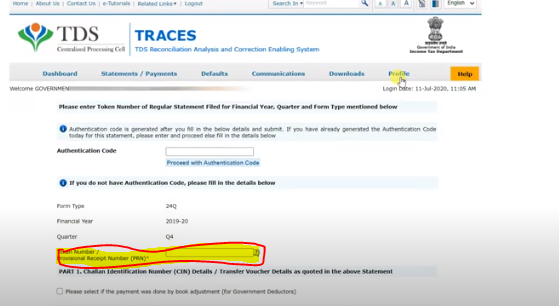

- (a) After clicking on the Profile button you will have to enter your RRR number, this number will get you the status of your last TDS return filing.

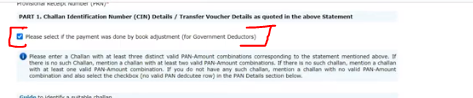

(b) If you are deducting the TDS of any government employee then please click on this acknowledgment button and if you have not deducted the TDS of a government employee then proceed without clicking this acknowledgment button.

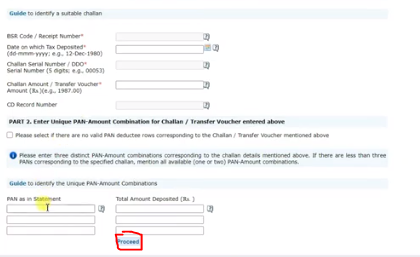

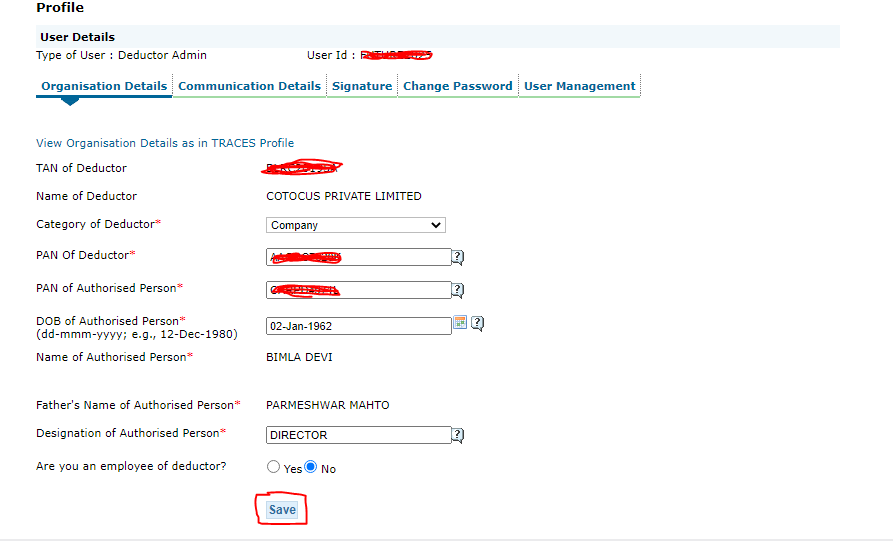

(c) Next, you need to enter your TDS data along with your company’s TAN number, and the deductor’s details along with his/her PAN number.

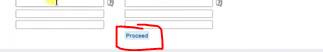

(d) After completing these steps please click on the Proceed button

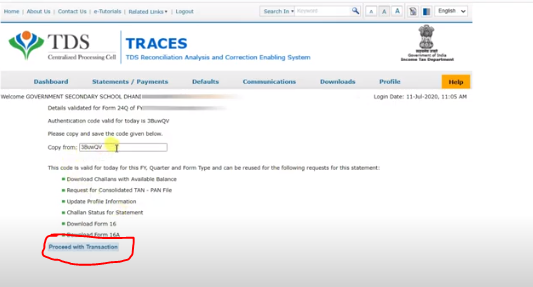

- then you click the proceed button you will get an authentication code this code helps you for your re-filling in your data and also you have to give a proceed with transaction option then click on it.

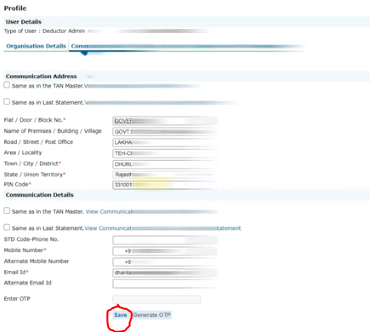

- Now you have all the details of the portal which you entered earlier, now you can change whatever you want here.

- after saving this you have see your full details of your company so now if you will change your company details, address, email id, add a new director.

- and click on the Save button,

So by following these steps you can easily change whatever you want.

Thanks