What is credit note?

When a company accidentally increases the amount when issuing its invoice, at that time we issue a credit note to rectify that invoice. When we issue a credit note to our supplier, due to the release of that amount of the credit note, we amassed the same amount as we have debited from it. (For example, when a company serves its customer, in return the customer gives them money, the company issues an invoice to its customer, which contains all the company information and details of the money received. So if the company accidentally overwrites the amount in the invoice making it difficult for the client to get his input tax credit, then to overcome this problem the company issues a credit note to his client so that his money goes to the client. be returned).

Step By Step process issue a credit note to your client.

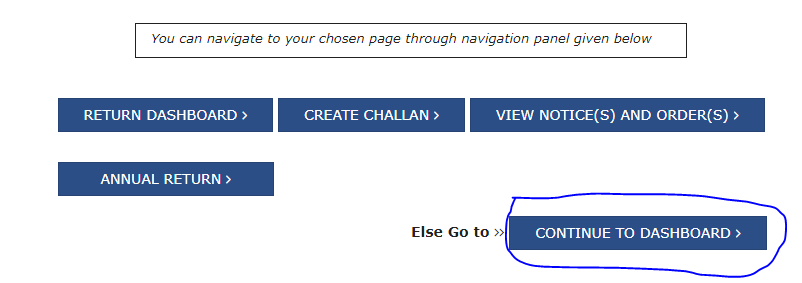

Step 01>>>>> Open your GST And go to the dashboard & Click Continue To dashboard.

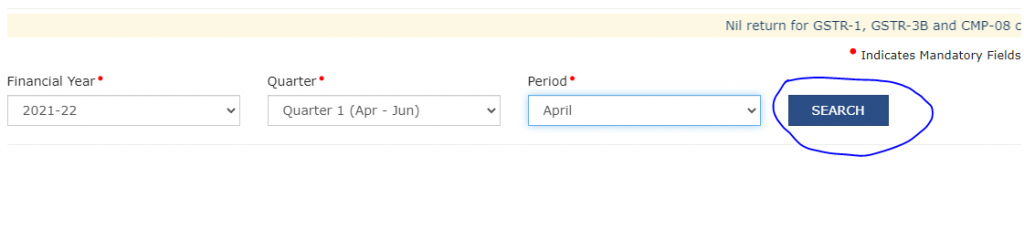

Step 02>>>>> Click return file option and select Month & year and then click search button.

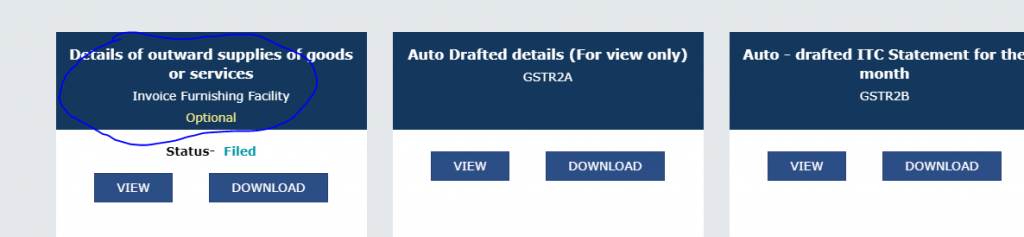

Step 03>>>>>> Click on the Details of outward supplies of goods or services Invoice Furnishing Facility

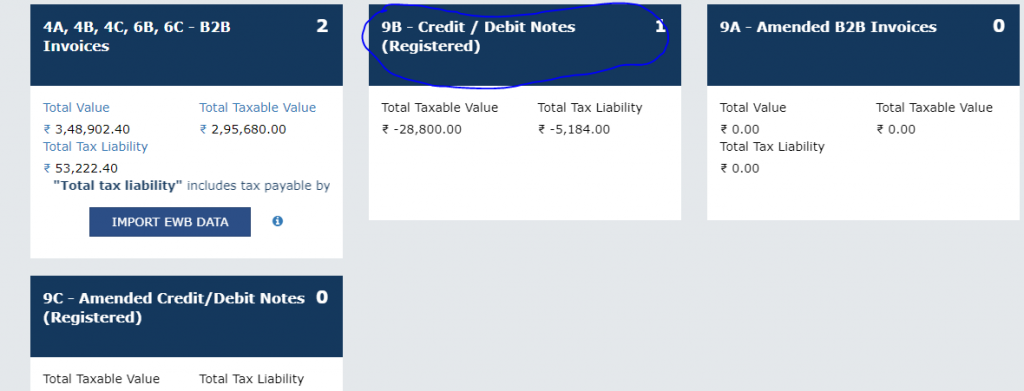

Step 04>>>>> After clicked Go to the table no.9B – Credit / Debit Notes (Registered)

Step 05 >>>>>> Enter your invoice details with your default amount and Filed it.

Note * Red Dots You are informed that it is mandatory to fill this column.

(a) Receiver GSTIN/UIN :- In this, you have to write the GST number of your invoice

(B) Debit/credit Note No:- In this, you have to write a different note number, so that you know how many credit notes you have issued so far.

(C) Credit/Debit Note Date:- In this, you have to write the date of the day on which you will issue the credit note.

(D) Note Type:- whatever you Issue Credit note/debit note

(E) Note value:- In this column, you have to enter the amount which is the actual amount of the credit note. {(original value of an invoice is 25000+200(GST) in the case of the client, wronged value is 30000with GST in company-issued to his client) then our real Credit note amount is 30000-25200= 4800 + 4800*18%GST = 864, The credit note value is 4800+864= 5664)}

(F) POS(place of supply):- And lastly you select Place of supply according to the GSTIN Number

After that, Finally your credit note has been issued to your customer.