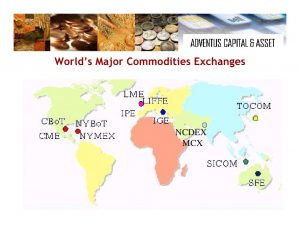

List of Top Commodity Exchanges in The World

1) Chicago Board of Trade (CBOT): This commodity exchange was established in 1848. It trades in financial and agricultural contracts. Originally this exchange only traded agricultural commodities such as corn, soybeans and wheat. Now, it offers futures and options contracts on a variety of products including silver, gold, energy and U.S. Treasury bonds. In recent years, the CBOT has added electronic trading features, which is remarkably different from the earlier open auction market. On 10/18/2005, the Chicago Board of Trade offered an initial public offering on the NYSE. Its listed under the ticker symbol “BOT”.

2) Chicago Mercantile Exchange (CME): Another one of the major exchanges is in Chicago as well. This one, popularly known as CME, has been in business for over a hundred years. The main commodities traded here are live and feeder cattle, hogs, pork bellies, lumber, milk, butter and fertilizer. Now, it serves as a marketplace for stock index, interest rate, foreign exchange and single-stock futures. One of the fairly unique instruments being traded is the weather derivative. These future contracts speculate on weather, anywhere in the world, at different times of the year.

3) New York Mercantile Exchange (NYMEX): Moving out of Chicago to another financial center New York, we have the NYMEX. This is one of the oldest exchanges in the United States. It specializes in petroleum and metal products. Between these two specialties there are a wide variety of options available.

4) New York Board of Trade (NYBOT): Sticking to New York City, we have the NYBOT. This was established as the first commodity exchange in the country. It trades cocoa, coffee, sugar, frozen orange juice, cotton as well as many other agricultural items. This particular exchange also trades currency pairs as well.

5) MCX Stock Exchange Limited (MCX-SXAT) is an Indian stock exchange. It commenced operations in the Currency Derivatives (CD) segment on October 7, 2008 under the regulatory framework of Securities and Exchange Board of India (SEBI) and Reserve Bank of India (RBI). The Exchange is recognised by SEBI under Section 4 of Securities Contracts (Regulation) Act, 1956. In line with global best practices and regulatory requirements, clearing and settlement is conducted through a separate clearing corporation, MCX-SXAT Clearing Corporation Ltd. (MCX-SXAT CCL).

6) Others: Outside US there are a few major exchanges for commodities such as LCE and TOCOM in London and Japan respectively.