Hey Friends,

Welcome to my blog! Here, I’ll guide you on the process of paying GST through a Credit/Debit Card. Stay tuned for step-by-step instructions and helpful tips to make your GST payments seamlessly. Let’s make the taxation process smoother together!

The government has announced a new facility for paying GST through Credit/Debit Cards. This is a beneficial feature for every GST taxpayer, as it allows easy payments using Credit/Debit Cards. I am genuinely pleased to share that if there are insufficient funds in our account, there’s no need to worry. The tax amount can be paid conveniently with the help of Credit/Debit Cards, and the noteworthy aspect is that taxes for all Credit/Debit Cards can be settled. A heartfelt thanks to the government is in order, as this facility makes payments hassle-free.

Here, I will explain how to make GST tax payments using a Credit/Debit Card.

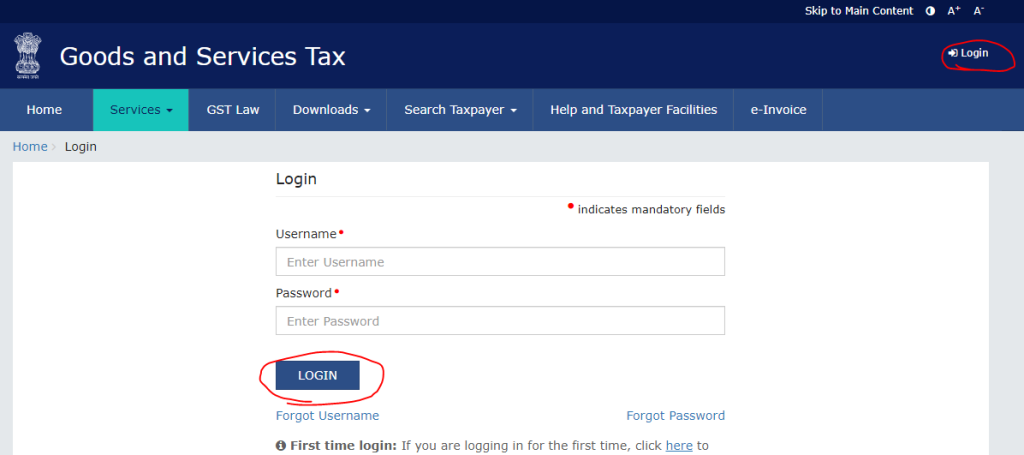

- Please log in to the GST Portal.

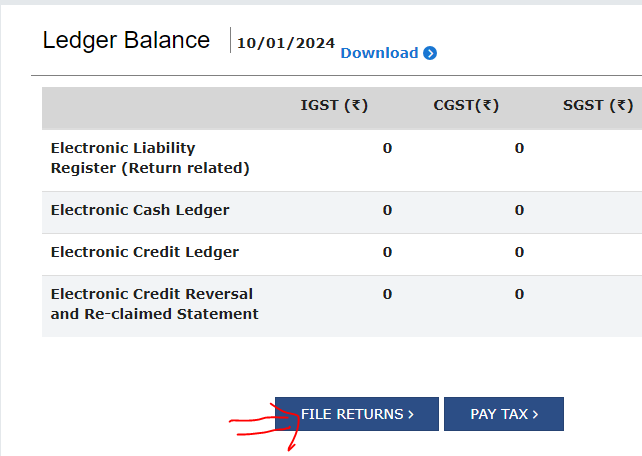

2. After that, Click on the file return button.

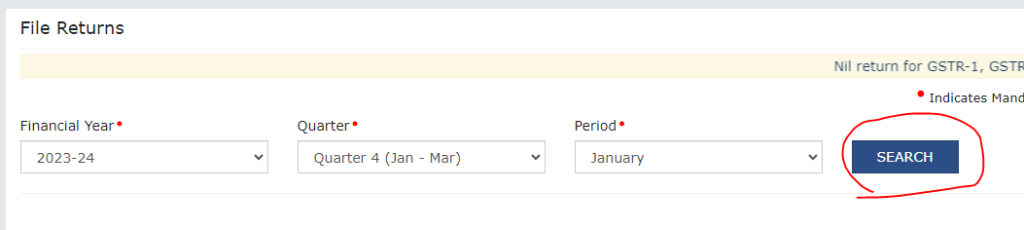

3. Select your filling period and click on the search button.

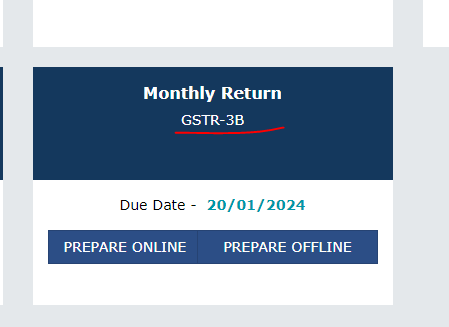

4. Select the GSTR-3B return.

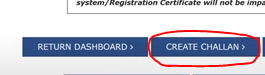

5. After that, Please click on the Create Challan Button.

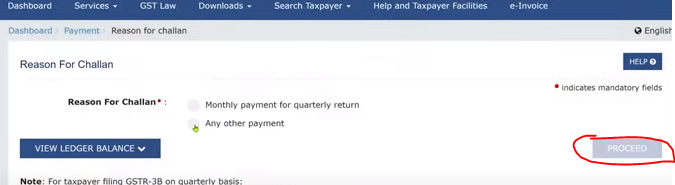

6. After that, Please select the Tax Payment method.

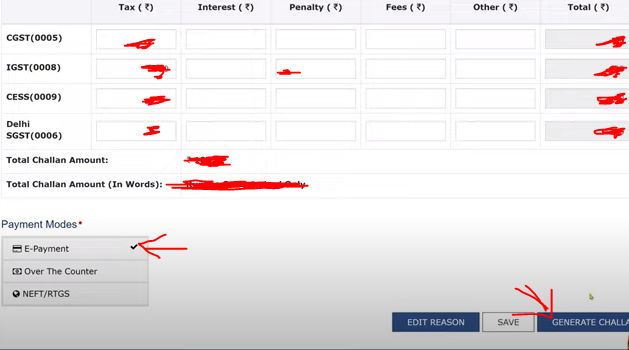

7. After clicking on the ‘Proceed’ button, review the tax amount details, which will automatically appear in the dashboard’s autofield. Next, click on the ‘E-payment’ option, followed by clicking the ‘Generate Challan’ button to proceed with the payment process.

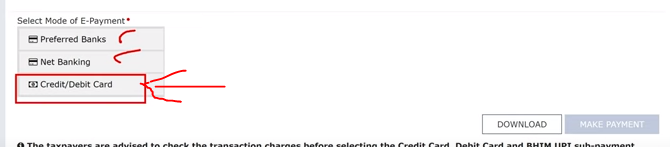

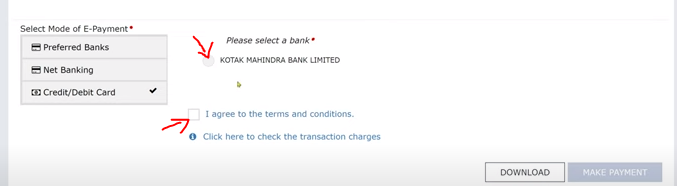

8. After that, Please select the Debit/Credit Card payment Method.

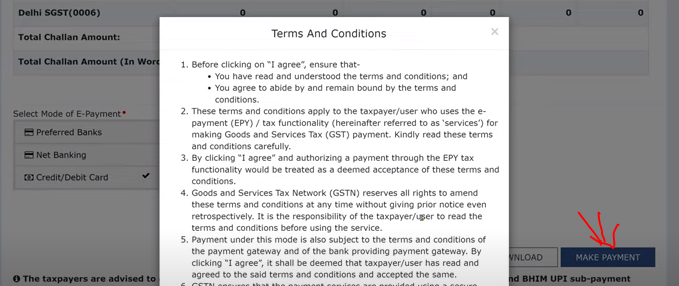

9. After that, please tick the check mark and accept the terms and conditions by clicking on it.

10. And last click on the Make Payment button.

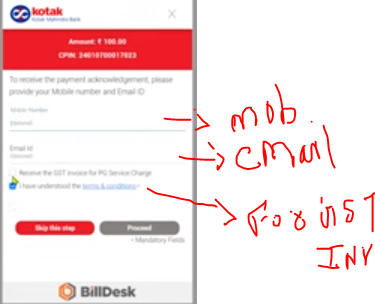

11. After clicking on the Make Payment Button, You can see the new window and in this window you have to enter your registered mobile number or registered email ID or If you want to take the GST invoice for the payment through the Credit Card then select the GST Invoice Button.

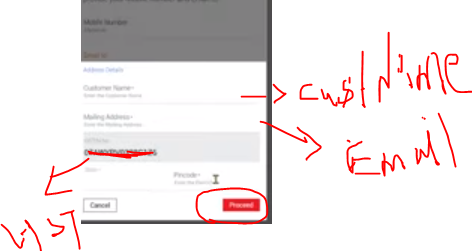

12. So If you want to take the GST invoice, you have to enter some basic details

- Customer Name

- Email Address

- GST Number

- State

- Pincode

13. And last click on the proceed button. (***Note Point – Transaction charge would be deducted for your transaction by using the credit card facility. We all know that if we will use a Credit Card then the Transaction charge will be deducted from the bank for this service)

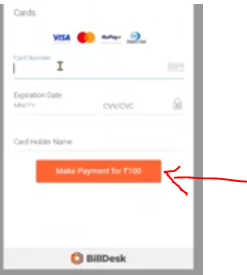

15. After clicking the proceed button you have to enter your credit card details for finishing this transaction. After entering these details just click on the make payment button after that, your payment will be successfully made to the government.

16. One last step is pending which is the OTP verification Step. Without OTP verification you can not able to make your payment so for that you have to enter an OTP that you will receive by clicking on the payment button. Then enter the OTP ad and click on the Submit button.

Thanks.