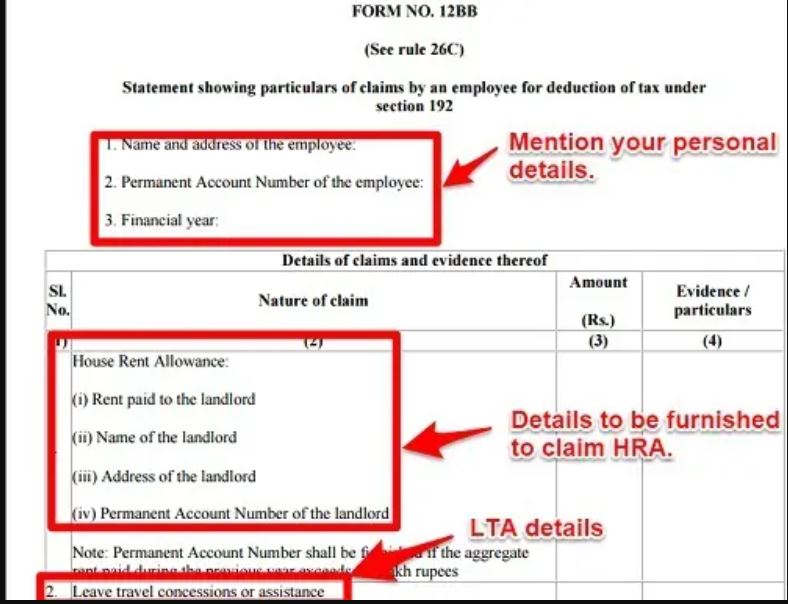

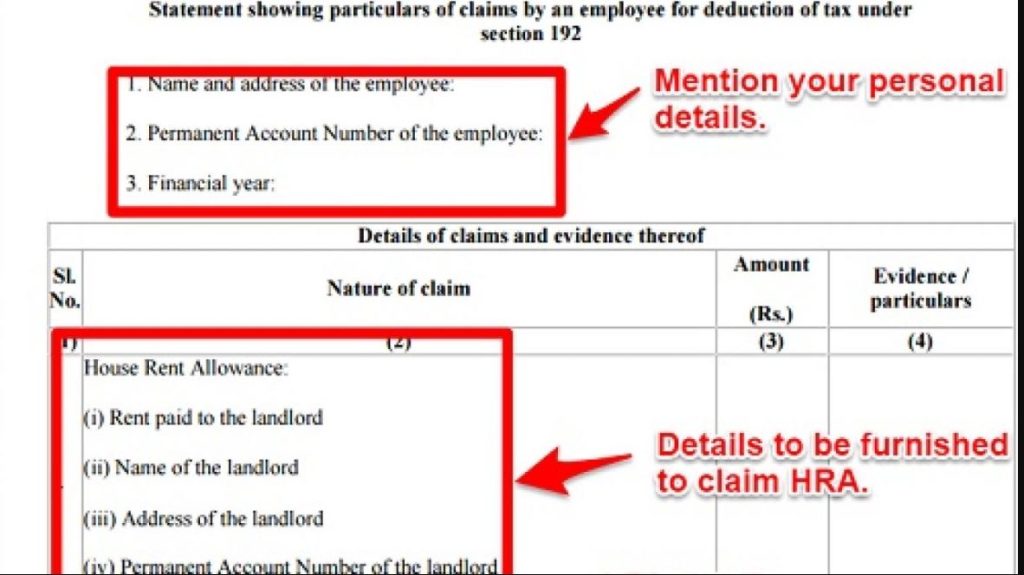

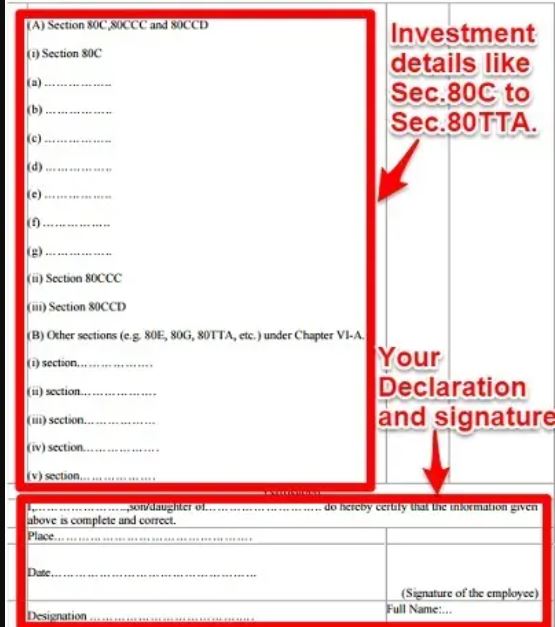

12BB forms are a set of forms required to be submitted by an employee to their employer for claiming tax deductions under certain specified expenses, such as house rent, travel expenses, and donations made to specified funds. These forms help the employer to compute the accurate TDS (tax deducted at source) from the employee’s salary.

Form 12BB reveals the investments and expenses you have made or incurred to claim tax exemptions through your employer. Usually, you need to submit Form 12BB in January or February, along with proof of your investment. Based on this information, your employer will compute TDS on your salary.