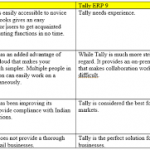

Quickbooks are focused on bookkeeping. Tally is focused on more advanced inventory and project management features. Quickbooks only offers a subscription-based payment model Tally allows you to purchase Tally as a one-off license Overview QuickBooks Online Accounting Software from Intuit is a cloud-based accounting software offered in a SAAS model. […]

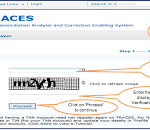

Continue readingStep by Step guide and tutorials for TDS filing in India

1 How can I file TDS? Guide for Uploading TDS Returns on the Income Tax PortalYou must hold a valid TAN and it should be registered for e-filing.Your TDS statements should be prepared using Return Preparation Utility (RPU) and validated using File Validation Utility (FVU)You can prepare your returns in […]

Continue readingHow a company and startup can start their PF accounts for an employee in India

1 What is a provident fund? A provident fund is a retirement fund run by the government. They are generally compulsory, often through taxes, and are funded by both employer and employee contributions. Governments set the rules regarding withdrawals, including minimum age and withdrawal amount 2 How can I open […]

Continue readingTop 10 Software for GST, Tax, and accounting in India

MARG GST:-This is one of the best GST software you can use for your business at an affordable price. Besides, the user interface of the software is convenient for beginners. The software also allows the users to convert the bill into various formats and provides the option to send them […]

Continue readingSection-1 and section-2 of the CGST ACT

What is actionable claim under GST| section 2(1) Transfer of property act,1882.actionable claim A claim to any debt other than a debt secure by mortgage of improvable property or by hypothecation or pledge of moveable property, or to any beneficial interest in movable property not in the possession, either actual […]

Continue readingISSUE OF GSTIN

The successful completion of an application process GST comparable it will To methodically they generate and issue a registration certificate to the application all business entities registering on the GST will be provided a band unique identification number known as GST Eilean or GST or number we had covered this […]

Continue readingGOODS AND SERVICES TAX NETWORK (GSTN)

The main interface between the taxpayer and the government is through a common postal card GST portal. this portal is set up and maintained by an entity called googs and service network and in short formate, it discards GST and GST is an important part of the GST regime or […]

Continue readingANOMALIES OF GST

GST is a form of tax which in its ideal structure would have only one rate of tax across all products and services and in most countries, this mode of taxation exists there is only one rate of tax levied across all the products and services that are supplied across […]

Continue readingA brief introduction to GST

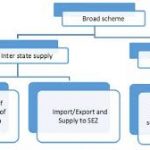

Goods and service tax or GST as it is popularly known is the newest tax system we just come into existence in India from 1st July 2017 . GST became A law going through a number of hurdles. it is also taken a long period of time to come through […]

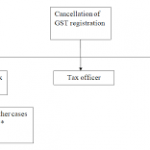

Continue readingCancellation of registration

Under by the gst registration can be cancled either by the tax authority or by the registration taxpaper him self or by his leagal hairs in day of his that but it under the following circumstances That is in case what The business has been discontinued or thanks for from […]

Continue readingOffice Rental/Lease agreement – Terms & Conditions – Draft/Format/Template

This lease or rent deed made herein <<Address>> on the <<Date>> between <<First party name/Owner>>, <<Address>> (hereinafter referred to as “the Lessor) (Which expression shall unless repugnant to the context thereof, mean and include its successors and permitted assigns) of the one part; AND <<Second party>>, having its registered office […]

Continue readingClarification on Company’s Director Reimbursement and Role?

Clarification on Company’s Director Reimbursement and Role? 1. How many directors may get reimbursement from the Company? Ans:- There is no restriction all directors can get reimbursement 2. Do the Director need to submit proof and how? Ans:- Yes, through vouchers,bills,letters 3. Director of the company can also work as […]

Continue readingGST Due Dates – After Lock Down – 2020

Government is lifting the Lockdown gradually and in step wise manner and now Taxpayers needs to keep a track of GSTR returns. Government has released a new notification with all the GSTR due dates and late fine provisions updates. We have simplified the notification and here you can find all […]

Continue readingIndustry Wide Impact Analysis in India due to coronavirus covid 19

Super 30 Hot Stocks to invest in May 2020 in India

1 Housing Development Finance Corp Ltd 2 HDFC Asset Management Company Ltd 3 HDFC Life Insurance Company Ltd 4 HDFC Bank Limited 5 Kotak Mahindra Bank Ltd 6 ICICI Bank Ltd 7 State Bank of India 8 ITC Ltd 9 Britannia Industries Ltd 10 Hindustan Unilever Ltd 11 Infosys Ltd […]

Continue readingFinally, GSTR-9 and GSTR-9C for FY 2017-18 Extended – GST UPDATE

Considering the difficulties being faced by taxpayers in filing GSTR-9 and GSTR-9C for FY 2017-18 it has been decided to extend the due dates in a staggered manner for different groups of States to 3rd, 5th and 7th February 2020 as under. Notifications will follow. Group 1: Maharashtra, Karnataka, Goa, […]

Continue readingTax Liability on exporting Goods and Services to Company Aboard from India

Is GST is applicable on client Aborad from Getting serrvice from India? No, service tax was not applicable. GST too is not payable, but if you are registered with GST there is a procedural requirement that you must submit a ‘letter of undertaking’ (form RFD-11 on the CBEC website, or […]

Continue readingHow to Submit Professional Tax – Karnataka ?

What is Professional Tax?Professional tax is a kind of tax which is levied by state government to all kinds of professions, trades, and employment who are functioning in their states. This tax amount levied monthly or yearly based on the income of such profession, trade and employment. Professional tax determined […]

Continue readingHow to calculate TDS of an employee ?

What is TDS (Tax Deducted at Source) ? TDS is a medium of collecting Income Tax in India under the Indian Income Tax Act of 1961. According to the Income Tax Act, if any organization or a person is providing salary / payment have to deduct tax at source, it the […]

Continue readingThis stock has destroyed 99% investor wealth in the last 10 years

Source:- cnbctv18.com ngineering and construction firm Punj Lloyd has emerged as one of the biggest wealth destroyers, tanking over 99 percent in the last 10 years. The stock, which traded over Rs 200 in 2009, is currently trading at around Rs 1.5 per share. To put into perspective, an investment […]

Continue reading