Hey all,

In this blog, I will let you know, a brief info about the Discard your income tax return button.

What is an income tax return?

An income tax return is a document or set of forms filed with a tax authority to report income, expenses, and other relevant financial information. In India, any person who has exceeded their income exemption limit or has additional income sources is required to disclose their income and deductions on the government portal. If they are liable to pay taxes, they must settle their tax obligations with the government. Failure to pay taxes may result in government action against such individuals.

Purpose of an Income Tax Return?

The purpose of an income tax return is very simple: if a person is liable to pay tax but does not do so, and the government is aware of this liability, they will take action and impose a penalty on such taxpayers. Conversely, individuals who fulfill their tax obligations contribute positively to the system and are considered fair taxpayers.

Types of Income Tax Returns.

There are typically different types of income tax returns for different types of taxpayers, based on their income sources and filing status. For instance, in India, there are seven different income tax returns:

- ITR 1: For individuals with income from salary, pension, and interest

- ITR 2: For individuals with income from business, profession, and other sources

- ITR 3: For individuals with income from multiple sources

- ITR 4: For individuals with income from salary, one house property, and other sources

- ITR 5: For individuals with income from business or profession and other sources

- ITR 6: For individuals with income from capital gains

- ITR 7: For Hindu Undivided Families (HUFs)

Let’s discuss the discard button feature.

What is the Discard option in Income tax?

The government has added a new feature to the income tax portal, allowing people to easily discard their returns using this feature. After discarding their return, they will need to create a new one for filing.

Why the government has added this Discard feature?

The government has added this feature because if any taxpayer fills out their return and makes any mistakes he can’t able to do the modification from the start. They have to file a revised return for the correction of mistakes that’s why the government has added this feature because if you make any mistake you can discard your return directly and make a new return for the filling purposes.

There is an issue with the discard button: if you have already verified your return, you won’t be able to use the discard button. This is because, after the submission of the e-verification process, your return is sent to the government, and as a result, you cannot discard your return once the e-verification has been completed.

Let me show you where you can see the discard button.

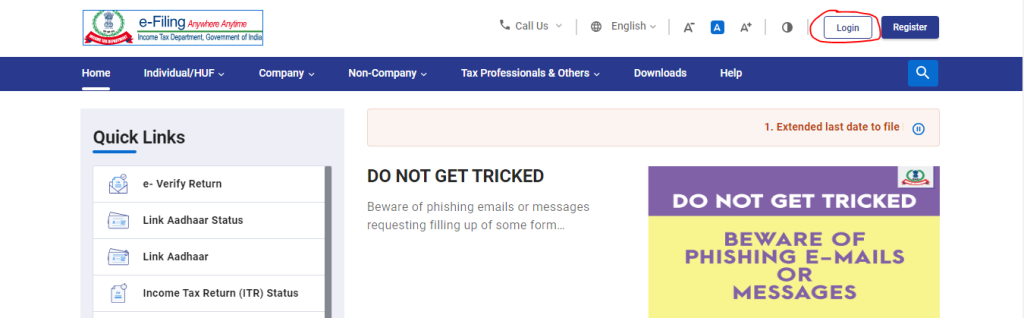

Step1. Please log in to your Income tax portal by clicking on the log-in button.

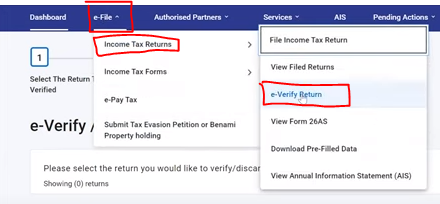

Step2. After the login, please click on the e-File option, and into the e-File button you can see the Income tax returns option and under this option, you will see the Discard button.

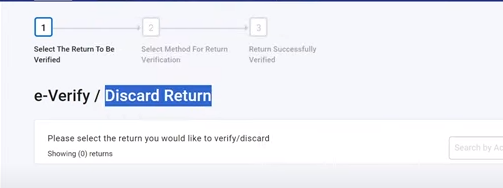

Step3. After going to the e-Verify Return you can see the discard button for discarding your return.

Note point***

If you will be missed to file the return then you will have to pay the late fees to the government.

Thanks,

[…] https://www.stocksmantra.in/discard-your-income-tax-return-a-new-option-on-the-income-tax-portal/ […]