Welcome Guys

This is Ravi Verma, and in this article, I will let you know about how to generate the GSTR-3B report from QuickBooks and, export it in JSON format.

Let’s get started,

What is Quickbooks online?

Intuit has developed this greater software that is Quickbooks online, in Quickbooks we can enter our day-by-day transaction report very easily, like:- sales report, purchase report, sales return report, purchase return report, expenses report, salary report, and other reports.

With help of this software we can generate our GSTR filling report and TDS filing report also, and we can see our profit and loss account, balance sheet, BRS Account, and all the companies related to this by using the Quickbooks online software.

How to generate the GSTR-3B report?

- Go to your browser and search

QuickBookslogin.

- Click on the Sign in button.

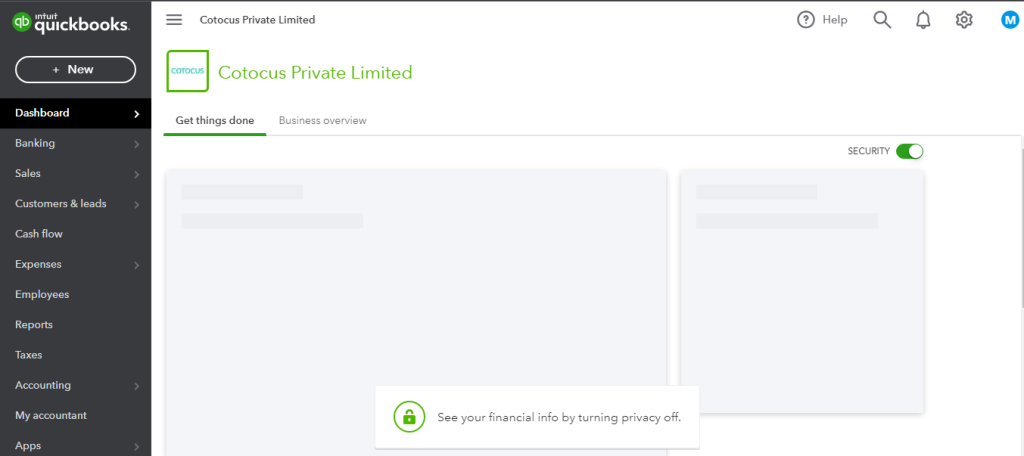

- After clicking on it please enter your login ID and Password and go to the dashboard of Q/B online.

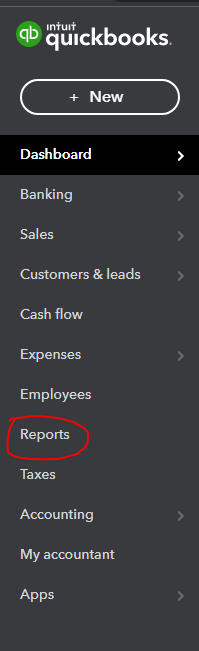

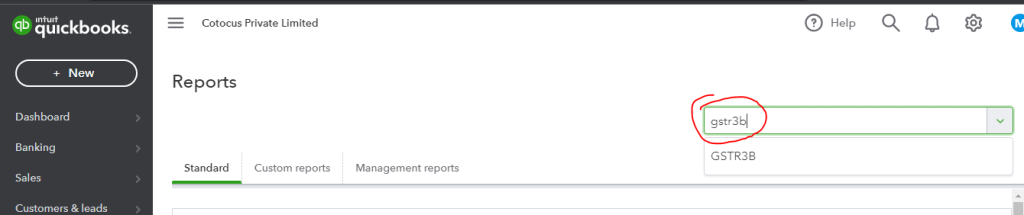

- Now go to the reportsection in Q/B online.

- After this go to the find section and GSTR3B. and click on the GSTR3B option.

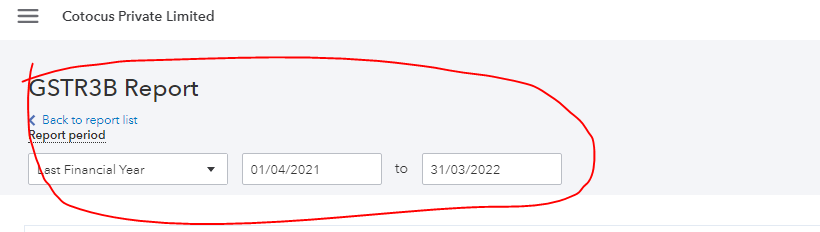

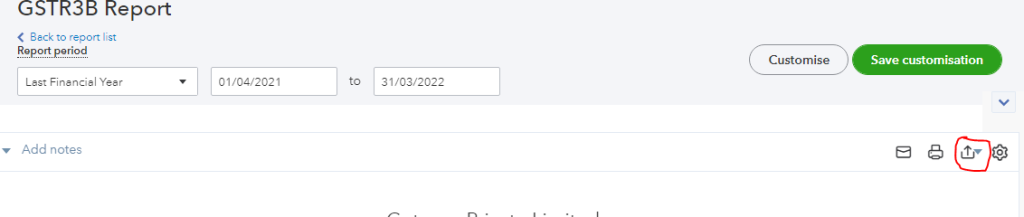

- Select your report period what ever you have find.

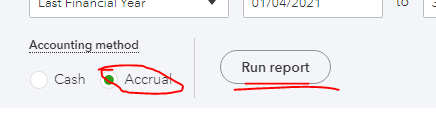

- And now select accrual method and click on the run report option.

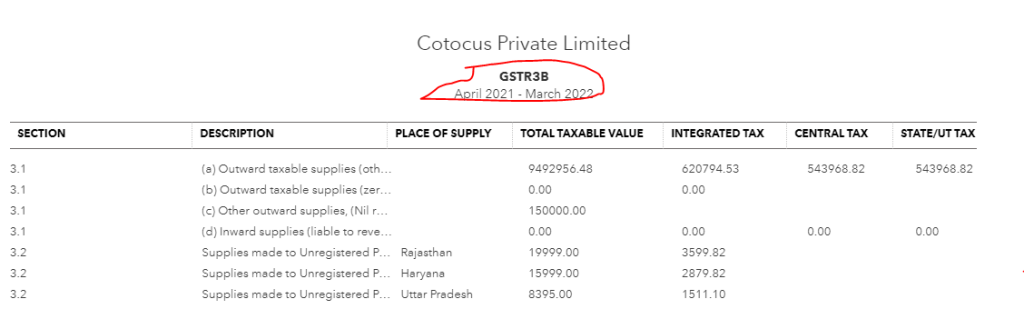

- And now you can see your GSTR-3B report.

How to Export the GSTR-3B report in JSON formate.

- Look at your right side here you will see a export button option.

- Please click on it and select the JSON option for your report.

- After click on ityou can easily download your GSTR-3B report in JSON formate.

Thanks for reading my blog.