Hey all,

Thanks for coming to my blog, in this blog, you would about the change of mobile number and email id in the GST portal.

Many people have no idea about their mobile number and email id mentioned in the GST portal. And for this reason, people are not able to file their returns with the help of EVC.

Do you want to know your registered mobile number and email id? that was registered in the GST portal?

Please follow these steps:

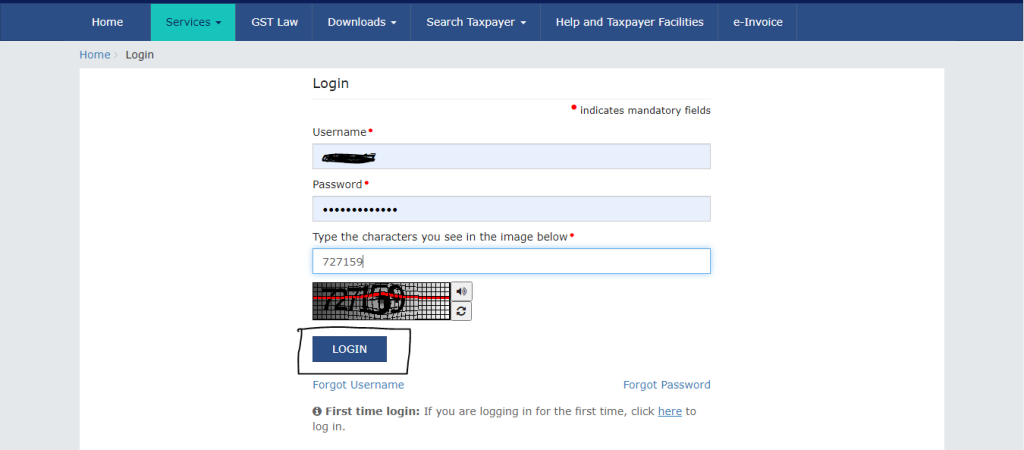

- Login to your GST portal with your correct credentials.

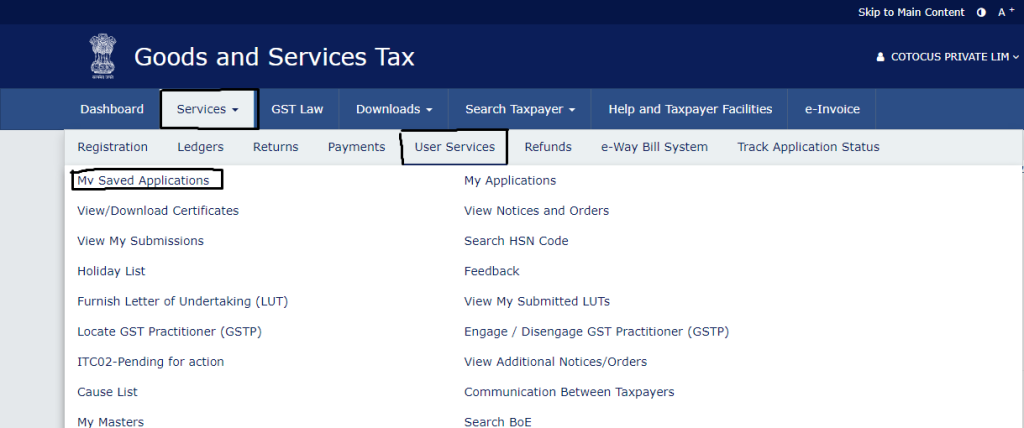

- After that, please click on the service tab button under this button you can see the user services option and after clicking on the user services option you would see my saved applications option and then click on it.

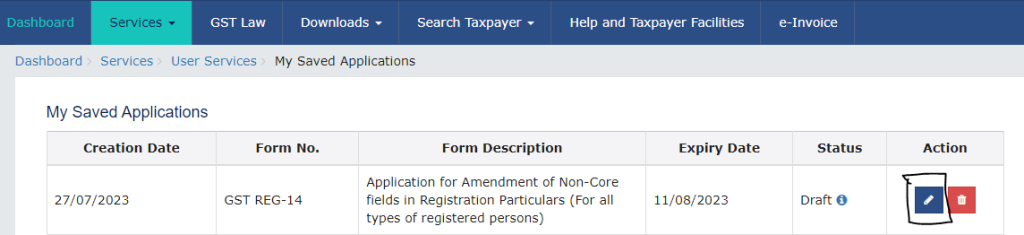

- After clicking on my saved applications button, you can see your saved application form so what to do? you have to click on the pencil icon.

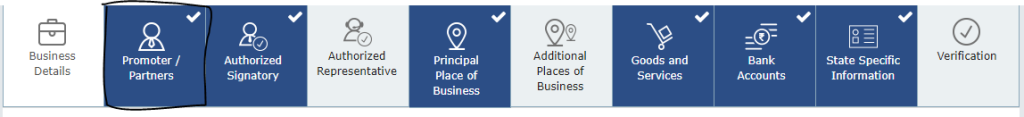

- After that, please on the promoters and partners option.

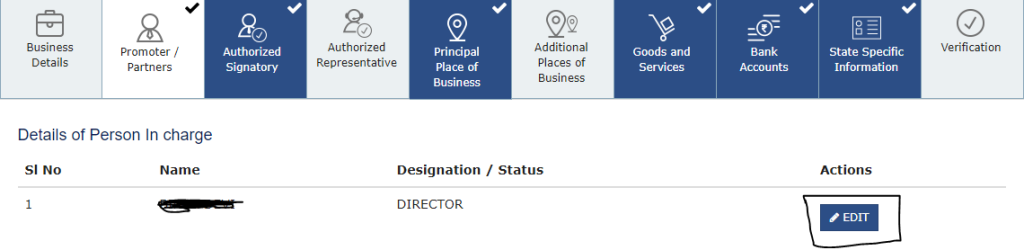

- After clicking on it, please click on the edit option.

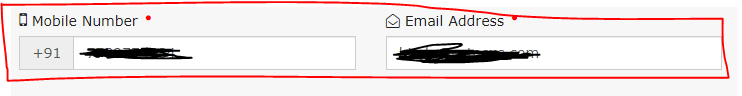

- And after that, do your scroll down you can see the mobile number option and email id option.

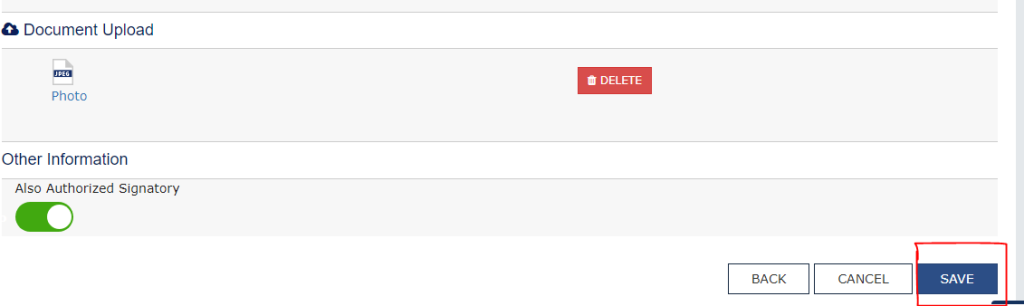

- and the last step is to do your scroll down and click on the save button after that, please choose the EVC option and enter both OPT (the opt will be sent to your mobile number and email id) after following all these steps you can change your mobile number and email in a minute.