Hey All,

Today, I will let you know how to attach the DSC after completing the process of Form 3CA filling

What is the 3CA form in income tax?

The 3CA form is an audit report under section 44AB of the Income Tax Act, 1961 in India. This form is used for providing the details of the audit conducted under section 44AB of the Income Tax Act, 1961, in the case of taxpayers who are required to get their accounts audited by a Chartered Accountant. Section 44AB specifies the criteria under which a taxpayer is required to get their accounts audited. Taxpayers falling under these criteria need to submit the 3CA form along with the audit report.

The form 3CA consists of various details such as the name of the taxpayer, their Permanent Account Number (PAN), the financial statements audited, and other relevant financial information. It is an essential document for individuals and businesses to comply with the Income Tax regulations in India.

Steps to attach the DSC for filling the form 3CA in income tax.

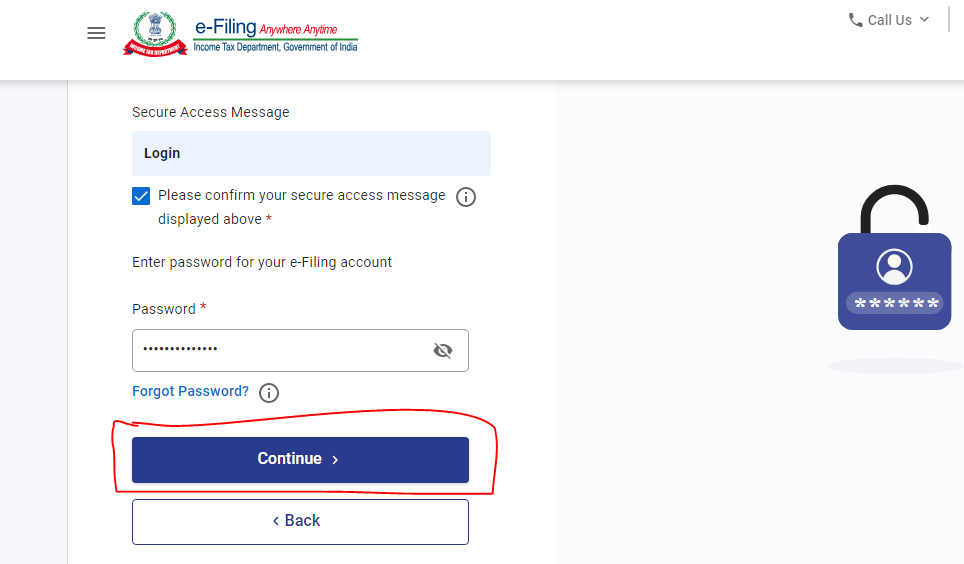

Step1. Login to your Income tax portal with your credentials.

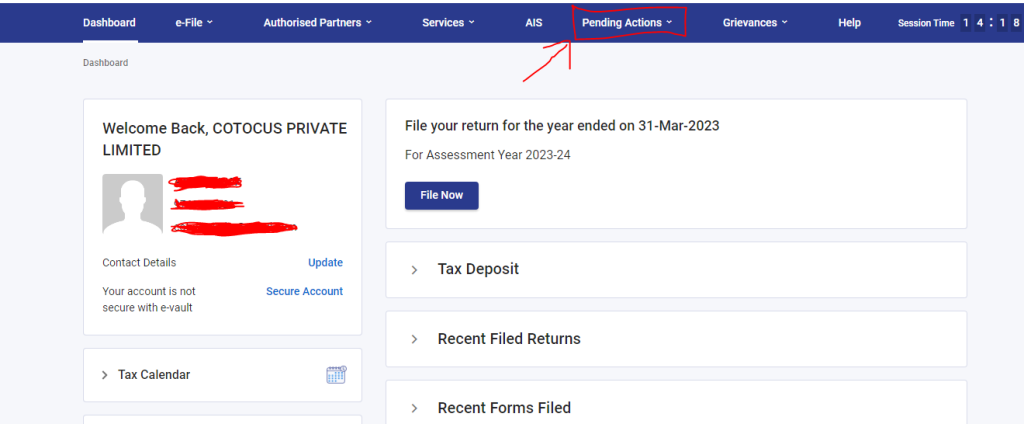

Step2. After login to the income tax portal. Please click on the pending actions button.

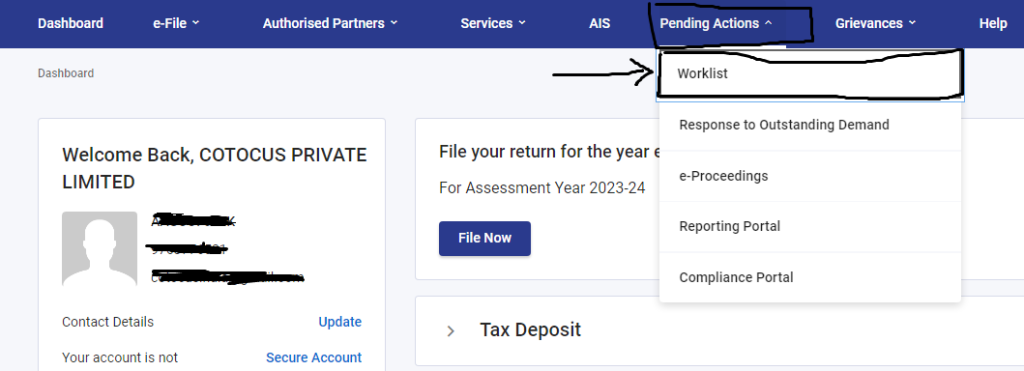

Step3. Under the pending action button, you can see the worklist option then click on it.

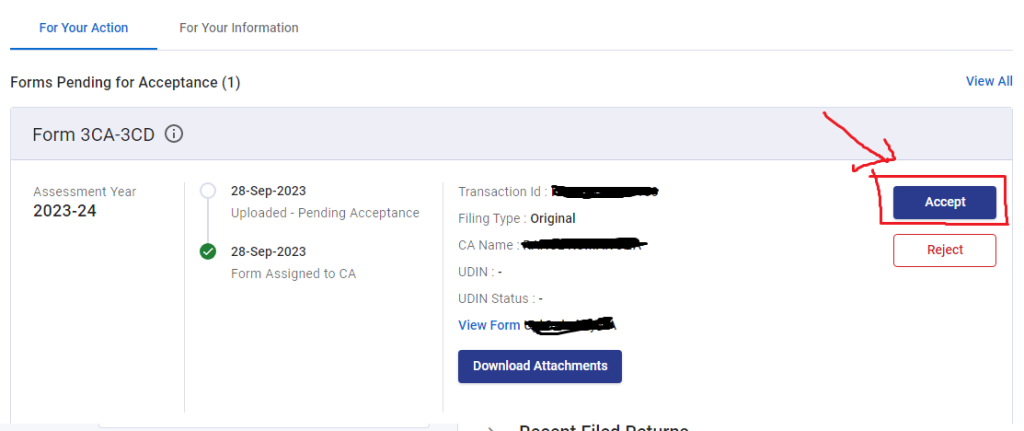

Step4. After completing these processes you will be able to your Form 3CA in your income tax Dashboard. What do you have to do? you have to click on the Accept button you can see this option on the right side.

Step5. After clicking on the accept button. you have to attach your DSC for the filling of your From 3CA through the Income tax Portal. And after attaching your DSC it will be filed.

Thanks,

[…] 3CA form DSC attachment process. […]

[…] 3CA form DSC attachment process. […]