Record owner &loan deposit

Now we are going to the dashboard and select much be accounts and that will give us the chart of account so if we select the top item here which will be the chart of accounts.

Then we going to each account and this is where. we can really find a registry for any of the accounts. now typically we are used to having to register for the checking account and it will look similar to having a register that we might see with our book and enter the transaction in a similar type of formate.so if we click just anywhere on the checking account or select the register over here we will go into the checking account register. now I am going to put the memo which would be owner deposit so that we know its from the owner.it’s going to be a deposit. I am tabbing through that’s when I tap through it went straight to the deposit screen.put your deposit Amount and the owner will be deposited. And then we are going to go through the accounts we could select the dropdown for the accounts and note it just to the expenses here as kind of a default. we want to have the putting the money in. we are really looking for an equity account. we could see the equity account over here and the chart of account that was generated when created in this company actually has an equity account that breaks out the owner investment so owner investments here what we are going to select.at the end of the month we are going to select the owner investments here and then we are going to say save this transaction.

We are going to record another deposit and that’s going to be from a loan we are going to say we got a loan from the bank another deposit transaction the same screen we are going to scroll over. we are going to see it from chase bank.

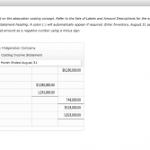

I am going to select tabun as we set this up when I select tab I do ask if we want to set it up as A customer or a vendor ar an employee of those three choices I am going to choose customer here and then enter this information although it’s not exactly a customer because of course it’s a loan payment but we are going to keep that there. we are going to have that the memo we could put some here like it’s a loan and we are going to tab.its going to be the payment deposit then and that’s going to be for this one will be your enter amount. if we select the dropdown it defaults to those expenses again we are kind of looking for liabilities here. we want to have a loan.so we see here we have a loan payable that is in the books when the chart of accounts was created by quick books as we set the company up.so we are going to select that item.here;s what the deposit will then look like and we are going to say save that so if we think about these. there are two transactions first was the checking account went up on the other side went to the equity account an owner’s investment.this one the loan that means that the checking account went up and the other side went to the loan payable that also went up for the liability. lats take a look at the balance sheets and see if we can see that same amount in the balance sheet.and let’s just type into the balance sheet up top and we are going to change the dates and going o run this report.but the owner investment same thing that will be there and then we will close out to retained earnings.