Add Bank Account

First We will open the dashboard of QuickBooks Online and click on the Chart of Accounts option in Accounting to add a new bank account, then it will show us physical type accounts such as current assets, current liabilities, inventories. We will click on the new button to add a new account, then fill in all the information provided in it, fill the account name, type, description, detail type, and all other columns and add the opening balance. After filling all, we will save and close and a new bank account will be added. After this, when we open the balance sheet by copying its URL and the new account will be opened and the opening balance will show. And if we want to see its transaction report, then click on the bank in the assets of the balance sheet, then there will be the option of checking so that we can see the transaction.

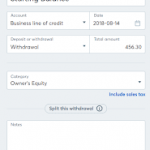

Add Credit card Account

Credit card accounts are liabilities that will be shown in the liabilities section. To open a credit card account, we have to go to the chart of the account option. Then I will have the option of a new option, after that click on it. After that, I will select the credit card option in the account type and enter my credit card name in the name and likewise fill all the options and we will enter and save the balance, after that, we will come back and refresh the URL If we do and search, then the credit card option will show the capabilities for balance sheets and equity options. By clicking this option, we can see its report (the date the credit card is added to, the date has to be completed).

ADD Equipment account

To add the equipment account, we will go to the dashboard of the Quickbooks and open the account option, go to the chart of account and check the account type. Then scroll down and click on the new option and after opening the entering face, all the options will be filled up (Account type – Fixed Assets, Account details – Machinery and Equipment, Real Amount). Refresh the balance sheets of tax and my equipment account will shop with its balance.