Record short term investment

We are going to go to that checking account down here or the accounting down here on the left-hand side. we could select a short term investment account. if we had it. but if dealing with cash that’s usually the first thing that’s easiest for most people to think about.so

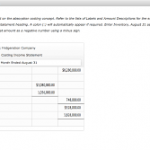

We are going to take the view register here and select the register.and what we are doing is we are taking money out of the checking account and we are putting into the short-term investment so we can see some of our drop downs here.

We are going to have a check number so we are going to say it’s going to be the check and then we are going to say the date. now note that the check number. while we are on the issue of check numbers it’s already here it’s already populating because it should be putting now if you were writing the checks by hand then of course you should be on that check number within the check that you are having to match up here if you were to print the checks you would still have our external checks that which you would have to print that cheque number on the external checks should match the cheque number automatically generated by that system.

That’s one of the internal controls related to each. if you don’t have a cheque number if this was an electronic transfer and you are just trying to put it in here to put it into the bank account to get your bank account correct so that you can reconcile.you could change the check number possibly to something else like a transfer or just delete.

In this account we are going to the balance sheets and put the date he is shown me all transactions. now we will go to the balance sheets and look short term investment. (overall means which investment is recovered by the 12 months he is short term investment) we are going to the dashboard in the account section and fill up all details and save this. now he presents me automatically short term invest investment in balance sheets.

Un deposited funds set up

We are going to the items down here will be in accounting we are looking for the chart of accounts. typically going to be an order buy types assets liabilities equity income and expense more especially bank accounts and account receivable than the current assets accounts or other assets account fixed assets account and then the liabilities and so on.

we are going to add another account.

It is going to be another asset account and it’s going to be just a holding account for our cash that we have or other receipt checks that we have received that we have not yet go into the bank and deposited. so we are going to a new account and we are going to make it another current asset type of account.

Then the detailed account there’s actually a detailed account for undeposited funds and that will help us to track this information.so we are going to go down and look for this undeposited funds account that will help us to you know track and group the information as we record these deposits into the bank.it will give us the default name as undeposited funds. that’s typically what most QuickBooks users would be used to. now we will save this.