Hi All,

In this tutorial, I will try to explain to you the way to address your additional business in GST through Geocoding.

What is geocoding in GST?

Geocoded is a way to verify your business place through the Indian map in one click, it means In the context of GST, geocoding involves the conversion of a registered business’s address into geographic coordinates, typically comprising latitude and longitude values. This conversion is accomplished through the utilization of a geocoding service, which matches the given address to its corresponding location on the Earth’s surface.

What are the benefits of addressing your business location through geocoding in GST?

There are multiple benefits of addressing your additional business location in GST through geocoding.

Risk – Due to a fraudulent business case, they are not providing their additional business address to the GST portal. Consequently, they are withholding full details from the department, prompting the GST department to initiate surveys for such businesses.

Improved accuracy of address data – Geocoding helps to ensure that GSTN records contain accurate and up-to-date address information. This is important for a variety of reasons, such as verifying the legitimacy of GST registrations and preventing tax evasion.

Better compliance – Geocoding can assist businesses in achieving better compliance with GST regulations. For instance, geocoding can be utilized to ascertain the accurate place of supply for transactions, a critical factor in calculating the applicable GST rate.

Reduced risk of penalties – By geocoding your business address, you can reduce the risk of incurring penalties from GST authorities due to inaccurate or incomplete address information.

Enhanced Efficiency – It streamlines tax administration processes, reducing the time and effort required to verify business locations and transactions, ultimately leading to greater administrative efficiency.

How do we address our additional business location for GST?

First of all, this is a good decision for adding your other business address to the GST portal.

Here are the steps –

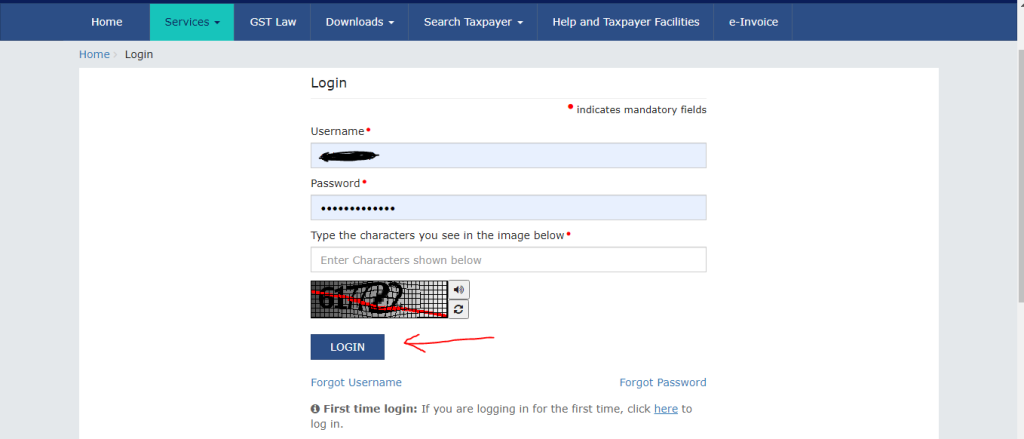

Login to your GST portal with your credentials.

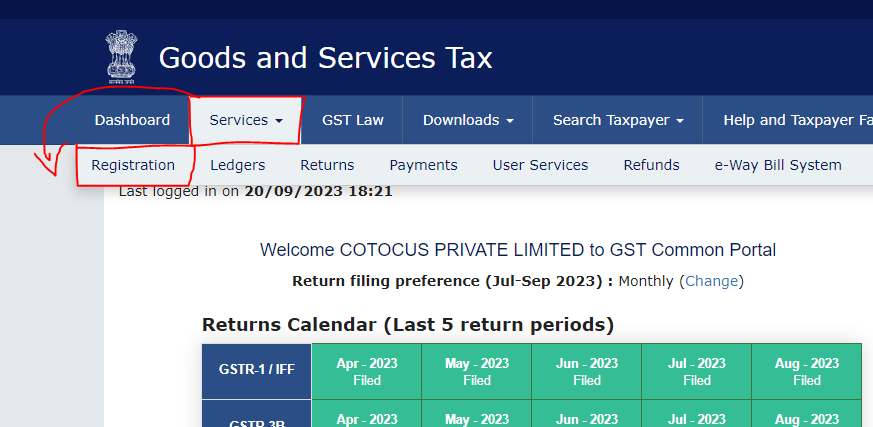

Click on the ‘Services’ tab button. Under this option, you will find the ‘Registration’ option. Please click on it.

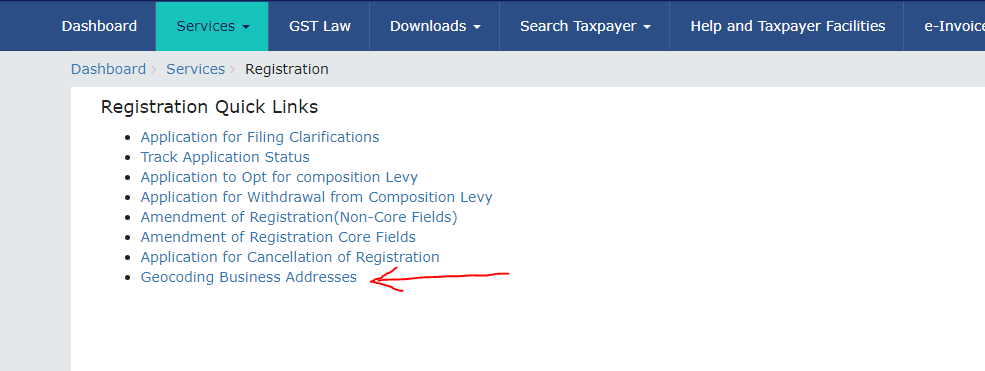

After clicking on the “registration option” you can see the “geocoding business addresses” option. Please click on it.

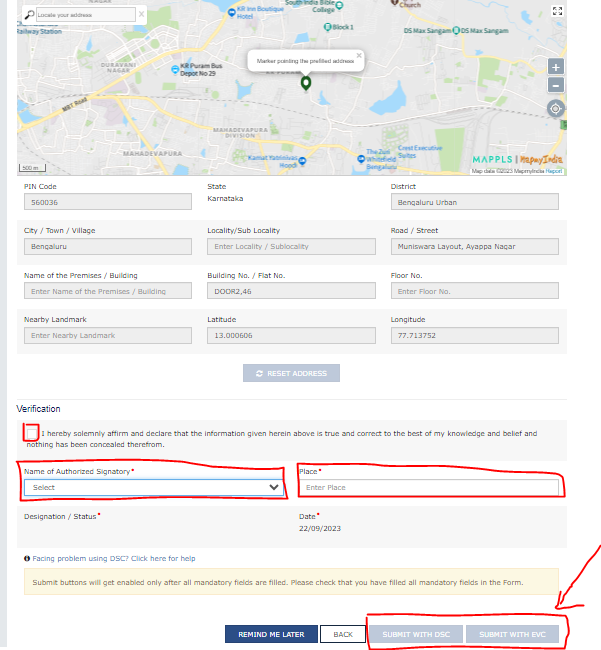

After that, please select the additional place of business option.

After that, please enter your additional business address in the given column and select the geocoded address.

After completing all these steps, one step is pending to follow. So in the last step, you have to select your filing process type you have to select DSC or EVC to complete this process.

Thanks,