Hey Guys,

Today, we will discuss about the new way to sell on an e-commerce platform without a GST number and how unregistered individuals or businesses can successfully enroll for the supply of goods through ECOs within a single State/UT.

What does Notification No. 34/2023 issued on 31 July 2023 say?

Notification No. 34/2023-Central Tax, issued on 31 July 2023, exempts certain unregistered persons from mandatory GST registration if they supply goods through e-commerce operators. This exemption is available to persons who meet the following conditions:

- They only supply goods through the e-commerce operator within one state or union territory.

- They do not make any inter-state supplies.

- They have a Permanent Account Number (PAN) under the Income Tax Act, of 1961.

- They have an enrolment number from the GST portal.

To obtain an enrolment number, unregistered persons must register on the GST portal and select the option “To apply as a supplier to e-commerce operators”. Once their PAN has been validated, they will be granted an enrolment number.

The exemption from mandatory GST registration is available from 1 October 2023.

This notification provides relief to small businesses and individuals who supply goods through e-commerce platforms. It is expected to reduce the compliance burden on such businesses and individuals and encourage them to participate in the formal economy.

Benefits of the notification:

- Reduces the compliance burden on small businesses and individuals who supply goods through e-commerce platforms.

- Encourages more people to participate in the formal economy.

- Helps to boost e-commerce in India.

Losses of the notification:

- Not able to supply their Goods or Services to another state & union territory.

- Not able to take the ITC of GST

- They can supply their goods and services at a certain amount of value.

- It has a limit under this notification number person can not able to sales their goods and services for more than 40 Lakhs.

Overall, this notification is a positive development for the Indian economy.

How to get the e-commerce enrollment number from the GST portal? as an unregistered person?

First of all please follow these steps after that you can get your registration number easily.

Step1. Go to the GST portal and click on the “services tab” Under the services tab please click on the “user services” button.

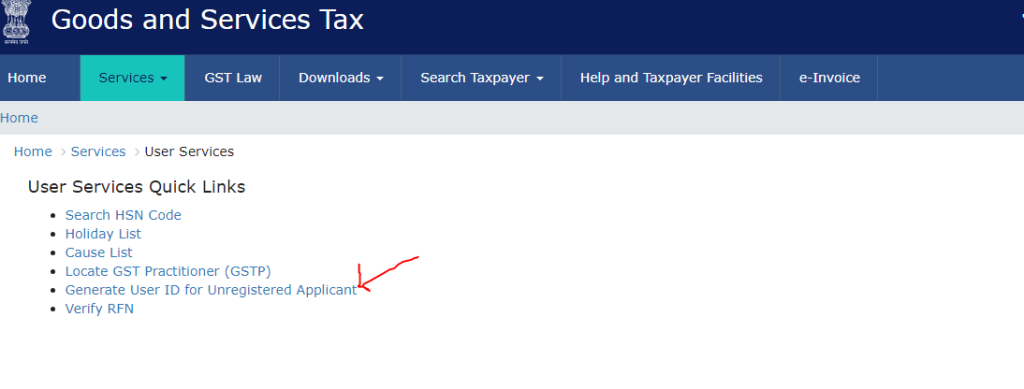

Step2. After clicking on the user services tab you can see the Generate User ID for Unregistered Applicant then please click on it.

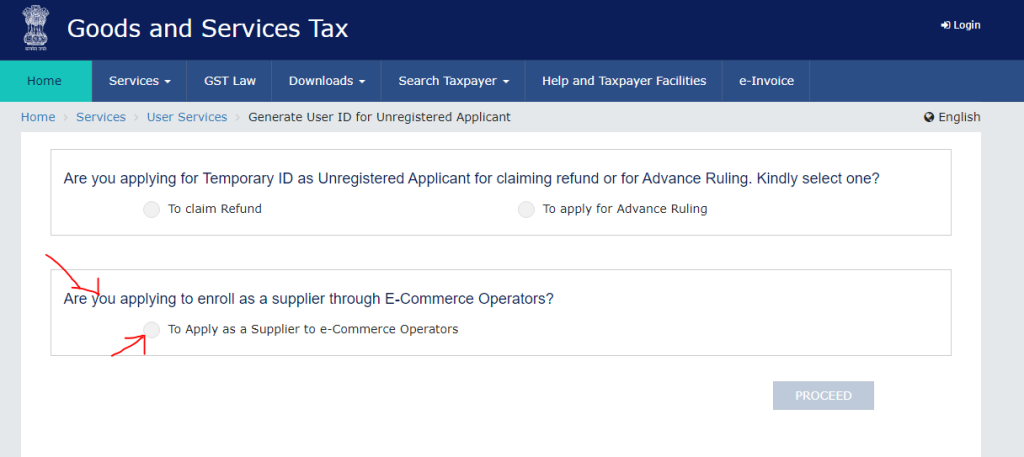

Step3. After that, you can see the 3 options on this page so you have to select the 3rd option which is “Are you applying to enroll as a supplier through E-Commerce Operators?” and last click on the proceed button.

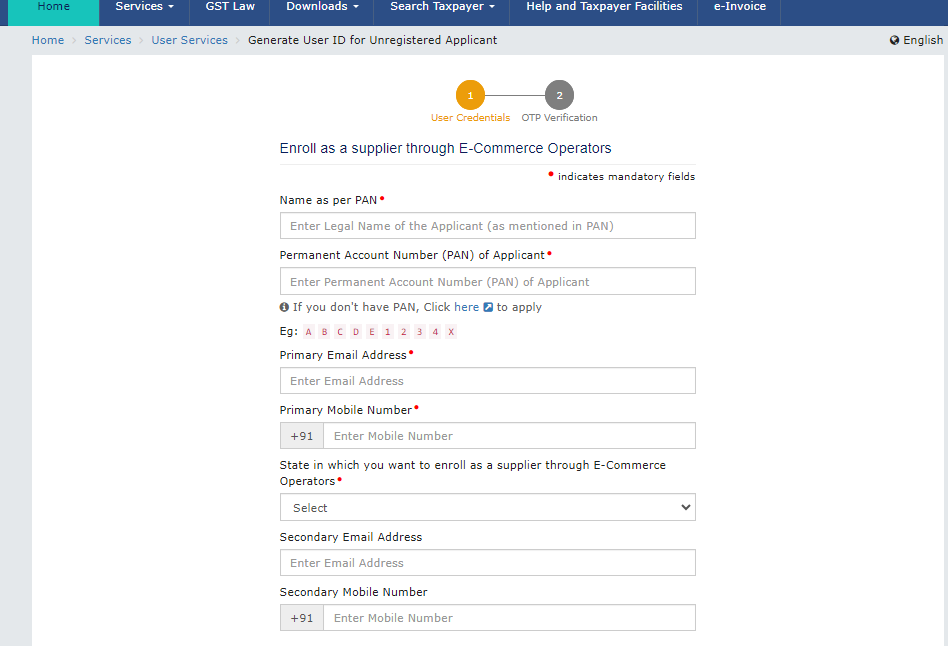

Step4. After clicking on the proceed button, you will go to the next page and on this page, you have to enter your PAN number, your name as per the PAN, and your email & phone number.

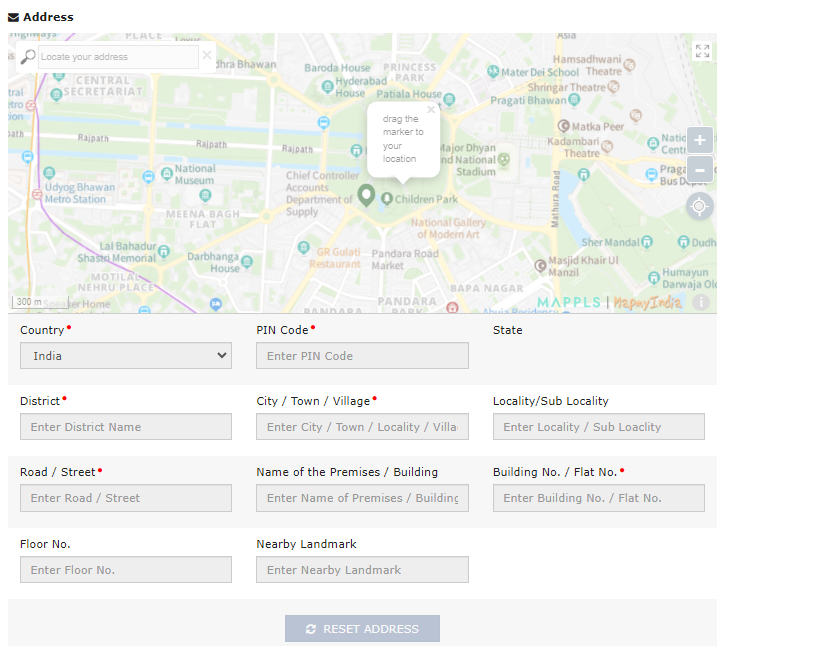

Step5. After that, do scroll down and enter your address.

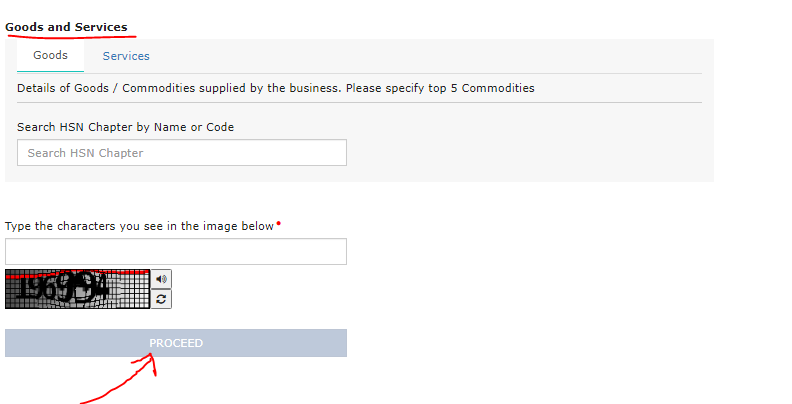

Step6. After that, please select your type and enter the HSN details of your goods & services. Lastly, enter the captcha code and click on the Proceed button.

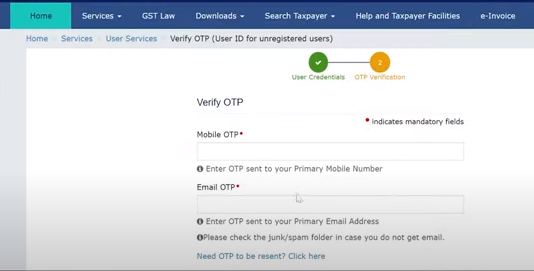

Step7. After clicking on the proceed button please enter the OTP, that OTP you will receive in your given email and mobile number.

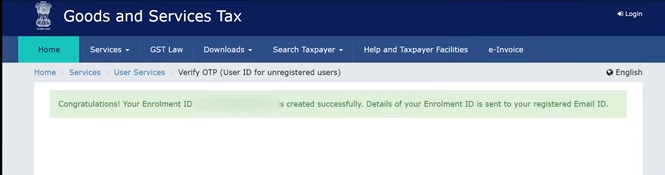

Step8. After finishing all these steps you can get the enrollment number in your registered mobile number and email ID, so you have to save this number because when you register your goods or services in e-commerce operators then this time, the portal will ask you to enter the enrollment number after that, you can get the registration on e-commerce portal.

Thanks,