Greetings

This is Ravi Verma, In this Article, I will let you know about the cash ledger balance.

Let’s Begin.

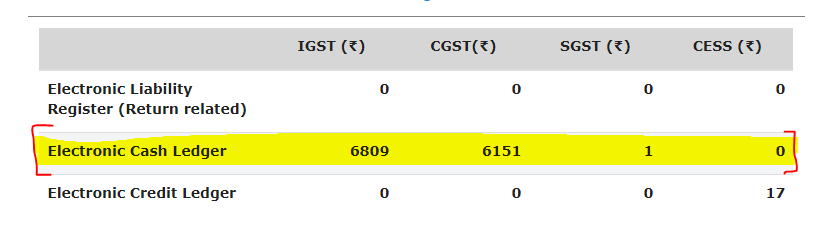

In my case of GSTR-3B filling, I have paid my tax payment of Rs 70,000.00, and my ITC is showing Rs 75,000.00. After the payment of my all taxes, 5000.00 rupees is showing in my cash ledger.

In which column will I enter my cash ledger balance in the GSTR-3B return?

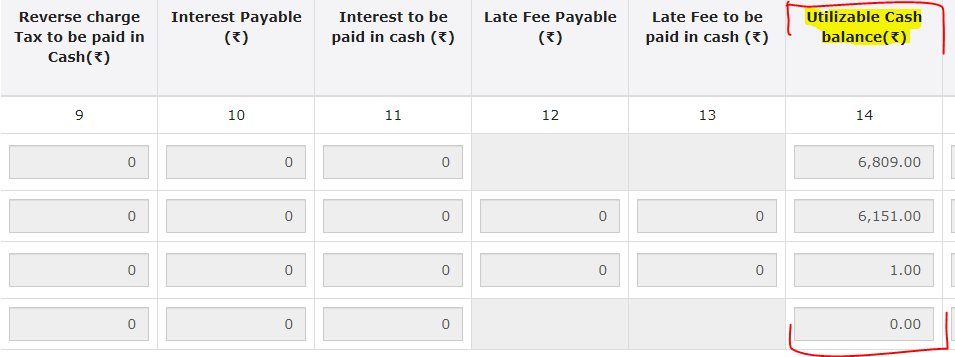

If my cash ledger column is showing 50,00.00 after all the payments of taxes, I can use this balance in my next GSTR-3B return at the time of tax payment and I will enter this amount under the column name of UTLIZABLE CASH BALANCE.

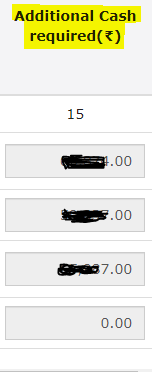

After taking this step, my total tax amount is showing (Total tax – Cash Ledger = Correct Tax Amount) Exact tax payment amount is in the column name of Additional Cash required.

Thanks,