Hi Friends,

This is Ravi Verma, In this article, I will tell you how to know your TDS challan in an online way.

Let’s start

Read properly after that you will download your lost TDS challan.

IF we have to deduct any TDS from the salary or other than salary then it is mandatory to pay that amount to the government on the 7th of every next month. That is mandatory for all employer to pay their TDS amount to the

And if we lost his TDS challan then we can download it in an easy way with the help of the OLTAS portal

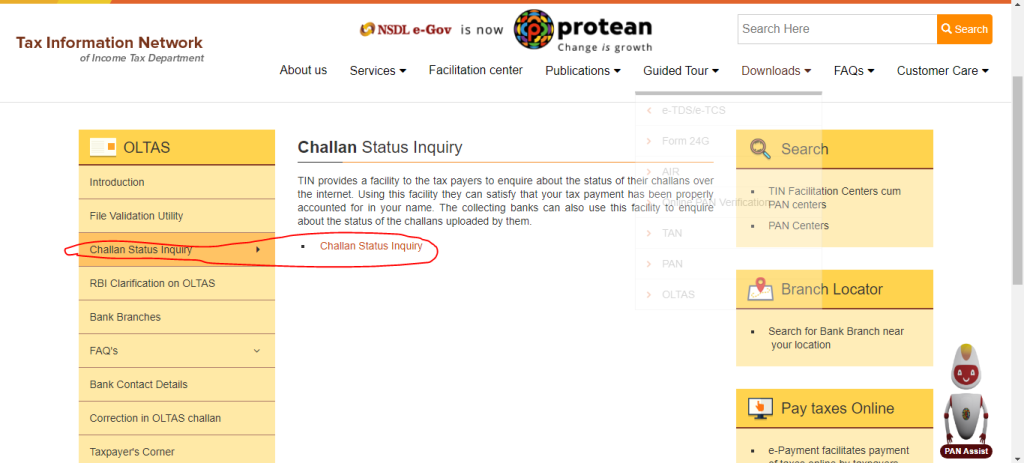

A. Go to your browser and click TDS challan status inquiry.

B. After that you have an interface of the OLTAS portal then you would click on the Challan Status Inquiry

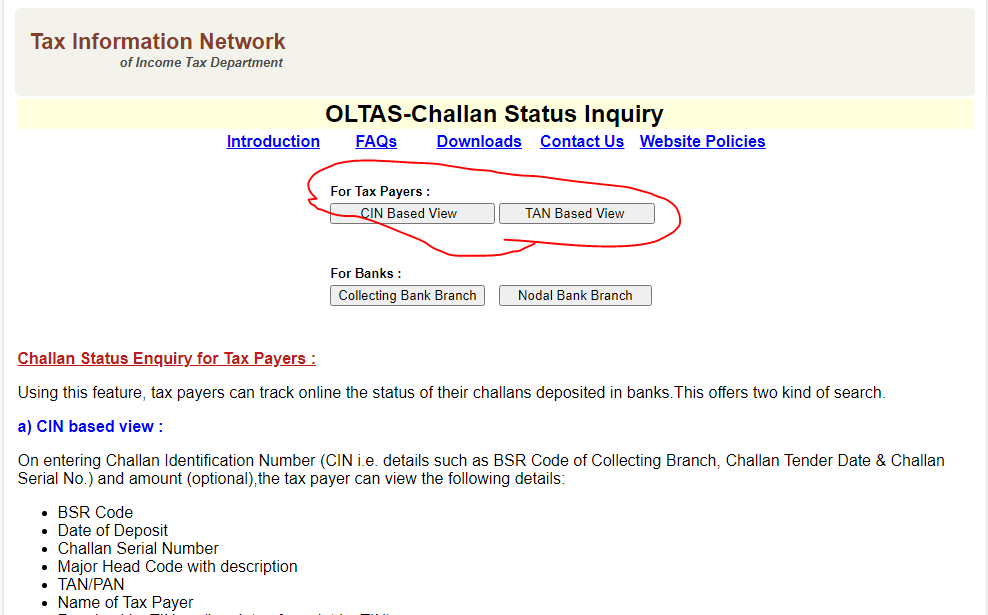

C. After clicking on that option you will see a new interface for your missing invoice details. if you want to find your missed challan from the CIN base then select it and enter your CIN number, and if you find your missed challan from the TAN base then select it and enter your TAN number under this portal.

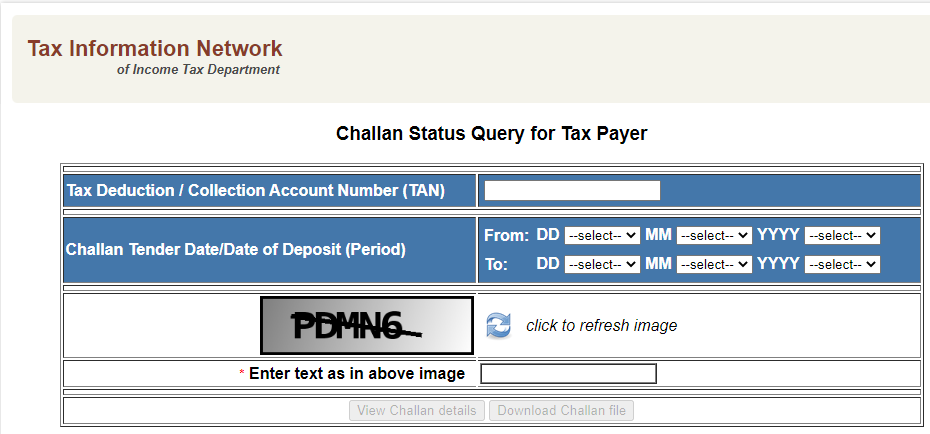

D. After selecting your TAN/CIN number option you will be seeing a new interface under this option you will enter your TAN/CIN number after that you select your date and also enter the captcha code this code is already given by the government in the portal.

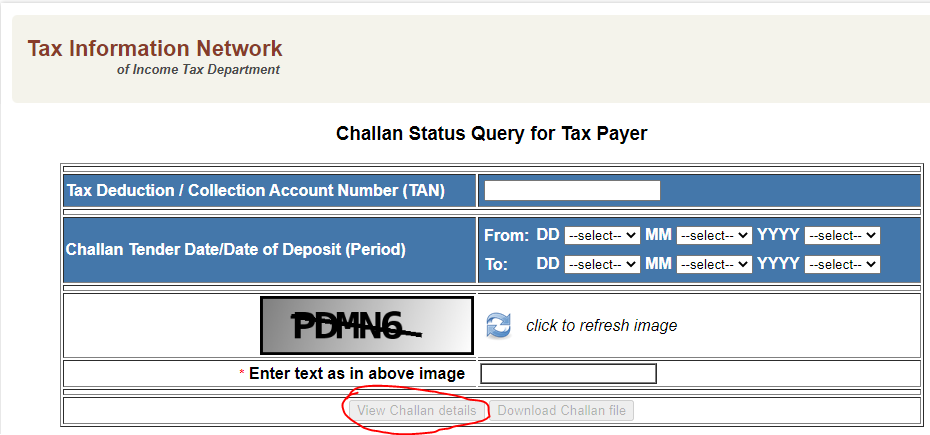

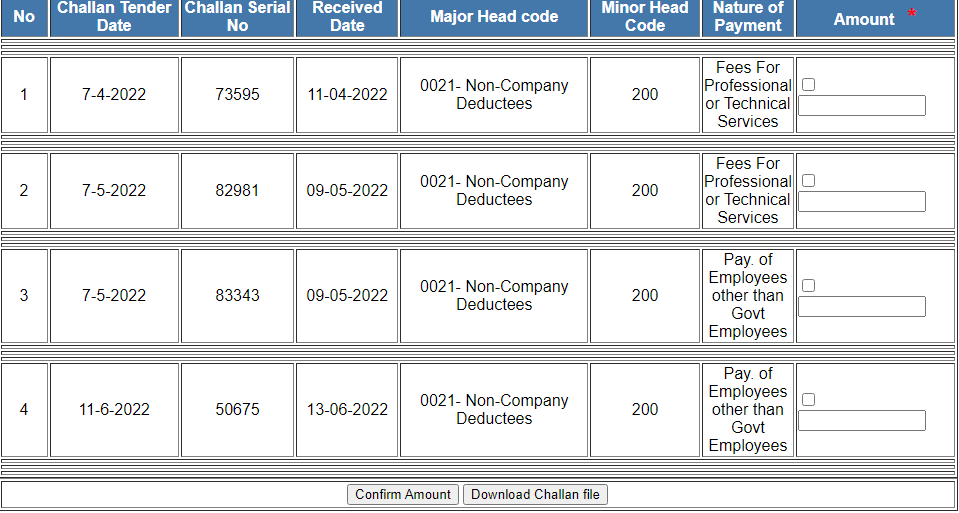

E. After doing all these things you have enabled your challan details then you would click on the view challan details option.

E. After completing all these steps you can see your challan status in front of your eye.

Thanks,