Hi Friends,

Today I will let you know how to set off the tax amount with the help of the Make payment/post credit to ledger option.

What is GST?

GST stands for Goods and Services Tax. It is a comprehensive indirect tax levied on the supply of goods and services in many countries around the world. GST is designed to replace multiple cascading taxes that were previously imposed, such as value-added tax (VAT), central excise duty, and service tax.

The main objective of implementing GST is to create a unified and simplified tax system that eliminates the complexities and inefficiencies of the previous tax structure. By doing so, it aims to streamline the tax collection process, promote ease of doing business, and reduce tax evasion.

Under the GST regime, all types of goods and services are classified into different tax rates, commonly referred to as tax slabs. These tax slabs may vary from country to country but usually include multiple rates, such as a standard rate, a reduced rate, and sometimes a zero rate for essential items. The rates are applied at each stage of the supply chain, allowing for the input tax credits to be claimed by businesses for taxes paid on their purchases.

Steps to pay the tax from make payment/post the credit to ledger option.

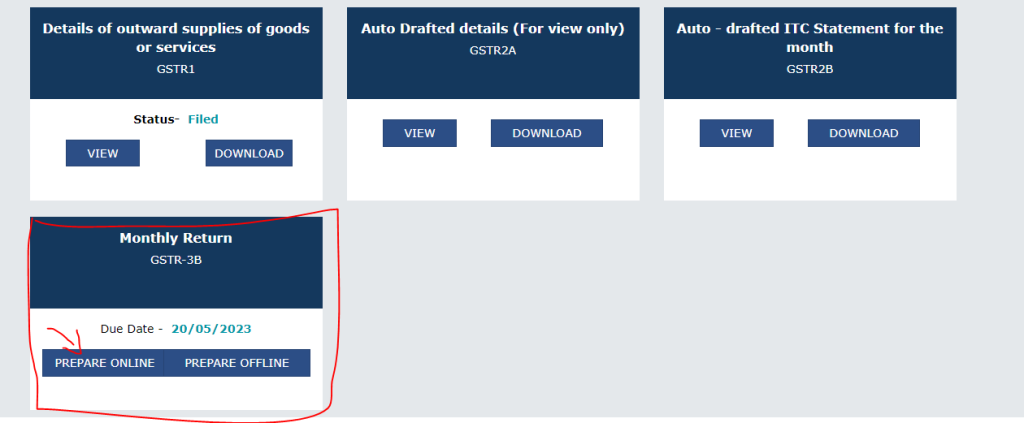

- After login to the GST dashboard please click on the GSTR-3B option.

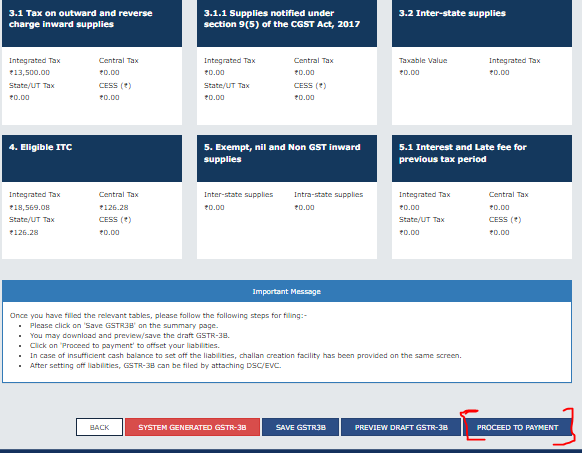

- After that do scroll down and you can the proceed to payment option and then click on it.

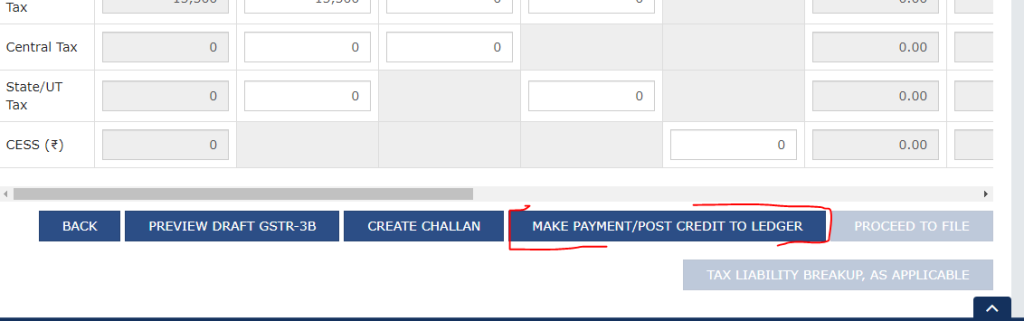

- After clicking on it you have an option i.e. Make Payment/Credit to Ledger then click on this option.

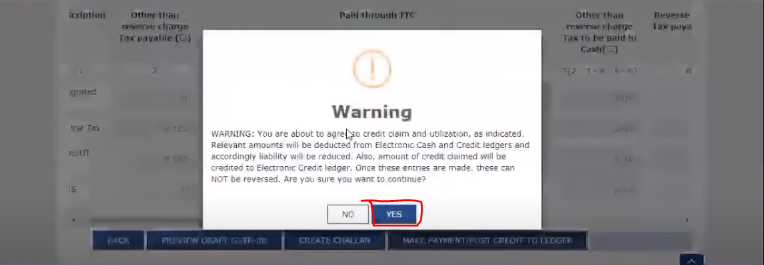

- After clicking on this option you will have to appear an option then click on the yes button.

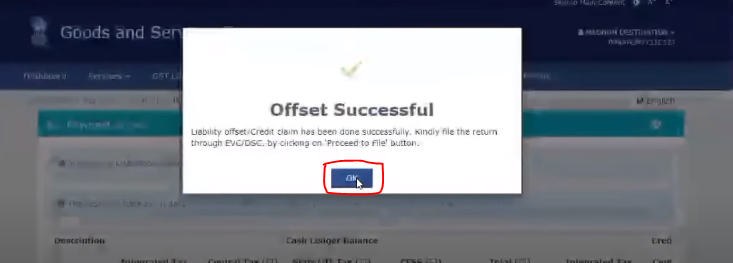

- After clicking on the yes button an offset message will appear in your dashboard then click on the ok button.

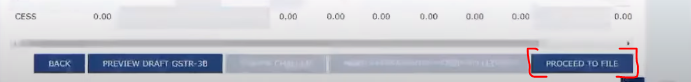

- After that, please click on the Proceed to File button.

- And now please attach your DSC and do the file return of GSTR-3B.

Thanks,