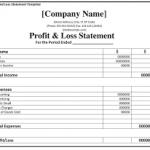

Profit & loss

Click the option of Report in the Dashboard of Quickbooks Online and go to the standard report, after that we will open Profit and Loss by clicking and the date for which the balance sheet is to be checked. In this, we can also check the entire one year (01/31/2020 to 31/12/2020) In this, we can make Profit & Loss report in three ways manually, monthly, and early in three ways. I want to know whether the profit has been made or the loss will reduce the entire expenditure of the company from the income, then it will be known what the net income has been and if we want to know the gross profit of the company, then the income minus cost of good sold = gross profit

Vertical analysis profit and loss

In the QuickBooks online dashboard, you will click on the report option and in it click on the standard report and open the Profit and Loss sheet. In it, they will put a date for one year and the report was run. After that, if we want to know the net income, then for that the total income minus total expenses = net income will show. Now the objective of the profit and loss is to generate whatever which are the income line. You have the assets that show you can generate adventure in the future. You have the capabilities under are going up under Are Hopefully helping you generate as you generate the liabilities and you have the expenses on the income statement. After this, if we want to see Profit and Loss as a percentage, then we will scroll to the top and drop and the box will show like percentage and report percentage.

Expense Profit and Loss

We will click on the report in the dashboard and open the Profit and Loss report in Standard. As of date is 12/1/2020 to 31/12/2020 now run the report. After that, we will scroll up and select Expense Profit and Loss in the search option. This will show the report on the expenditure percentage. After that, I will click in the Customize option and select the Surrey section according to it and save the Profit and Loss report at the Expense of%.