Hi Guys

This is Ravi Verma, In this article, I will let you know about applying for the GSTIN number.

Let’s get started.

First of all thanks for reading my knowledge full blog, I would give you the surety that after reading this you can easily Do your GST registration without any problem.

Please Follow these steps for a better understanding of GST registration.

A. Go to the official website of GST.

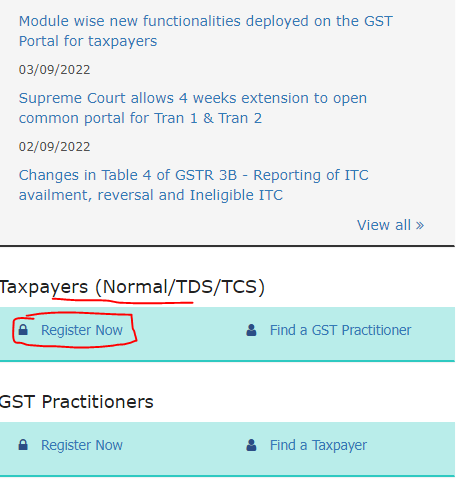

B. Scroll down and click on the button of Register Now under the head of Taxpayers (Normal/TDS/TCS).

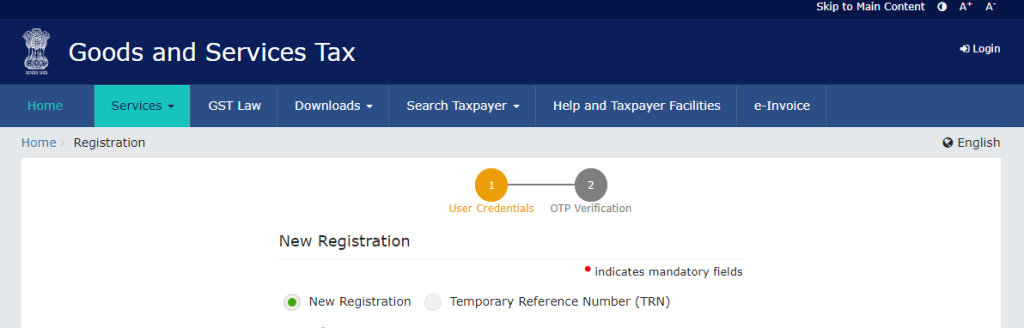

C. So in this option you would be happening 2 steps the 1st is for new registration and 2nd is after taking the TRN number.

D. In the first step, you would enter your user credentials and your details. now move on to the first step.

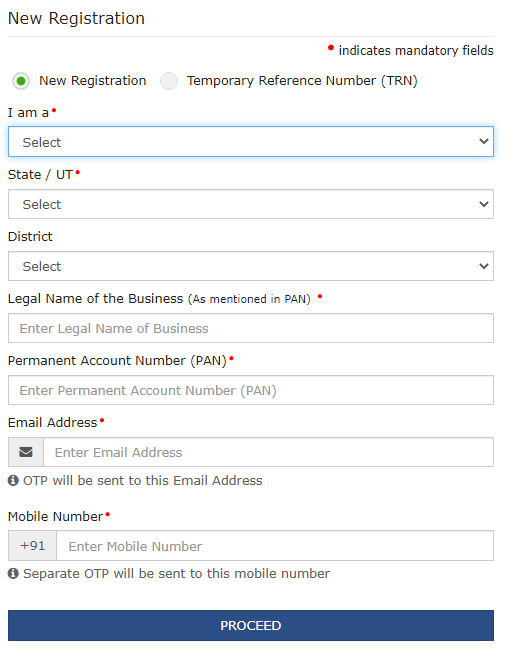

- Select your nature.

- Select your state.

- Select your city.

- The legal name of your business is as per the PAN.

- Enter the PAN number of your business.

- Enter your registered email id. in this ID you will get an OTP for the TRN generation.

- Enter your mobile number, in this number you will get an OTP for the next process.

- After that click on the PROCEED button.

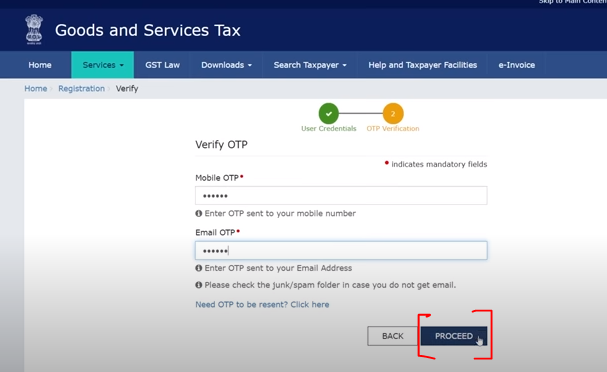

E. After clicking on the PROCEED button, you would get an OTP in your email ID and, your mobile number for the next process. then enter this OTP here and click on the PROCEED button.

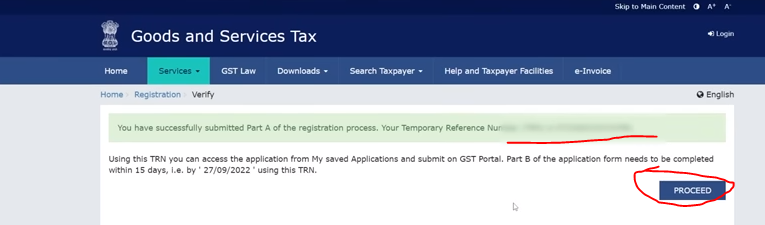

E. After that, your TRN number (Temporary Reference Number) will show on your dashboard please make sure you have noted down this number. then click on the proceed button.

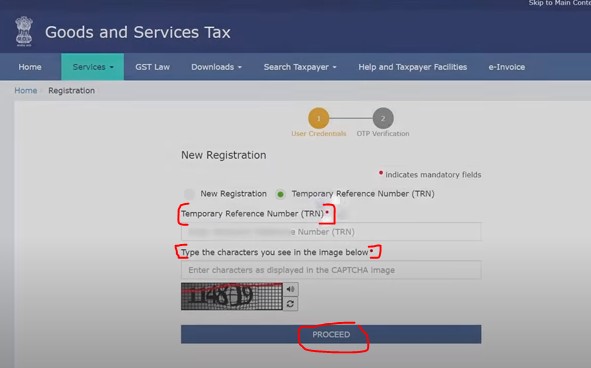

F. After the proceed button you have to enter your TRN number and captcha code as well and click on the Proceed button.

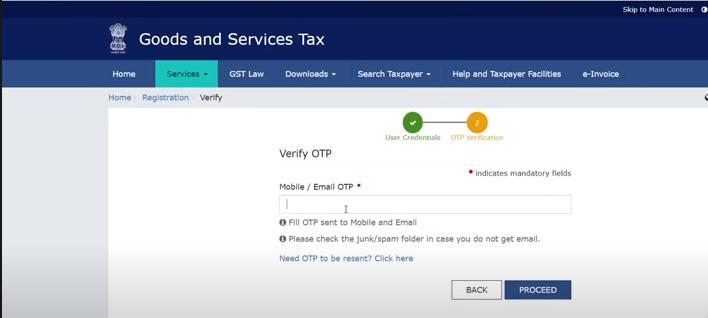

G. Again you will get an OTP in your mail id please enter this OTP here and click on the proceed button.

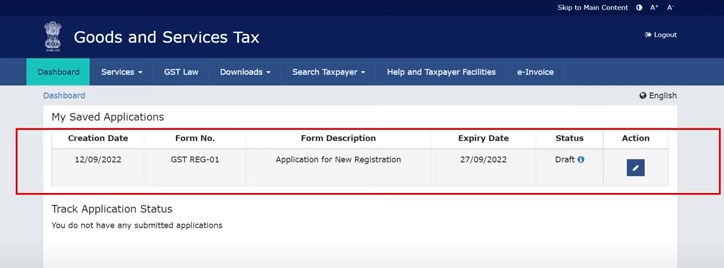

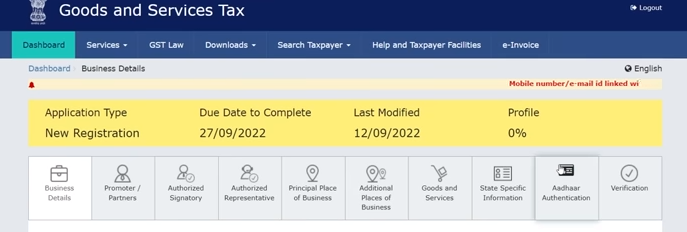

H. You will get a confirmation message for your New GST Registration.

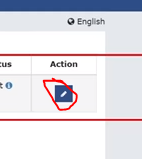

I. Now click on the action button.

J. Now you have to fill the details in these columns properly.

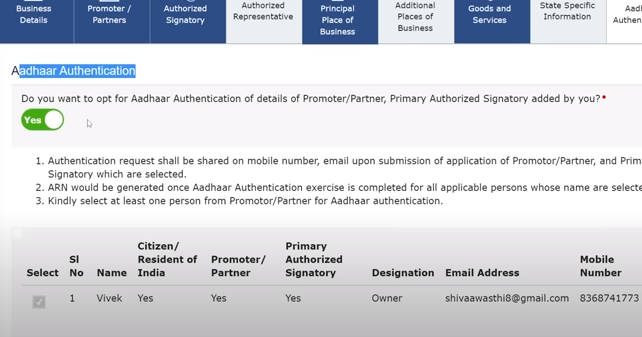

K. After doing all these tables the last one is Aadhar authentication so make sure your number is linked with your Aadhar card after that you can complete this process.

L. After 07 working days you would be received your GSTIN number.

SPECIAL NOTES

- After getting the GSTIN number first you would apply for your professional tax registration.

- You have a DIN number

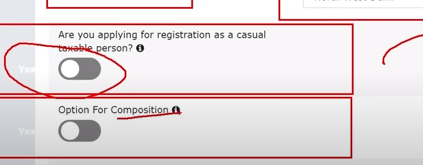

- If you are opting for regular GSTIN taxpayer then you don’t need to select ” composition scheme and Casual taxpayer person please don’t tick these two columns”

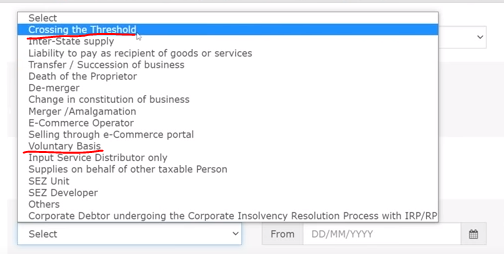

- Reason to obtain registration – you can select the voluntary basis option and crossing the threshold limit.

- In the column of authorized signatures, you have to select one of the primary authorized signatory options and do scroll down lastly click on the save and continue button. you do not need to fill in any info in this column.

Thanks,

For reference, you can see the full step to get a GSTIN number in an online way