- What is GSTIN ?

When a person registers his company within the Goods and Services Tax, he is given a Goods and Services Tax Identification Number.

- What are the type of GST?

There are Three Types of GST.

(a) CGST (Central Goods & Service tax):- It means that if we purchase any of the goods in any Place, then whatever tax will be there, the Central will also have to pay tax.

(b) SGST (State Goods & Service tax) :- It means that if we purchase any of the goods in any State, then whatever tax will be there, the State Government will also have to pay tax.

(c) IGST (Integrated Goods & Service Tax) :- Within this, we purchase any goods at any place in India, then we will have to pay tax to the Central Government.

- What is inter-state supply and intra-state supply?

Inter-state:- If we purchase and Sales of goods and services from one state to another state then we call it inter-state supply.

Intra-State:- If we purchase and Sale of goods and services in the same state then we call it intra-state supply.

- What is Exempt Supply ,Nil rated Supply And zero rated Supply?

any goods and services that we use every day. those Goods and services which are out of tax imposed by the Indian Government, we call it Nil rated & Exempt Supply.

Like :- Salt , potato, fruits , green vegetables ,

- What is Zero-Rated Supply?

If we buy any goods from the special economy zone, then there is no tax on that place, we call it Zero rated supply.

Like:- Maharashtra, Gujarat, Tamilnadu, Kerala, Chennai, Andhra Pradesh, West Bengal, Uttar -Pradesh.

- What is meant by reverse Charge?

When we purchase goods and services from a person who is either a lawyer or a political person, then the government says whatever the person purchases. He will deposit the tax himself.

- If we purchase the goods from an unregistered person, then who pays tax?

If a registered person purchases any goods or services from an unregistered person, the tax has to be paid by the registered person.

- Can a Unregistered person Take Income Tax Credit?

No, we cannot take income tax credit till we bring our business under the Goods and Services Tax Act.

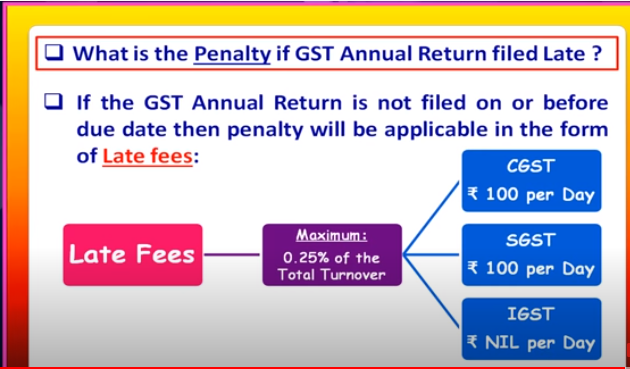

- If we do not file my return till my due date in my Goods and Service Tax, then how much do we have to pay.

If we do not file the return date of our (GST) till its last date, then we have to give 100 Rupees (CGST) and 100 Rupees (SGST). Meaning we have to give 200 rupees late fee.

- What is Annual return and the due date of filing Annual return?

We file it once a year. In which I have a report of all the sales and purchases of one year, which is either my quarterly or monthly. Within this, an annual return file of all taxpayers (GST) Has to do. Excepting this following person:- (a)(ISD) Input Service distribute. (b) Non-Residence Taxable Person (c) person Paying TDS under section 51 of GST Act.

There Are four types of GST annual returns.

(1) GSTR-9:- These are for all taxpayers who are regular taxpayers. Those who file their financial year (GSTR-1) and (GSTR- 3B).

(2) GSTR-9A:- Whichever composition scheme is selected in it, which files its return (GSTR-4), then has to file (GSTR-9A) for the annual return.

(3)GSTR-9B:- These options belong to a company with e-commerce. Those who file their return in this GST-8 financial year.

(4)GSTR-9C:- Any company whose annual turnover is more than 2 crores, they have to file this. (GSTR-9C) in which they have to submit their annual audit report and a copy of the tax paid.

Note*** Once we file the annual return of (GST), we cannot edit it again. And we can file it both online and offline

Due Date for an annual return:-Whenever our financial year ends, we have to file annual returns before the next December month. (31st Dec of every month)

Penalty if GST Annual return filed late?:- In this penalty, we have to pay 0.25% of the entire turnover.

- What is the due date of payment of GST under QRMP scheme ?

The due date of GST payment is 25th of every month.

- How much do we pay for tax in (GST)?

We pay our tax in 5 ways inside it.

IGST (Integrated Goods & Service Tax)

CGST (Central Goods & service Tax)

SGST (State Goods & Service Tax)

CESS (Assess)

Interest, penalty, ETC.

- what do you understand by input tax?

Meaning of input tax. When we buy an item, while buying it, we have to pay tax on what we called input tax.

- When someone registers inside the person (GST), can they claim an input tax credit?

But it should not fall under the composition scheme. They can then claim an input tax credit.

- When a person is registered in GST And they buy some goods for installment. So can he claim his income tax credit?

When a person is registered under GST and has purchased any goods on installment, he cannot claim his input tax credit until he has paid his last installment.

- What is an Invoice ?

When a company gives goods or services to a person, the company issues an invoice, stating all the payment terms.

- Can a unregistered person issued a tax invoice?

No, a company registered within GST can issue tax invoices.

- What do you mean by bills of supply?

Bills of supply can be issued by an unregistered person, the composition scheme which is opted for also issues a bill of supply. necessary detail filling under this bill.

(1) Name And Address

(2) Serial number

(3) Date of Issue

(4) Shipping address And GSTIN Number

(5) HSN/ACS Code

(6) Taxable value

(7) Description

(8) Discounts

- What is Credit Notes?

When we sell some goods to a person. And if there is any problem in our sale, due to which we have to return the cash, in this case we issue a credit note to him.

- What Are Debit Note?

When we sell some goods to a person. And we have reduced the rate of goods which has caused us to lose, so in this case, we issue him a debit note.

Other FAQ’s

- GST – QRMP Scheme – Frequently Asked Questions (FAQs)Part 1:- http://bit.ly/3uY13Eb

- GST – QRMP Scheme – Frequently Asked Questions (FAQs)Part 2:- http://bit.ly/3e6bbVE