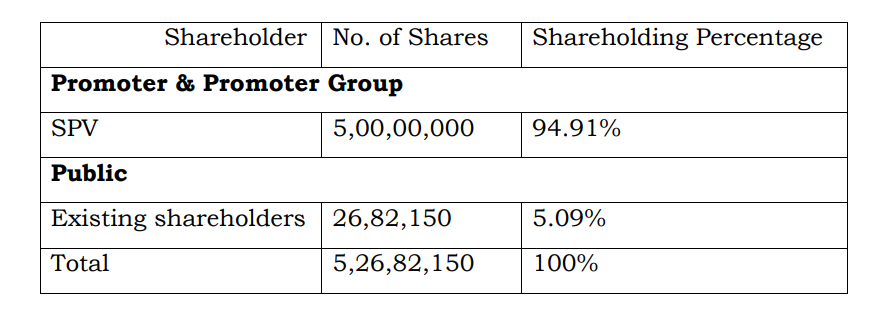

The Resolution Plan provides for the cancelation and extinguishment of all presently outstanding ordinary equity shares being held by the existing shareholders, subject to issuance of one fresh equity share of face value of Rs. 10 for every 275 ordinary equity shares held by existing shareholder. Thus, 73,75,91,263 existing equity shares of face value of Rs. 10 each will become 26,82,150 ordinary equity shares of Rs. 10 each. It is also provided that the Special Purpose Vehicle (SPV) — Hazel Infra Limited – will take over the Corporate Debtor and this SPV shall subscribe to 5,00,00,000 fresh ordinary equity shares of face value of Rs. 10 each.

Thus, once the share capital of the Corporate Debtor is reorganised, the SPV will hold 94.91% while the public shareholding will be 5.09%.