Hi Guys

This is Ravi Verma, in this article, I will tell you how to file a NIL TDS return online.

Let’s start,

- What is TDS?

Its full name is Tax Deducted at Source, According to the Income Tax Act, 1961, every individual or organization is liable to pay taxes if their income is above a certain threshold.

When the salary of a person exceeds the limit prescribed by the government, then TDS is required to be deducted from the income of that salaried person.

- Why is TDS necessary?

Any person who resides in India has to pay tax to the Indian government and TDS is a direct tax, when the income of an Indian crosses the limit then he has to pay tax to the government.

If a person does not pay tax to the government, then notice can be issued to take legal action against him and the government can also impose a fine on him.

- These are the steps to file a NIL TDS return.

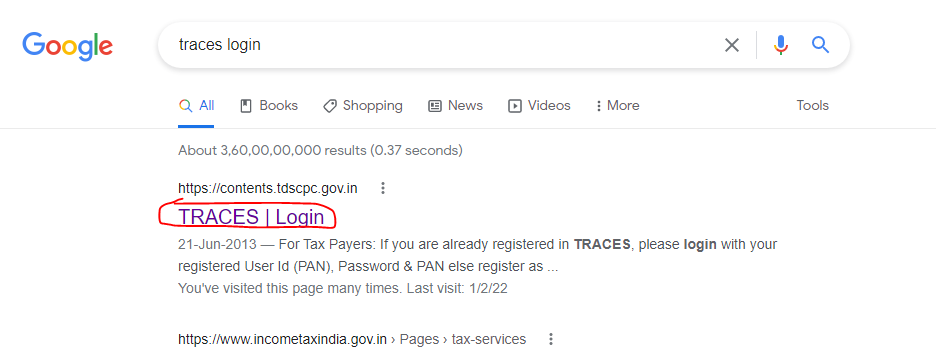

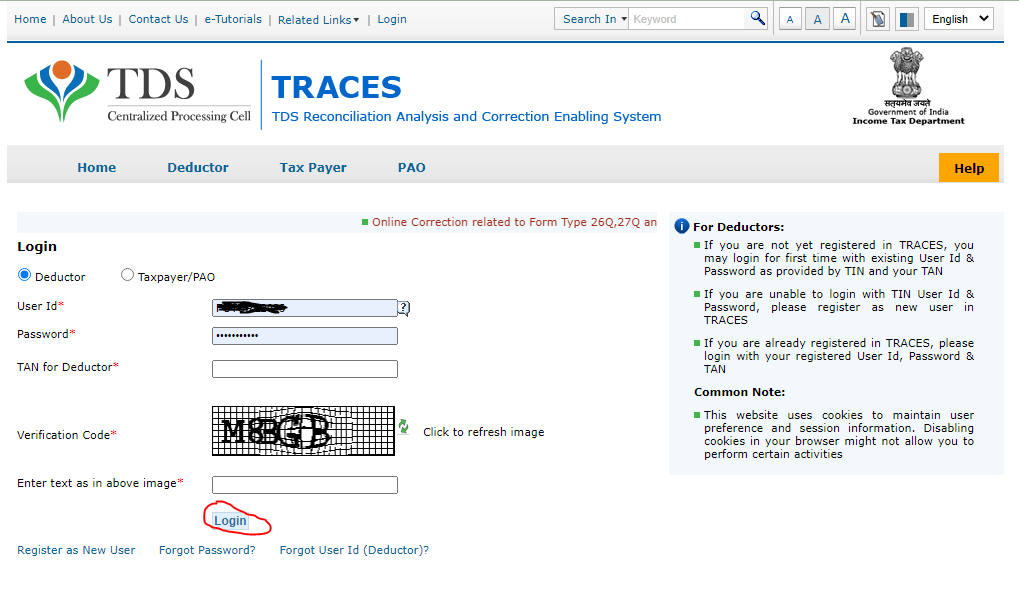

- Go to the traces site.

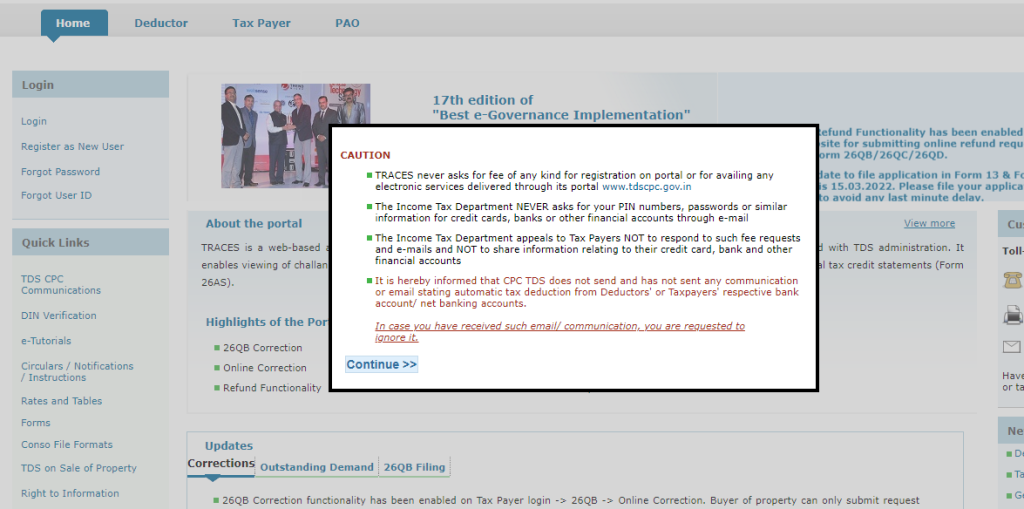

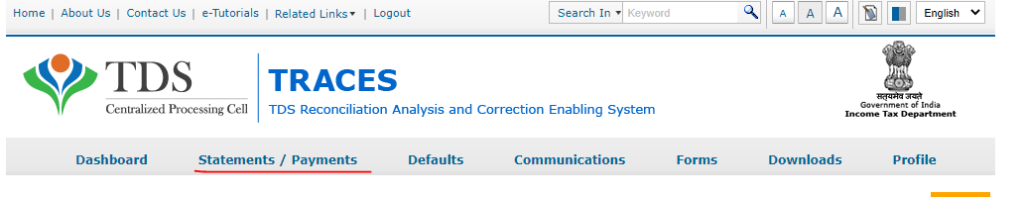

2. This is the TDS dashboard.

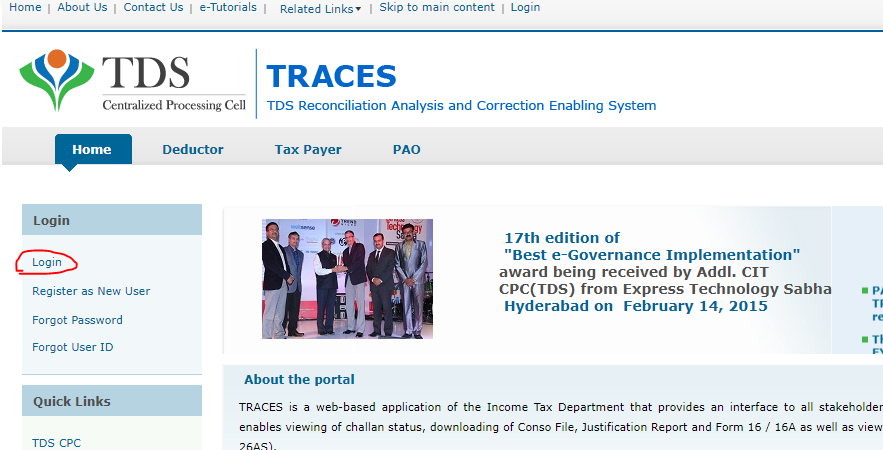

3. Click on the Login button.

4. Select the Deductor option and after doing so enter your login credentials and TAN number as well.

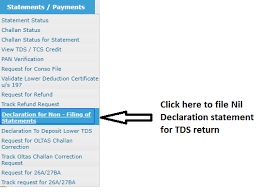

5. Click on the Statements/payments icon.

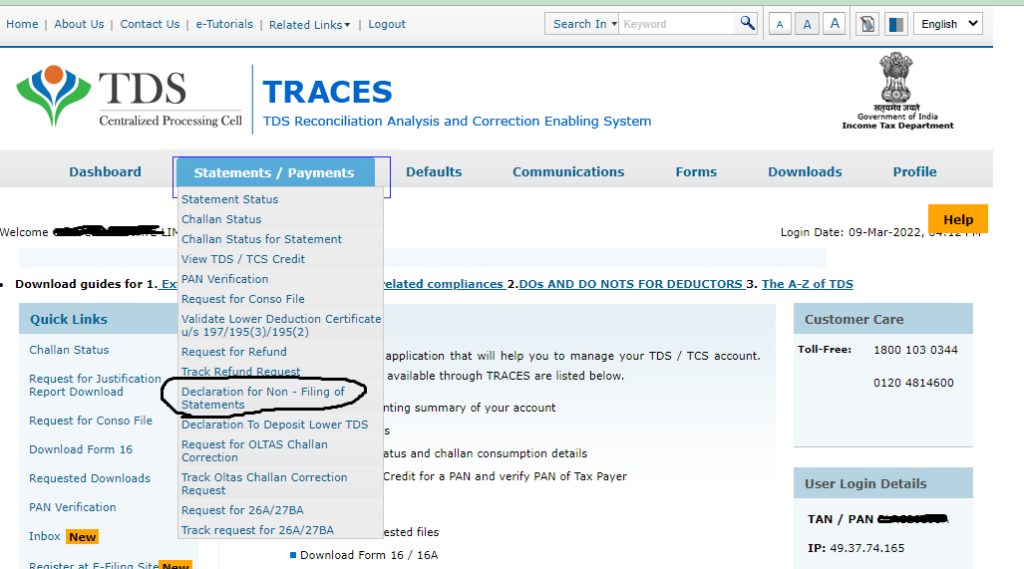

6. Below this button, you will see Declaration for Non-filing of Statement then click on it.

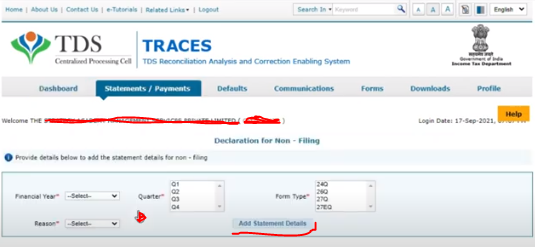

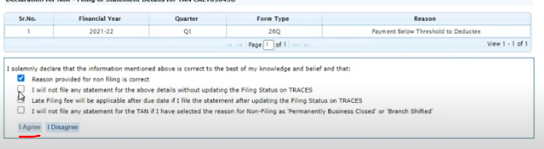

7. Now select your financial year, quarter, give reason and also select the form types then click on add statement details

8. In the below you will see your data then click on proceed button

9. As you click on the proceed button, the portal asks you to select all the required columns, and click on the I agree option.

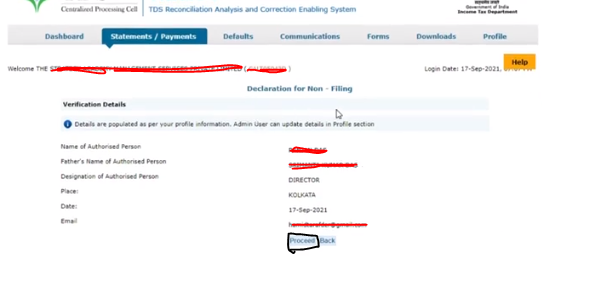

10. Now you will see the details of the director of your company, with the help of whose signature you file the return, then you have to click on the Process button.</div>Now you will see the details of the director of your company, with the help of whose signature you file the return, then you have to click on the Process button.

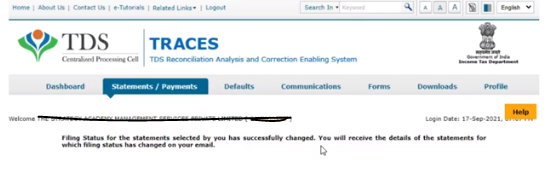

11. After this step, you will get a notification that your file has been saved successfully.

Thanks,