Hi Guy’s

This is Ravi Verma, In This Article, I will tell you about how to File an EPF return.

Let’s Start,

- What is EPF ?

Provident fund (PF Act, 1952) is one of the main savings platforms in India, When an employee works in a company, he is paid a salary by the company and under this, the employer deducts some amount from his salary and deposits it in the Employees Provident Fund, And the percentage by which the employer deducts some amount from his employee’s salary and deposits it in his employee’s provident fund, the same amount is deposited by the employer in his employee’s provident fund on his behalf.

- Mandatory Columns to fill EPF

- UAN number.

- Name of employee

- Grosss wages

- EPF wages

- EPS wages

- EDLI wages

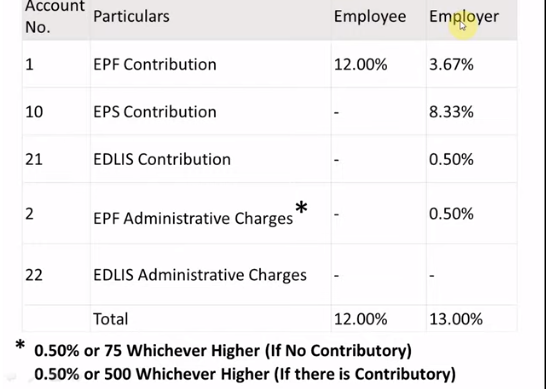

- EPF contribution(12%)

- EPS contribution 8.33%

- Different between EPF and EPS 3.67%

- NCP (If any employee has taken leave, enter the day in this column)

- Refund of Advance

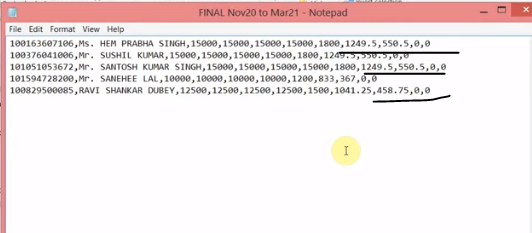

Note – Don’t use (,) commas.

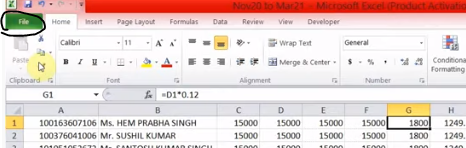

- How to create a csv file from excel?

After making your reports in excel

- Click on the File button.

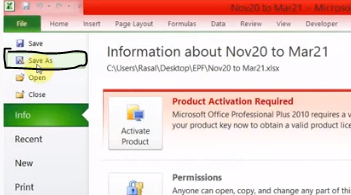

2. Click on the save as an option.

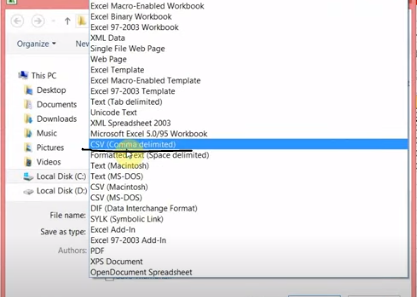

3. And choose CSV (comma delimited)

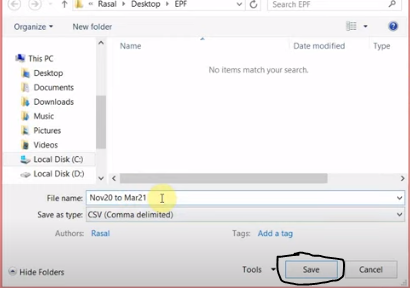

4. Select your location and save this data.

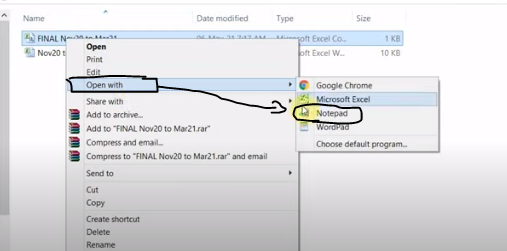

5. After saving your file go to your file location and right-click on this file and select the Open with Notepad option.

6. First of all, remove the dot (.) of your data.

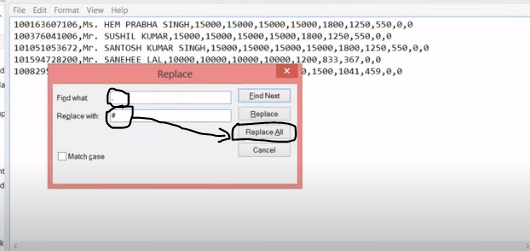

7. After removing all dots (.), now change all commas to hashtags (#).

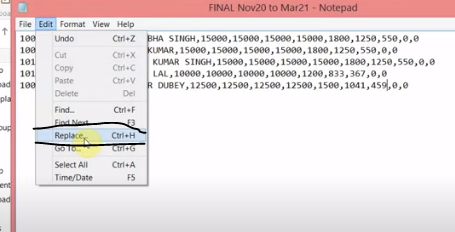

8. Please click on the edit option and under that you will click on replace option.

9. Click the replace all option.

10. Now save your data and turn it off.

- Steps of the online EPF filling process.

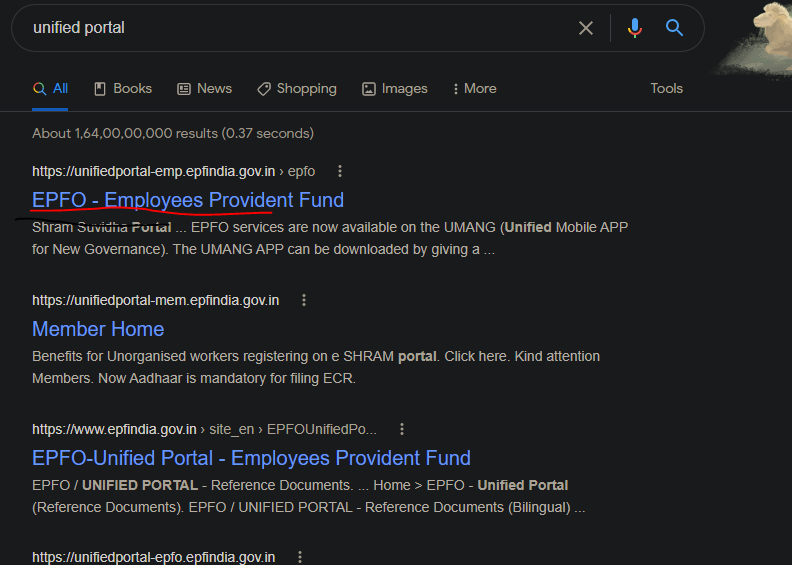

Step 01:- Go to your browser and search unifiedportal.gov.in and click the EPFO option.

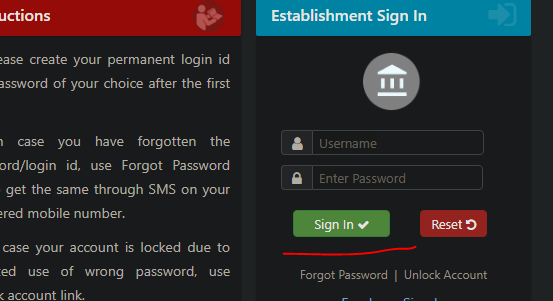

Step02:- Login to your EPF portal with your credentials.

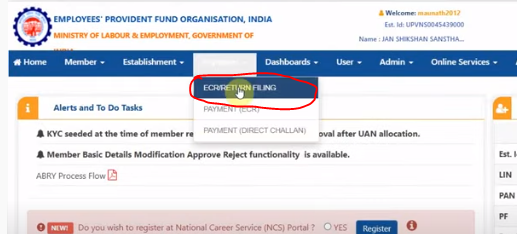

Step03:- After login to your EPF portal go to and click on the payment option under this option you will see ECR return filing option then click on it.

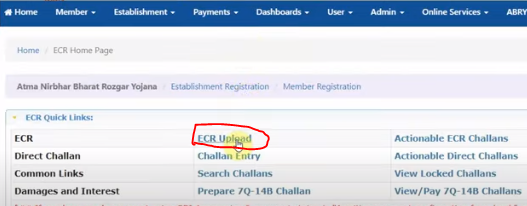

Step04:- Click on the ECR upload option.

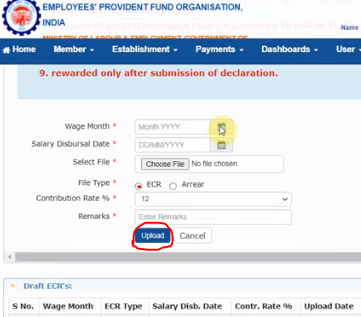

Step05:- Enter return filing date, salary credited date, then after doing all the things select your ECR report, also please select your file type and comments and click on the upload option.

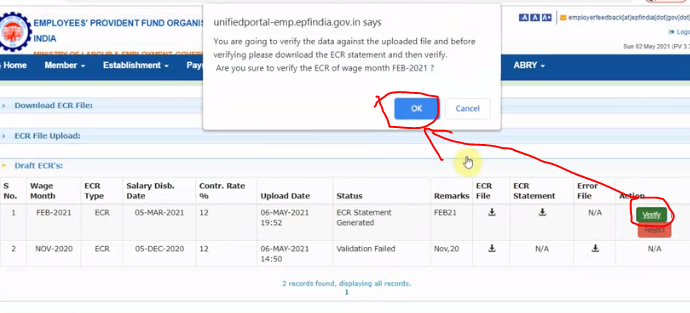

Step06:- After clicking on the Uploaded button scroll down and click on the Verify option.

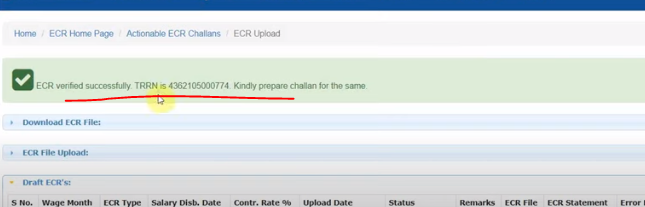

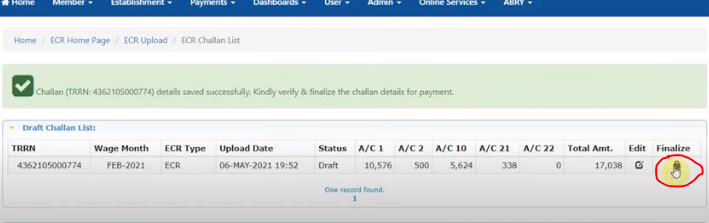

Step07:- After this, you will receive your TRRN number.

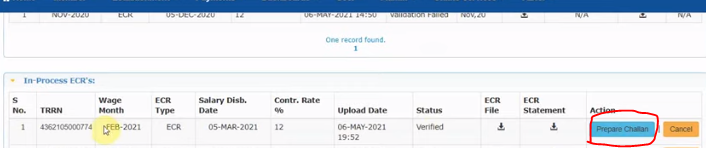

Step08:- Now start creating Challan.

Step09:- Click on Create challan option.

Step10:- This is the calculation sheet of EPF.

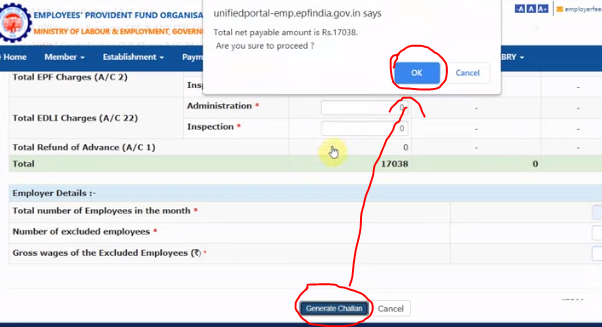

Step11:- After verifying all the details please do scroll down and click on generate challan option.

Step12:- Now you have to click on the final button, after clicking on this button your challan has been successfully submitted, after clicking on this you can no longer make any changes in the challan.

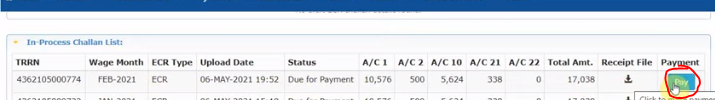

Step13:- Now click on the payment option you can easily file your EPF return.

Thanks,